After the government’s decision to remove the long-term capital asset benefit given to some mutual fund categories effective April 1, 2023, investors’ interest in products offering the benefits of the earlier tax system has been growing.

Against this backdrop, WhiteOak Capital Mutual Fund’ has launched a new fund offer ‘WhiteOak Capital Multi Asset Allocation Fund. The NFO is open for subscription from May 03 to May 10.

While the fund is an open ended scheme with an exposure to equity, debt, money market securities, and gold/silver related instruments, the hybrid fund’s domestic equity exposure (between 35 per cent and 65 per cent) will give investors old tax benefits due to indexation.

Here is a detailed review.

Role of multiple assets

Economic cycles and markets across the globe are dynamic. As a result, performance of different asset classes depend on the current stage of the economic cycle, global scenarios, geo-political events, etc.

Equities relatively perform well during the economic recovery phase, while bonds provide better returns during recession and periods of falling interest rates.

While no investment is recession-proof, some tend to perform better than others during downturns. During periods of high inflation, prices of commodities like gold and oil and their finished products tend to go up.

Due to the dynamic nature of global markets and economic cycles, it is not possible to time the winning asset class consistently. Furthermore, there may be prolonged cycles of outperformance and underperformance of these asset classes.

Investors should ideally have a mix of asset classes in their portfolios. For this, multi-asset allocation funds offer a single-window solution for investors.

This approach helps investors in using different asset classes to their advantage.

The below given table shows that different asset classes have varied degrees of correlation.

Investors can use these correlations to achieve reasonable returns with moderate volatility over long-term.

Investment strategy, approach

WhiteOak Capital Multi Asset Allocation Fund exposes investors to domestic equity and related instruments, gold, fixed income instruments, foreign equities, etc.

Under the multi asset allocation approach, allocations will be based on relative attractiveness of various asset classes. For this, an internal proprietary model will provide direction.

Different funds follow different approaches to decide the mix of various assets. Dynamic mix is better than the fixed mix as the latter is based on regular review and rebalancing.

Under normal scenario, the new fund’s domestic equity allocation (net) will be 15-45 per cent (35 per cent to 45 per cent including arbitrage positions). The allocations will be made across sectors and m-caps.

Fixed income allocation will be 10-55 per cent (0-10 per cent REITs, INVITs), 10-40 per cent in gold (including silver and other commodities) and 0-10 per cent in foreign equities (mostly, stocks in western markets such as the US).

Domestic equity allocation will be decided by in-house market valuation index, while foreign equity allocation will be based on relative attractiveness of domestic equity against foreign equity. Gold allocation will be based on relative attractiveness of gold versus equity and relative strength of the US dollar. Silver and other permissible commodities will be opportunistic positions.

WhiteOak Capital Multi Asset Allocation Fund seeks to generate superior “risk adjusted return”. This indicates less focus on absolute return, and more focus on delivering smoother investment outcomes.

Tax implications

As mentioned earlier, the government has decided to remove the long-term capital asset benefit for mutual fund categories such as debt mutual funds, including target maturity/index debt funds and ETFs, gold funds and ETFs, international funds, etc.

For new investments from April 1, 2023, there is no distinction between long-term and short-term holding period for these categories of funds. The gains from these funds will be added to investor total income and taxed at their income tax slab rate.

Also read: Budget 2023: Gap between old and new tax regime narrows

So, for these investments, even if an investor’s holding period is over 3 years, one will not receive any indexation benefit. Indexation is used to adjust the purchase price of an investment to reflect the effect of inflation on it. With the help of indexation, one is able to lower long-term capital gains, bringing down the tax payment.

However, if the equity allocation is between 35 per cent and 65 per cent (such as WhiteOak Capital Multi Asset Allocation Fund), investors can take advantage of the old tax rules. In other words, short-term capital gains on holding period of less than 3 years will be taxed at your slab rate. For holding period of 3 years and above, long-term capital gains will be taxed at 20 per cent with indexation. This is an advantage.

Performance of Multi-asset funds

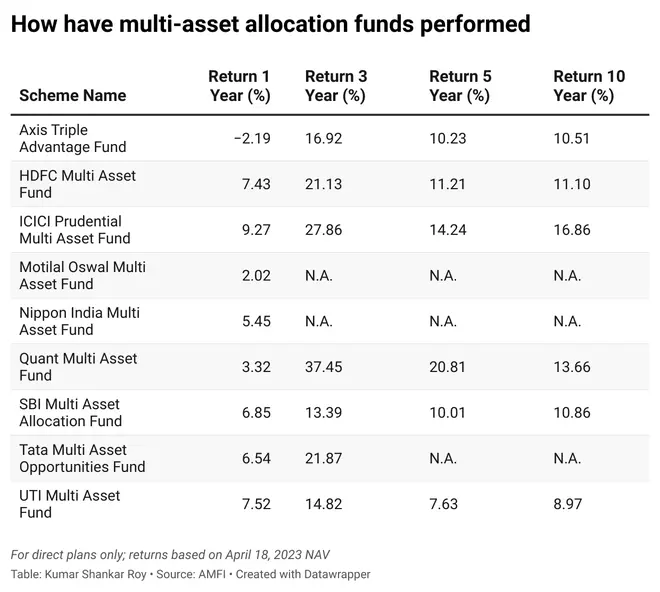

The nine multi-asset allocation funds manage about ₹25,000-crore of assets.

Most of the funds in the multi-asset allocation category do not have a pure-play long track record. Examples include SBI Magnum MIP Floater becoming SBI Multi Asset, HDFC Multiple Yield becoming HDFC Multi Asset, ICICI Pru Dynamic to ICICI Pru Multi Asset, etc.

The below given chart shows how the nine funds have performed over 1-, 3-, 5- and 10-year timeframe.

Our take

WhiteOak Capital Multi Asset Allocation Fund seeks to achieve reasonable return with moderate volatility for its investors over medium- to long-term. The scheme can be a hassle-free and tax-efficient way of investing in various asset classes via a single mutual fund scheme.

For those investors who want lower volatility and greater predictability of returns, multi-asset offerings may be a good option. Going ahead, factors such as allocation mix and equity exposure will determine the actual returns.

Also read: Kosamattam Finance’s NCDs offer up to 9.5% yield: Should you invest?

Investors are requested to approach tax consultant to understand tax implications before making an investment decision. Making an investment decision only on the basis of tax benefit/advantage is a sub-optimal approach. So, investors must be clear in their objective while opting for a multi-asset fund. If they already own products such as dynamic asset allocation fund or balanced advantage fund, a multi-asset fund only adds commodities/international stocks to the mix.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.