As we move towards the final phases of the general elections, there is heightened volatility in the markets with anxiety increasing over the possible outcome and whether there would be continuity in the verdict. That aspect, along with uncomfortably high valuations in many segments after the rally in the past one year, means that market may continue to gyrate.

As asset allocation once again gains prominence (as indeed it does at most times) in investor portfolios, hybrid funds may be suitable for investors who wish to generate stable returns with reduced risk levels. And equity savings funds are especially suitable when volatility runs high in the markets.

Equity Savings funds are hybrid schemes that invest in a blend of equity and related instruments, bonds and derivatives. As equity investments, including derivatives, usually make up at least 65 per cent of the portfolio, these funds enjoy equity taxation.

In this regard, HDFC Equity Savings Fund (HDFC Multiple Yield earlier) is a sturdy scheme in the category and has consistently delivered robust performances over the years. With above-average, double-digit returns over the medium and long terms, the fund can be a good diversifier for a conservative investor’s portfolio, especially in the current environment. Investors can consider parking lump-sums (if they have a surplus amount currently) in the fund with a 3-5-year perspective. Others can consider SIPs in the scheme.

Durable performance

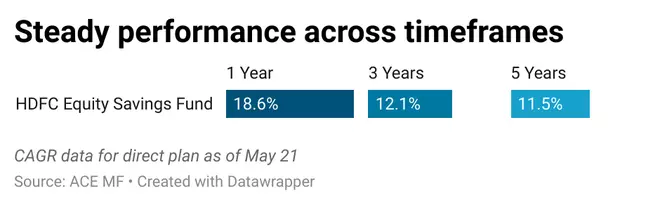

HDFC Equity Savings has been a quality performer in its category. On a point-to-point basis, the fund has delivered double-digit returns across timeframes –- short, medium and long term. In the last one and three-year periods, the scheme has given 18.4 per cent and 12.5 per cent, respectively.

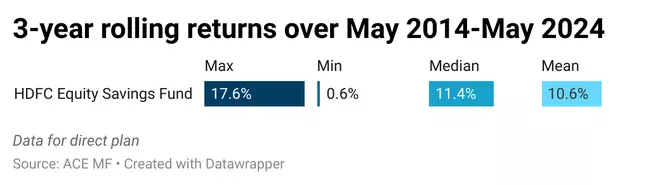

When three-year rolling returns are taken from May 2014 to May 2024 (10 years), HDFC Equity Savings fund has delivered a mean of 10.6 per cent, which is among the best in the category.

If 3-year rolling returns are taken over the above-mentioned period, the fund has given more than 10 per cent returns nearly 70 per cent of the time. With the same timeframe and rolling period criteria, HDFC Equity Savings has delivered more than 8 per cent nearly 84 per cent of the time and in excess of 12 per cent over 32 per cent of the time.

When SIP returns (XIRR) are considered for the past 10 years, the scheme has given 13.5 per cent.

Clearly, the fund has been quite consistent over the past several years. It has also outperformed the Nifty Equity Savings Index TRI across time horizons.

Dexterity in portfolio moves

With respect to the spread of investments, HDFC Equity Savings judiciously combines stocks, bonds and derivatives to ensure optimal risk-adjusted returns over the long term.

The equity portion of the portfolio is generally kept at 65 per cent levels or higher (65.76 per cent in the April portfolio). HDFC Equity Savings also takes derivative positions, which can go above 33 per cent at times. Currently, the hedged position in the equity and related instruments is 33.32 per cent. So, a good part of the equity portion is hedged and also opens the possibility of accruals to the portfolio via premium pay offs.

The stocks are taken almost entirely from the Nifty 100 basket. Exposure to mid and small caps is very low. Thus, the equity portion is quite moderate on risks. Banks, automobiles and pharmaceuticals are among the top sector holdings most of the time.

In the debt portion, government bonds are key fixed-income holdings for the fund. The sovereign securities held in the portfolio mature over the next 5-10 years. If long-term yields come down as the interest rate cycle takes a downward path, there would be scope for capital appreciation. In corporate bond holdings, most of the securities are AAA rated and a small portion AA-rated instruments of reputed firms. A few years back, the fund held additional tier 1 (AT1) bonds in its portfolio. It exited those investments, so the portfolio has a fairly safe debt portion that has very low credit risk.

For investors with a modest risk appetite, this fund can be a part of their satellite portfolio as a diversifier. A lump-sum investment with a time horizon of five years can be rewarding for investors.

SIP investments for a similar or higher term could also be considered. Equity taxation for such funds ensures that the risk-adjusted return is healthy over the long term.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.