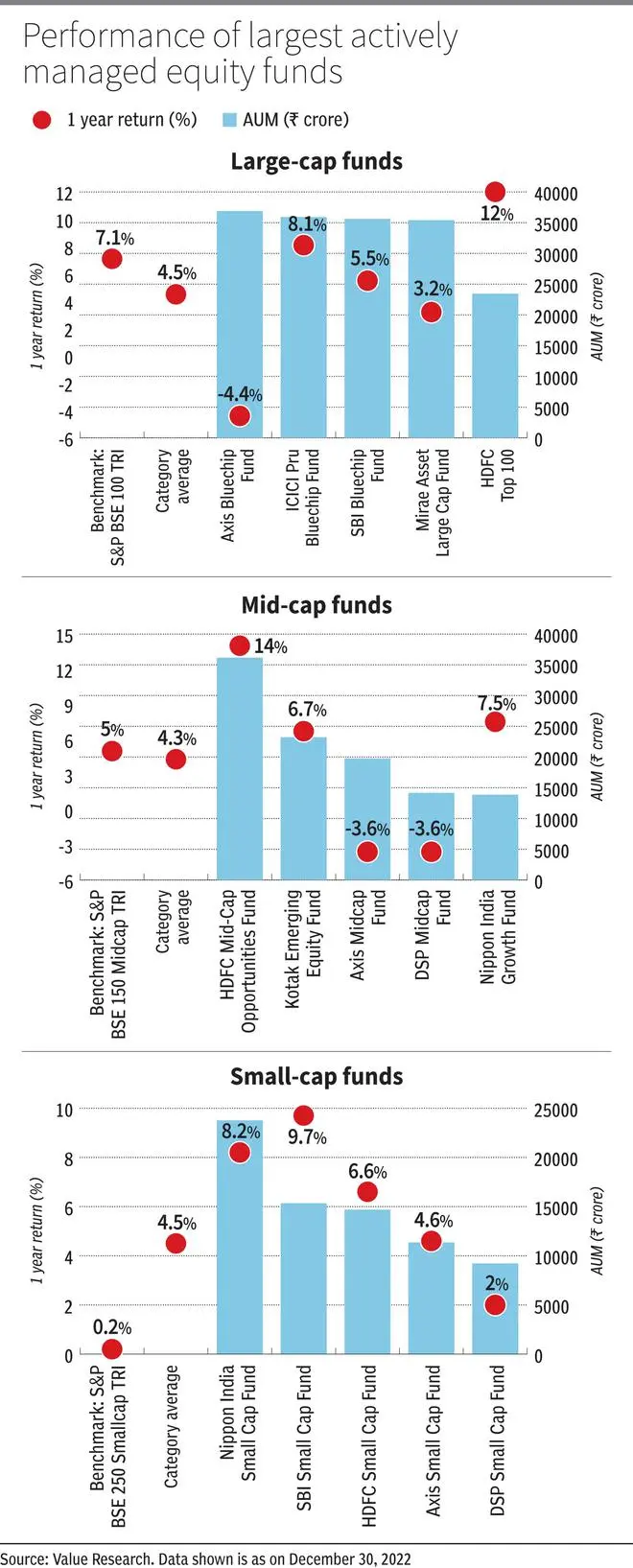

Large-cap indices managed to outperform mid- and small-caps in 2022. The S&P BSE 100 TRI gained about 7 per cent, compared with 5 per cent rise and flat return for BSE 150 Midcap TRI and BSE 250 Smallcap TRI, respectively. However, the category average returns for the actively managed funds in all the three categories is quite similar. Only about 15 per cent of the large-cap active funds have been able to beat their benchmark, while the figures for mid- and small-cap active funds are 36 per cent and 73 per cent, respectively.

Here we analyse the performance of the five largest actively managed funds from each of these three categories.

What funds held

The five large-cap funds have their highest exposure to financial services (FS) and technology sectors, which is in line with their weightage in the benchmark. Financials get about 32-39 per cent of corpus of these funds with Axis and HDFC being overweight on the sector. While other funds have their holdings in technology sector in similar lines with benchmark, SBI is underweight on the same. Axis’ and SBI’s funds have invested a good portion in Retail and industrials, the sectors which have attracted minimal exposure from most funds and benchmark. Except ICICI Fund, all funds are underweight on oil companies, which account for a significant portion of the benchmark (about 11 per cent). Every fund is underweight on consumer non-durable sector, where the benchmark has a major holding. The SBI Fund is overweight on Auto space by a good margin while on the construction companies’ side, ICICI and SBI funds have been overweight.

FS (11-22 per cent) and industrials sectors (5-22 per cent) account for major holdings for the five mid-cap funds. All funds, except Nippon India, are overweight on industrials space where Kotak fund is having highest percentage holding, while for FS Nippon India and HDFC (highest holding) funds are overweight and other funds are underweight. This is followed by consumer goods, which also account for a healthy exposure from funds (except Axis Fund) where DSP is overweight and has highest holding, while other funds’ holdings are in line with benchmark. If other major holdings for specific funds are considered, retail is held by Axis, chemicals by DSP, software by Axis (though significantly reduced) and healthcare by DSP and Nippon.

In the small-cap space, industrials and consumer goods account for among the major holdings in all funds in which SBI Fund and DSP Fund respectively hold the highest percentage holdings. Axis and HDFC funds are having significant exposure to IT, but it has drastically reduced in the during the last year. Nippon and HDFC funds have seen huge uptick in their holdings in FS space and have highest exposure to the sector in line with the benchmark. Further DSP also accounts for good portion of its holdings in auto and metals sectors where other funds are having insignificant exposure.

What drove scheme performance

During 2022, investor interest was seen shifting from growth to value stocks which seems to sum up the performances of funds in both large- and mid-cap spaces. In the large-cap space, only two funds — HDFC Top 100 and ICICI Pru Bluechip Fund — have been able to beat the benchmark, while for mid-cap three funds — Nippon India Growth, Kotak Emerging Equity and HDFC Midcap Opportunities — topped the benchmark. Driven by value style of investing, HDFC Top 100 and HDFC Mid-cap Opportunities funds (having lower P/E compared with others in category) have been among the best-performing funds in their respective categories delivering returns of nearly 12 per cent and 14 per cent respectively. Picks such as NTPC, Coal India and ITC boosted the performance of HDFC Top 100 Fund, while HDFC Mid-cap Opportunities Fund could deliver good returns on account of strong performance of its stocks such as Indian Hotels, Bharat Electronics and Hindustan Aeronautics. Axis Bluechip and Axis Midcap funds were among the worst-performing funds in their categories and delivered negative returns. Axis Bluechip and Axis Midcap funds’ performances have been dragged down by their exposure to underperformers such as Avenue Supermarts, Bajaj Finance, Bajaj Finserv, Infosys and Coforge.

In the small-cap space, each of the five funds have outperformed the benchmark by delivering returns ranging 2-10 per cent with SBI Small Cap Fund being the highest among the lot, while DSP Small Cap Fund was at the lower end. SBI Small Cap Fund’s strong performance was driven by stellar returns of industrials stocks such as Triveni Turbine, Elgi Equipments and Timken India. This was followed by Nippon India as it generated about 8 per cent return on account of strong performances by stocks such as Tube Investments, Poonawala Fincorp and Bank of Baroda.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.