We have had gold ETFs aplenty for long. Even silver ETFs made their debut recently. For the first time, we have a scheme that combines investments in both the precious metals in a single fund of fund.

Edelweiss Gold & Silver ETF Fund of Fund seeks to invest in these two metals in equal proportion. The case for investing in gold as an inflation hedge is well-known. Silver, on the other hand, is known to be more volatile as it is used in several industries and is thus linked to overall economic activity.

Here is what you must know about how the silver-gold combination fares, before you take an informed call on whether to invest in the fund.

Low correlation with Nifty

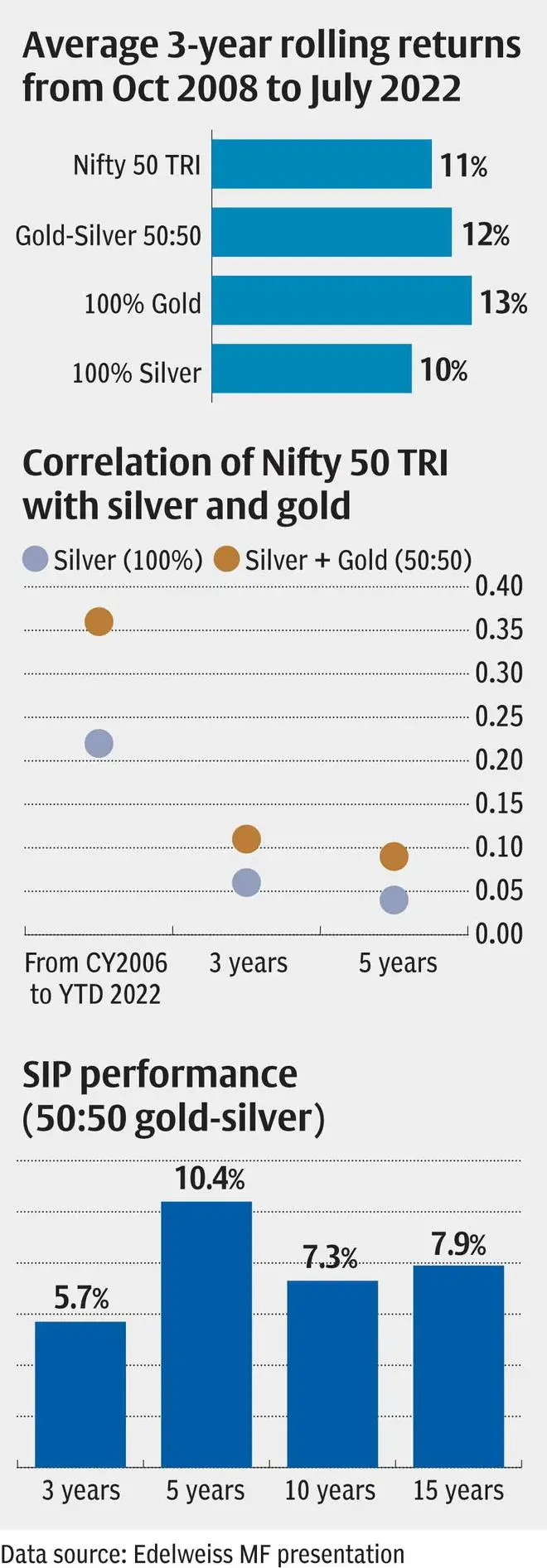

Data of silver prices taken from the MCX and Nifty 50 TRI movements over 16 calendar years starting CY2006 and YTD 2022 indicate that correlation between silver and Nifty is weak across short and long timeframes. This correlation further reduces with a mix of gold and silver in a 50:50 proportion. The correlation between Nifty and gold-silver in the ratio of 50:50 going by returns from CY 2006 to YTD 2022 is just 0.22. In general, a correlation coefficient of less than 0.3 suggests very little correlation. A value of 0.3-0.5 indicates low correlation between the compared variables.

Better rolling returns

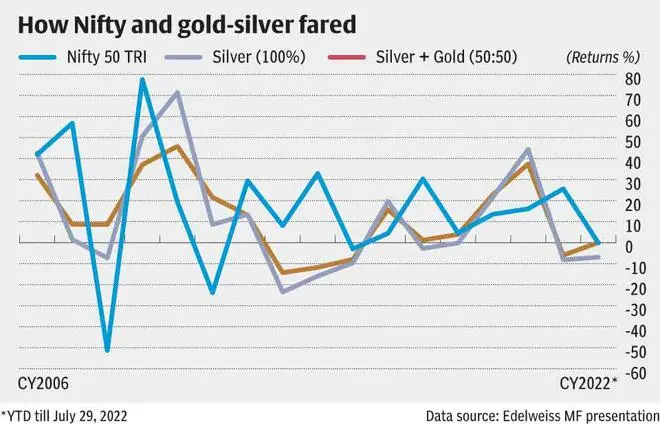

The other key point that emerges from the data is that while in many years, silver has delivered spectacularly more than the Nifty (2010, 2016, 2020 being examples), unlike gold or the Nifty, silver has also had continuous years of negative returns. Rolling returns over three-year periods suggest better returns from a 50:50 gold-silver mix rather than silver alone

Three-year rolling returns from October 2008 to July 2022 for Nifty 50 TRI is 11 per cent, while it is 12 per cent for gold-silver (50:50). For 100 per cent silver and gold it is 10 per cent and 13 per cent. Thus, silver by itself has delivered quite reasonably and in combination with gold has even managed to outpace the Nifty 50 TRI.

Mixed bag

From CY 2006 to YTD 2022, in seven of the 17 years (around 40 per cent of the time), the gold-silver combination has done better than the Nifty 50 TRI.

- Trailing returns over a 15-year period gives 10.8 per cent returns from a gold-silver combination, while the Nifty 50 TRI delivered 10.6 per cent.

- On the other hand, SIP over 15 years in gold-silver mix would have delivered 7.9 per cent, while systematic investments in the Sensex ETF over the same period would have given 12.9 per cent returns.

On a standalone basis, gold has beaten consumer price inflation in 12 of the past 16 calendar years.

Dynamics of the two precious metals

Gold hasn’t had a great run in recent times, especially as we face challenges on economic and political fronts across the world – such situations should have made gold rally more. It has delivered just over 9 per cent in rupee terms in the last one year.

In the backdrop of Chinese banks facing challenges, the US and UK likely to enter recession, crude prices remaining elevated and continuing geopolitical tensions, gold may yet rally from here on. As mentioned earlier, over the long term, it has definitely acted as an inflation hedge.

Silver is linked to industrial use – electronics, batteries, smartphones, electric vehicles and solar panels, among others. As digitisation becomes the norm across a host of industries, silver does have the potential to rally. Given that its fortunes may be linked with economic activity, any weakness on the macro-economic front may hurt.

What should investors do?

Investors with a relatively higher risk appetite can perhaps consider the fund for diversification given the inflation-beating returns that a 50:50 gold silver mix has managed over the past 15 years. Exposures must be kept small. Lump-sums may be better. Given that neither of the two metals has had a runaway rally amidst volatile markets, investors can even wait and invest after the fund develops a track record. But investors must not go overboard, going by the data point that this combination could even outpace the Nifty 50 TRI in some years. . A tactical exposure to the satellite portion of your portfolio may be desirable.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.