With rising interest rates, surging inflation and a global slowdown creating a wall of worry for stock markets to climb, Indian equities have been correcting quite sharply in recent weeks.

This presents a good opportunity for long-term investors to add to their equity holdings, provided they have the stomach for interim losses and can hold on for six or seven years. The correction may take some time to play out, and any future bull market may be led by a completely different set of sectors. Therefore, it is important to make your fund choices carefully now.

ICICI Pru Value Discovery Fund, an 18-year-old fund that adheres stringently to the value mandate, may be a good bet for equity SIPs.

Since 2021, the fund has pulled out of the extended patch of poor performance that weighed it down between 2016 and 2020. Three factors make a case for buying this fund now.

Time for value funds

Value-oriented funds tend to be better at containing losses than growth funds during deep or prolonged market corrections. They also tend to be better at participating in the early stages of a new bull market.

This has been tested in the last two market cycles. In the last leg of the dotcom bull run from end-1996 to end-1999, the MSCI India Growth index was up over 200 per cent, while the MSCI India Value Index delivered just a 10 per cent absolute gain. But when the markets went into free fall from early 2000, the value index began to outperform and continued to do so in the new bull market from 2003. Between end-1999 and end-2006, the MSCI Value Index more than trebled, while the Growth Index managed to just double.

The MSCI India Growth Index again outdid the Value Index in the bull run from 2005 to mid-2007. But as the global financial crisis hit, it corrected and the MSCI Value index began to pull sharply ahead, outperforming until 2011.

In an entrenched bull market, the growth style usually outperforms the value style because investors become less sensitive to valuations and chase after stocks that are already delivering on business growth and visibility. But when the drivers of the bull market get challenged, those very stocks can get swiftly de-rated. In such cases, stocks with a higher margin of safety (value stocks) tend to better contain losses and prepare your portfolio for future pullbacks.

Sticking to its mandate

Not all equity funds that describe themselves as ‘value’ funds actually give a high weight to valuations in their stock-picking. The kind of stocks making up a fund’s portfolio are usually a good indicator on whether a fund is truly value-oriented or chases momentum.

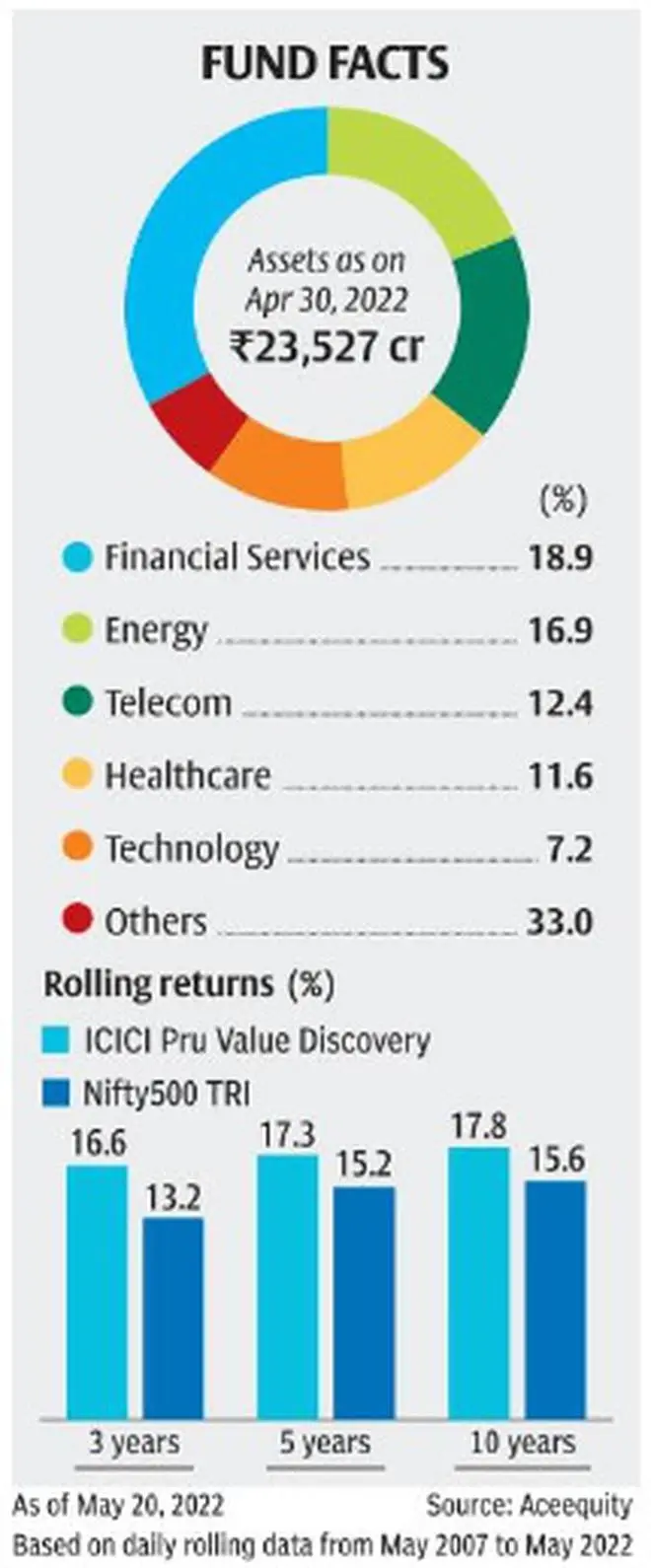

Compared to the value category, ICICI Pru Value Discovery has been consistently underweight in financials (19 per cent weight), mainly holding corporate banks and overweight in energy (17 per cent weight), telecom (12 per cent) and pharma (11 per cent) which tend to be much smaller weights in the peer funds. Four of the top five holdings of ONGC, Sun Pharma, NTPC, Bharti Airtel and ICICI Bank are non-consensus holdings.

Value funds face a challenge in walking the thin line between buying cheap stocks which may turn out to be value traps and stocks with promise that trade below intrinsic value. After struggling with this balance between 2016 and 2018, it seems to have cracked the code lately.

Between April 2021 and April 2022, the fund has cut exposure in sectors such as software, metals, automobiles and cement, while adding to positions in corporate banks, oil and power.

The value style also needs a seasoned manager at the helm, who can hold on to his conviction in a momentum-driven market. ICICI Pru Value Discovery is managed by Sankaran Naren, a seasoned value style manager along with Dharmesh Kakkad.

Improving performance

ICICI Pru Value Discovery went through a bad patch between 2016 and 2020, when its performance significantly lagged both peers and the equity category. The weak performance during that period appears attributable to the fund’s investments in deep value stocks that failed to re-rate, its large-cap focus (peers had higher mid and small-cap allocations) and the market’s strong growth leanings.

But with the deep correction of March 2020 shifting the market mood, ICICI Pru Value Discovery’s performance has also charted a recovery. In the last three years, the fund’s one-year rolling returns have been ahead of its category about 68 per cent of the times, with average returns of 22 per cent against the category’s 20 per cent. This has helped lift its long-term record. Its three-year, five-year and seven-year rolling returns in the last 15 years now average a 16-17 per cent CAGR against the benchmark Nifty500 TRI’s 13-14 per cent.

Though the fund remains heavily large-cap tilted with an 82 per cent allocation to large-caps in April 2022 compared to 65 per cent for the category, this can work to the fund’s advantage in a correction where small and mid-caps may suffer disproportionate damage.

Negatives

The fund’s large size (over ₹23,500 crore compared to under ₹9,000 crore for most peers) takes a significant toll on portfolio manoeuvrability. The fund may find it difficult to build meaningful positions in mid and small-cap stocks that offer value. Should its sector or stock calls go wrong, unwinding and rebuilding positions will take considerable time, dragging performance.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.