In the stock market’s game of snakes and ladders, winners and losers change every few months and hence themes working today may not click tomorrow. Many join the bandwagon of a theme only after the train has left the station or exit when the theme is about to come in currency. The over-100 thematic and sectoral funds make it confusing even for MF investors to choose the right one from. In this backdrop, ICICI Prudential Thematic Advantage Fund offers a simple auto-pilot method of investing in emerging opportunities across sectors and themes through a fund of funds (FoF) structure. Its good track record of returns, robust theme selection, balance between concentration and diversification, while also taking care of rebalancing of portfolio in a tax-efficient way, are positives.

Challenges in thematic investing

A theme is a combination of allied sectors / stocks, which are interwoven around a common idea or opportunity. Popular themes include financialisation, infrastructure, consumption, digital etc.

But there are some key problems one will face while doing thematic investing. One, understanding the correlation of sectoral performance and macros is a daunting task due to time constraint and limited resources. Winner keeps changing if you tracked sectoral performance (calendar year). Power did well in 2021 and 2022. But, in 2020 it was healthcare stocks that ruled the roost, post the world waking up to Covid. The years 2017 and 2019 had seen Consumer Durables stocks coming to the fore. And 2018 was all about IT stocks.

Secondly, even sophisticated investors find it difficult to control greed and fear emotions during market extremes. IT sector (Nifty IT) which returned over 700 per cent between February 1999 and February 2000, trapped investors who got in afterwards and during March 2000 to March 2001, the sector crashed nearly 65 per cent once the dot-com bubble burst. In 2013, Taper Tantrum phase, most of the investors missed the export-oriented theme (IT and Pharma), even though certain markers such as weaker domestic macro environment and expensive currency existed.

Three, direct thematic investing approach faces issues related to exit strategy and taxation on rebalancing.

Auto-pilot route

An FoF route to thematic investing can be an optimal way to gain from attractive themes as the FoF can choose themes to be bullish on and leave out the not-so-promising ones. Robust theme selection becomes important in this context. Also, FoFs can adopt a style that is neither too concentrated nor too diversified, thus striking a good balance. . ICICI Pru Thematic Advantage Fund comes from a fund house that has a track record of delivering right calls. Some examples are the calls of global funds (in FY13), infra, banking (FY14), tech funds (2017), sell small- and mid-caps, and buy gold (both 2018).

Returns and portfolio

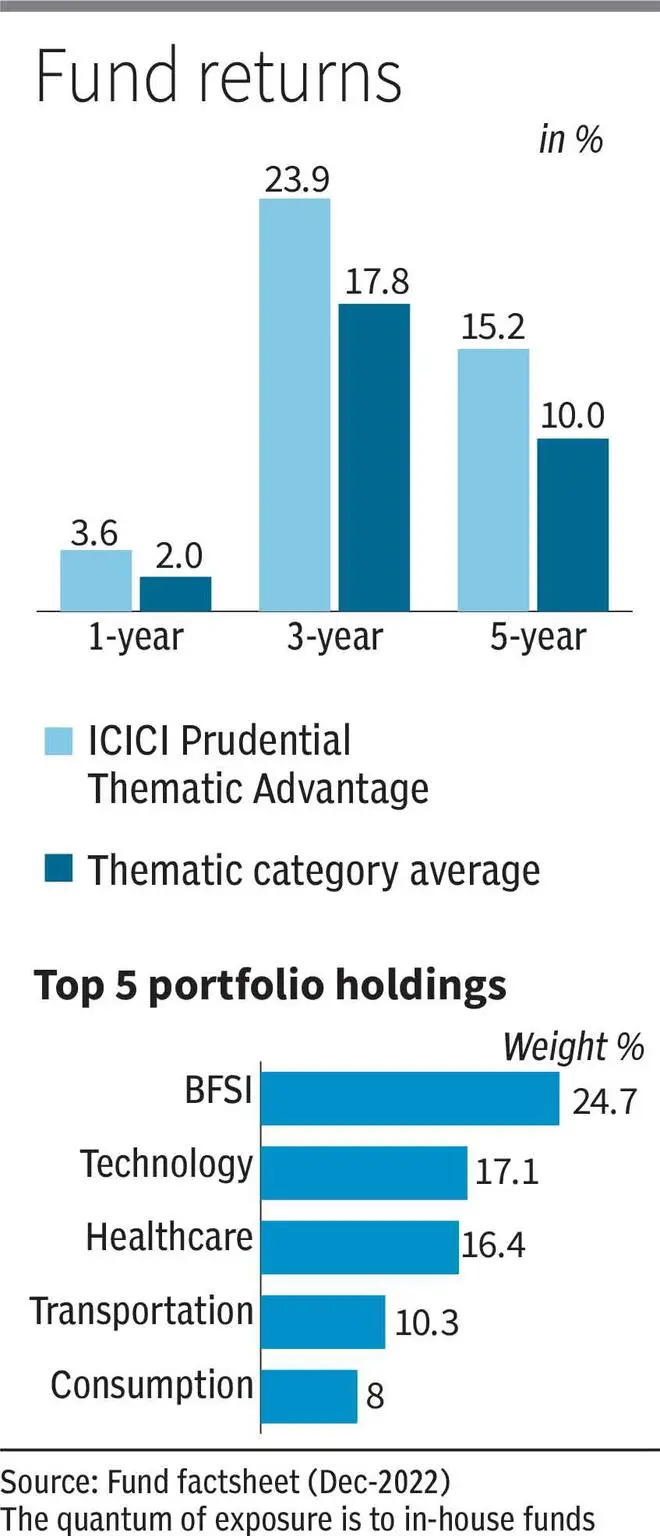

The ₹900-crore ICICI Pru Thematic Advantage, which can choose from over 10 in-house thematic / sectoral funds, has shown good performance too. In the one-year period, it has comfortably beaten thematic category average. In the three- and five-year period, the fund has given 23.9 per cent CAGR and 15.2 per cent CAGR, about 500-600 basis points higher than thematic category average. It has also beaten its stated benchmark (Nifty 200 TRI) in one-, three-, and five-year periods.

As per latest factsheet (December 2022), the FoF has 95.8 per cent in MF units and 4.2 per cent in short-term debt and net current assets. The fund right now has highest allocations to BFSI, tech, healthcare, global equities, exports etc. The top-5 highest fund weights are in ICICI Pru Banking & Financial Services (24.66 per cent), ICICI Pru Technology (17.10 per cent), ICICI Pru Pharma Healthcare and Diagnostics (16.45 per cent), ICICI Pru Transportation and Logistics (10.33 per cent) and ICICI Pru Bharat Consumption (7.96 per cent). Its least equity fund weights are in ICICI Prud Commodities (2.66 per cent) and ICICI Pru Exports and Services Fund (7.25 per cent). The fund also has 9.4 per cent in ICICI Prud Floating Interest.

Its dynamic theme/sector allocation moves include hiking BFSI exposure from 4 per cent in October 2021 to about 25 per cent in December 2022 on strong credit offtake, good asset quality and margins. Similarly, for healthcare, the fund upped allocation from 4 per cent in January 2022 to over 16 per cent in December 2022 on reasonable valuations, strong product pipeline and defensive nature (against volatility). Transportation and logistics is a new entrant in its portfolio. It has also hiked exposure to US stocks on global equities relatively cheaper valuations compared with domestic ,and also better position of US amongst developed markets.

Investing for long-term in the FoF is eligible for indexation benefits as per prevailing tax laws. The regular plan has a total expense ratio of 1.6 per cent and direct plan is available for 0.25 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.