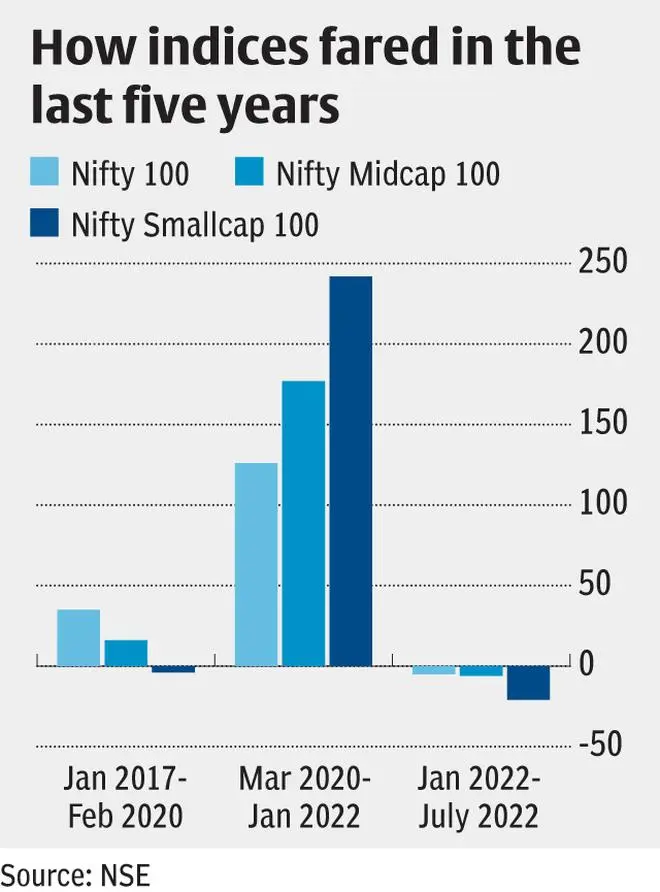

Large-cap stocks can be an attractive option under the right macroeconomic conditions. In a risk-on environment when liquidity was abundant in the economy, small-cap and mid-cap companies outperformed large-cap peers. But it has been large-cap stocks that delivered better returns in most other periods, even considering the highly volatile period of the last five years. In the periods prior to Covid (January 01, 2017, to February 28, 2020), when growth indicators of GDP, interest rates and inflation were in the normal range, large-caps performed better. Even in periods beginning January to now, when pessimism has taken hold of growth indicators, large-caps witnessed the smallest draw-downs. Only in the period from March 24, 2020, to January 01, 2022, when central banks ploughed abundant liquidity into the system, Nifty Full Small Cap 100 index and Nifty Midcap 100 index performed better compared to Nifty 100 (see table). This shows that investments based on market capitalisation need to consider liquidity and risk perception in the markets for better timing of entry and exits.

Quant Mutual Fund’s latest NFO Quant Large Cap Fund, combines large-cap investing with an additional active layer. It utilises quantified liquidity and risk perception measures along with traditional valuation metrics to invest in large-cap space while sticking to the adage, timing is everything. The open-ended equity scheme that predominantly invests in large-cap stocks will have its NFO open till August 3.

Quant Mutual Fund group manages equity, debt, and hybrid plans based on a ‘quantamental’ analysis platform. The fund changed hands from Escorts Mutual Fund to Quant Capital in 2018 and now has ₹9,600-crore AUM. Its large- and mid-cap fund, that comes closest to the current NFO in terms of mandate, is in the top percentile of its peers with last one-year returns of 14 per cent and five-year returns of 13.6 per cent CAGR, albeit on a small corpus of ₹155 crore. The largest fund with ₹2,300-crore assets operating in the multi-cap category, Quant Active Fund has generated returns of 6.7 per cent and 20.7 per cent CAGR in the last one year and five years, respectively.

Investing framework

The fund will have Nifty 100 index as its benchmark. The fund will invest a minimum of 80 per cent in large-cap stocks and up to 20 per cent in Nifty 500 stocks. As per the latest AMFI data, the 100th large-cap stock has a market cap of ₹47,000 crore. The fund will also write call options up to 20 per cent of the portfolio value in order to generate alpha.

The fund will have a top-down approach, where risk and liquidity analysis of global, followed by Indian economy is used to determine risk-on/risk-off environment. The basic outcome should indicate the mix of leveraged versus defensive bets based on the risk-on/off scenarios. From macro analysis, the focus moves to individual stock selection using Quant’s VLRT framework. The VLRT framework stands for – valuation, liquidity, risk appetite and timing. A 33 per cent weight is assigned to the first three factors with ‘timing’ as the tool guiding investments overall. Each of the factors is analysed by a different team for independent analysis with cumulative rating assigned to each stock for investment.

While valuation and its measurement are well understood, the other two factors seek to quantify sentiment shifts, liquidity data and game theory analysis to generate alpha. The liquidity metric assumes that money flows from one asset-class to another. This flow is measured by a proprietary money-flow analysis, holding patterns, indices weightages and indices rebalancing exercise indicating the favoured asset-classes now.

The risk appetite metrics quantifies behavioural patterns marked as fear, euphoria, greed and others. By plotting the three — valuations, liquidity and risk appetite, the mutual fund analyses the macro-investing environment and acts accordingly. From despair and opportunity when all three are low, to euphoria when all three are high, and followed by capitulation stage when liquidity retreats but valuation and risk appetite are still high (sounds familiar to the current conditions). Based on the outcome of independent analysis of the three factors in a top-down manner, the stock selection will be pursued in Quant Large Cap Fund.

Monetary policies across India and globally are expected to regulate liquidity in the markets in the medium term. In such a scenario where the shifts in risk appetite and growth expectations can be drastic, the quant-based, large-cap fund can be a risk-managed vehicle for generating excess returns over broader markets. The mutual fund group has put its differentiated investing philosophy to work and generated comparable results as well. But the investing based on changing trends may imply a high turnover of the portfolio to generate alpha. Also, the utilisation of call options adds a layer of risk not found in traditional large-cap funds. Overall, the fund may operate on the riskier corner within the large-cap space.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.