It is well-known that consumption is a driving force of the Indian economy. Rising disposable income, growing urbanisation, the highest working age population, and big aspirations are cited as factors behind the consumption story.

The latest to throw its hat into the thematic consumption fund category is Kotak Consumption Fund, whose new fund offer period closes on November 8. The thematic consumption fund category has 17 existing schemes. So, how is the new Kotak offering different? Here is a lowdown.

Consumption plays

Consumption as a theme is a big one. It offers a play on multiple sectors such as FMCG, automobiles, consumer durables, telecom, consumer services, healthcare, power, real estate and textiles. This is a large universe of stocks to choose from.

Consumption-linked stocks have been market darlings for quite some time now. Historically, they have enjoyed premium valuations thanks to their perceived potential. As a result, consumption stock baskets (such as the Nifty India Consumption Index) have sometimes (2008 and 2020) experienced lower drawdowns than the broader market.

While 4-5 passively-managed products based on Nifty India Consumption are available in the market, actively-managed portfolios can use their expertise, research, and analysis to make investment decisions that may lead to better returns than the index.

About Kotak Consumption Fund

Given that there are over 10 actively-managed consumption oriented funds with many years of operating history in this space, it is important to know how Kotak Consumption Fund will be different in its approach.

Suitable top ideas to be selected by in-house research from Kotak’s coverage. The fund will use the flexibility to buy across all market segments (flexicap approach). It aims to identify companies with a BMV (Business - Management - Valuation) approach from a selected sector. GARP (Growth at Reasonable Price) will be given preference while selecting companies.

Consumption stocks and fund returns

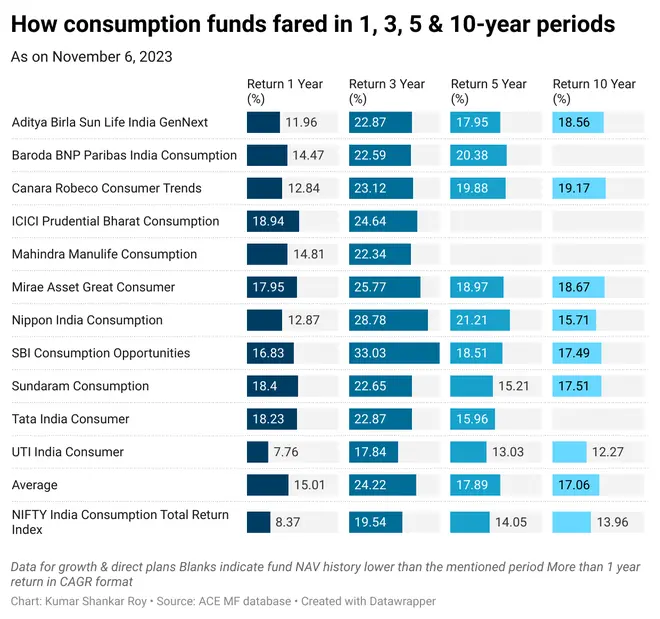

Most existing actively-managed consumption funds have clocked 15-24 per cent returns over the short and long-term. In doing so, they have created decent excess returns over the Nifty India Consumption Index (see table below).

A majority of consumption funds have top holdings distributed across Avenue Supermarts (DMart), Bharti Airtel, HDFC Bank, Hindustan Unilever (HUL), ITC, Maruti Suzuki, Nestle India, Titan Co., Trent and United Spirits, September 2023 portfolio data shows.

In terms of market capitalisation, most existing consumption funds have nearly 60 per cent in large-caps, 15 per cent in mid-caps, and 17 odd per cent in small-caps.

Our take

Given the demographic dividend as well as the population, consumption in India is often said to be an evergreen story for long-term investors. This is also one reason why non-cyclical consumer goods stocks consistently trade at high valuations.

While consumption may be an evergreen theme, does it mean you can invest in consumption stocks/ funds at any point in time and make money? Thematic investing requires better timing of entry and exit. The Nifty India Consumption index 1-year forward valuations (price to earnings and price to book) currently trade near 5-year averages, which necessitates a more neutral view. A correction may brighten chances of returns.

Note popular consumption stocks may already be present in many of your equity fund portfolios through other funds. So, investors should consider whether there is any merit in making an extra allocation to this theme. If your portfolio level exposure to the consumption theme is decent, skip any extra allocation.

It would be prudent for investors to wait for the Kotak Consumption Fund to establish a track record before considering exposure, despite the fund house’s reputation and the apparent potential of the theme.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.