If you want to up your financial services play, but are wary of excessive exposure to banking given your existing investments, here is a fund that can pique your interest.

ICICI Prudential Mutual Fund has announced launch of ICICI Prudential Nifty Financial Services Ex-Bank ETF, an open-ended exchange traded fund tracking the Nifty Financial Services Ex-Bank index. The NFO period closes November 25. The scheme is designed to reflect the behaviour and performance of top 30 companies of financial services sector except banks, based on free-float market capitalisation from Nifty 500 index. How has this strategy worked previously? Let’s find out.

Financial services juggernaut

For any growing economy, financial services makes a huge contribution. With the Indian economy becoming one of the fastest in the world, financial services has played a big role so far.

There is an increasing participation from all parts of the society in credit, investments and insurance. The sector is poised to witness an unprecedented growth. In a leg up, digital revolution is also contributing to the growth of financial services companies who are adapting to this change.

While banking is a big segment in overall financial services pie, the universe has insurers, holding companies, financial institutions, financial technology firms, brokerages, investment banks, wealth managers, exchange and data platforms, housing financiers, asset managers and NBFCs. Excluding banks, segments such as NBFCs, Insurance, Capital Market etc. are currently under-penetrated among masses.

Banking too much?

Private-sector banks and PSU-sector banks trade, based on price/book valuations, currently trade at discount to Nifty50. Banks as a sector have done well this year (up 21 per cent YTD), outperforming the benchmark indices by 15 percentage points. This has also led to exposure to banking increasing across fund portfolios.

Overall equity mutual fund portfolios have a dominant exposure to banking stocks (21.18 per cent). This is the biggest single-sector allocation. In the 50-share Nifty index, four of top ten stock weights are banks (HDFC, ICICI, Kotak and Axis) accounting to nearly 23 per cent allocation.

At an industry level, financial services exposure, which is heavily reliant on banking, stands at over 30 per cent individually in benchmark indices viz. Nifty50 and Nifty100.

All of the above means that if you take exposure to any actively or passively managed portfolio, the chances are high that banking exposure will increase. Some investors may not be comfortable with such elevated levels of exposure.

Bank-less play

The Nifty Financial Services Ex-Bank index offers a differentiated way to play the theme without incremental rise in banking exposure. The top weights of the 30-stock index are HDFC, Bajaj Finance, Bajaj Finserv, SBI Life, HDFC Life, Bajaj Holdings & Investment, ICICI Lombard, Cholamandalam Investment and Finance, Shriram Transport Finance and SBI Cards.

The index, which is rebalanced semi-annually, is relatively new as it was launched in Feb-2022.

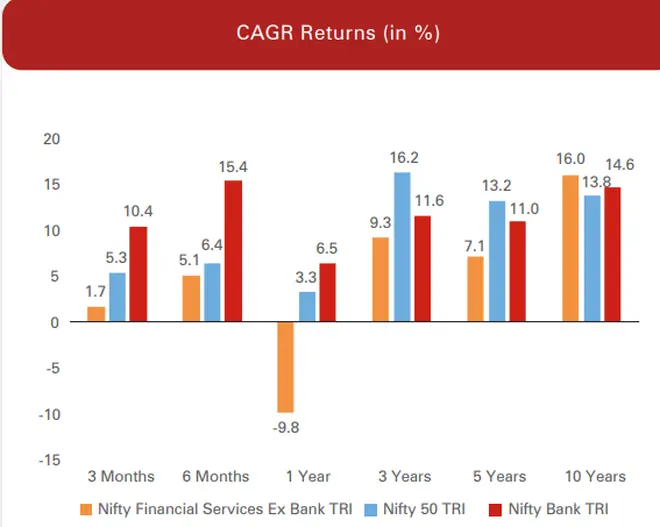

Let us see without banks what is the performance of the financial services index. Interestingly, the Nifty Financial Services Ex-Bank (16 per cent CAGR) has outperformed both Nifty 50 index (13.8 per cent) and Nifty Bank index (14.6 per cent) over last 10 years i.e. long-term.

However, the relative performance of Nifty Financial Services Ex-Bank in the 3- and 5-year periods has been poor (see chart below).

So, if the Nifty Financial Services Ex-Bank plays catch up as banking stocks over the next few years do not relatively perform, this strategy of excluding banks from the basket could work.

Also, note that Nifty Financial Services Ex-Bank Index is less volatile than Nifty Bank index across all time frames (3, 5 and 10 years).

While this is an obvious conclusion, the lower volatility quotient needs to be watched if the ex-bank index starts performing better in the future.

Our take

ICICI Pru Nifty Financial Services Ex-Bank ETF can be used by investors seeking low-cost ETF exposure to financial services without increasing exposure to banks.

Do remember the ETF investment strategy has to revolve around reducing the tracking error to the least possible through regular rebalancing of the portfolio, considering the change in weights of stocks in the index as well as the incremental collections/redemptions in the scheme.

For those young investors who believe that India at the beginning of long credit cycle, removing banks from the equation may not be prudent. They can choose between ICICI Pru Nifty Private Bank ETF and ICICI Pru Nifty Bank ETF for concentrated banking exposure. For a simple financial services play, one can consider Mirae Asset Nifty Financial Services ETF.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.