As we near the end of the financial year, many of you would be scurrying to invest in tax-saving instruments. Equity linked savings schemes (ELSS) or tax-saving mutual funds continue to be popular with investors, given the deduction it allows under section 80C and the minimum lock-in it entails, of just three years.

In this regard, Bank of India Tax Advantage Fund (BOI Tax) may be a suitable addition to your portfolio if you have a medium risk-appetite. The fund has been consistent in its performance and has a track record of nearly 14 years. BOI Tax has been a steady outperformer over the years and has delivered better returns than its benchmark – BSE 500 TRI – as also several peers.

The fund can also be held for periods longer than the mandatory three-year lock-in, so that you reap better returns. Here’s why BOI Tax must be on your radar for tax-saving and portfolio building purposes.

Consistent outperformer

BOI Tax has been around since February 2009 and has improved its performance record over the past five-seven years.

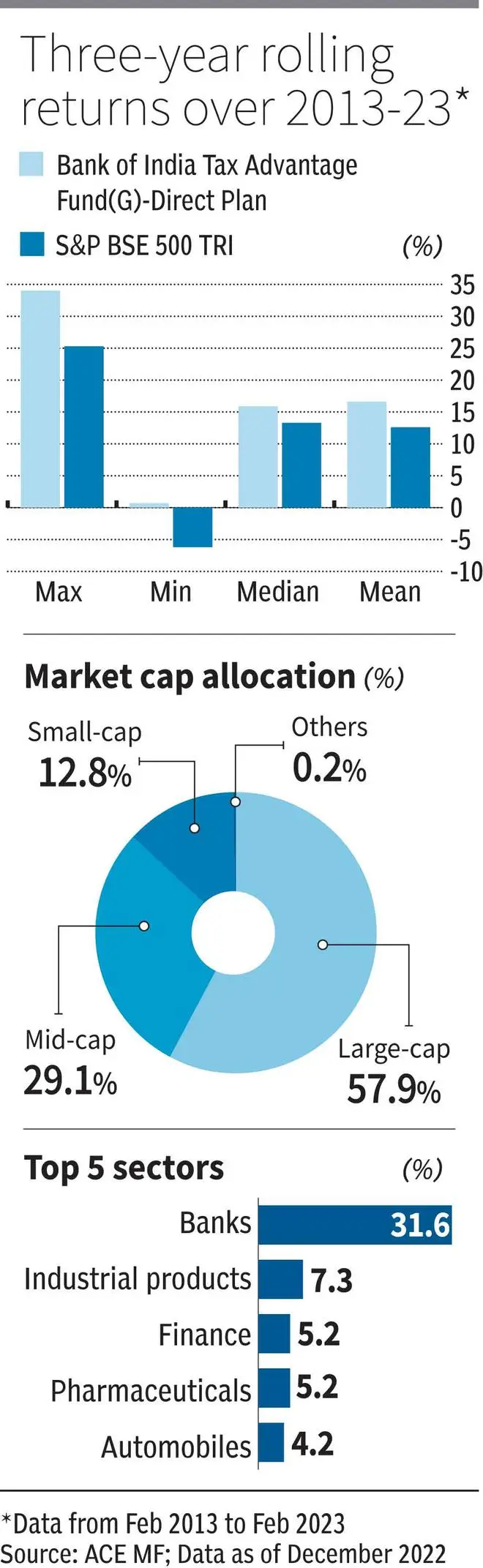

When we take the three-year rolling returns for the fund from February 2013 to February 2023, the fund has delivered mean returns of 16.6 per cent, good four percentage points higher than the BSE 500 TRI. This places it among the top few funds in the category.

These returns are also higher than those of peers such as JM Tax Gain, Aditya Birla Sun Life Tax Relief ’96 and Kotak Tax Saver.

Further, over the same 10-year period mentioned earlier and based on three-year rolling returns, BOI Tax has outperformed its benchmark more than 86 per cent of the times, indicating a high level of consistency in returns.

When a longer five-year rolling return period is considered over 2013-23, BOI Tax’s returns are still quite healthy at 15.8 per cent.

Lumpsum investments, say twice or thrice a year, can be considered in the fund. If the SIP route is taken, each instalment of your investment gets locked for three years.

Mixed portfolio approach

BOI Tax takes a mix of opportunistic and value styles of investing and has been reasonably successful in identifying the right sectors depending on the market environment.

The fund was able to identify pharma and consumer non-durables early in 2020 and was able to ride the rally in those stocks in the immediate aftermath of Covid-19. Subsequently, the scheme loaded up on software stocks as well, which had a great run till late 2021.

Chemicals was another segment that BOI Tax increased stakes early.

However, from late 2021, it changed its strategy as there were huge rallies in some segments, and valuations had risen sharply. The fund pared exposure to software and pharma stocks from early 2022, as also consumer companies, while increasing stakes in banks and financials.

In terms of diversification, BOI Tax holds more than 50 stocks in its portfolio most of the time. Barring the top three-four stocks, holdings are fairly diffused.

The fund follows a multi-cap style of investing. Small-caps, in general, have accounted for a little less than 15 per cent of the portfolio, while mid-caps make up around 30 per cent. The remaining portion is held in large-caps, though in the recent December 2022 portfolio, it has over 57 per cent in such stocks. Large-caps had been outperformers over mid- and small-caps for much of 2022.

Despite having significant exposure to mid- and small-caps, the fund falls less than the benchmark during corrections.

Barring the volatile period in early 2020, the fund has always remained almost fully invested and not taken any significant cash calls across market cycles.

BOI Tax can be a good addition to your portfolio, even as a part of your larger portfolio if you can hold on for more than five years.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.