It was a deal waiting to happen for several years and perhaps the low interest rate regime was one of the biggest compelling factors to time it now. For non-banks with a book of ₹1-lakh crore or more, the regulator has been vociferously nudging them to function like banks. While the RBI is silent on corporates owning banks, it was always comfortable with the proposition of NBFCs merging with banks. Therefore, the HDFC-HDFC Bank merger was more or less a given, considering the recent regulatory tightening. Shareholders of HDFC will get 42 shares of the bank for 25 shares they hold in the parent company. This places the bank at a premium to HDFC. However, the one to really benefit from the deal would be HDFC.

The housing financier gets access to funds at a much lower costs than the current 5.83 per cent, allowing it to price its loans more attractively and grow the market. There is a wide network of 6,342 branches HDFC gets access to. And more importantly, folding into the bank can ensure a greater retention of customers for HDFC as they would get access to a bouquet of loan and savings products.

But what’s in store for HDFC Bank? The bank has historically functioned at 4 per cent plus net interest margin (NIM), whereas that of HDFC is a few notches lower at 3.6 per cent as on December 31, 2022 (Q3). Post merger, home loans will account for 33 per cent of the bank’s total book as against 11 per cent now. Therefore, a rejig in portfolio would have a direct impact on the profitability. Added to this is the regulatory requirements.

With about ₹6.18-lakh crore of HDFC’s book getting integrated with the bank, the statutory reserve requirements – namely cash reserve ratio (now at 4 per cent) and statutory liquidity ratio (18 per cent of liquid assets) for the bank is set to increase. This cost is being pegged at ₹70,000-80,000 crore, which might further drag the margin down by 0.75–1 per cent. Then, there is an incremental requirement to meet the priority sector lending norms, which could be an additional drag of ₹90,000 crore. Overall, HDFC Bank is starring at a scenario were holding on to its traditional four per cent NIM may not be feasible any longer. Even if the funds parked in the regulatory reserves are invested in G-Sec, earning 6.8 per cent interest, this income will be treasury gains and won’t add to the profitability.

In addition to lower NIMs, there could also be questions around growth. At HDFC Bank’s current size of nearly ₹13,69,000 crore, growth has been challenging in the recent times. After 21 quarters, the bank had posted its traditional 20 per cent growth rate in March 2022 quarter (Q4 FY22). Now, with its gross loan book set to touch the ₹20-lakh crore mark (second to SBI in terms of book size), it would be a tall expectation to see the bank grow at its past rates.

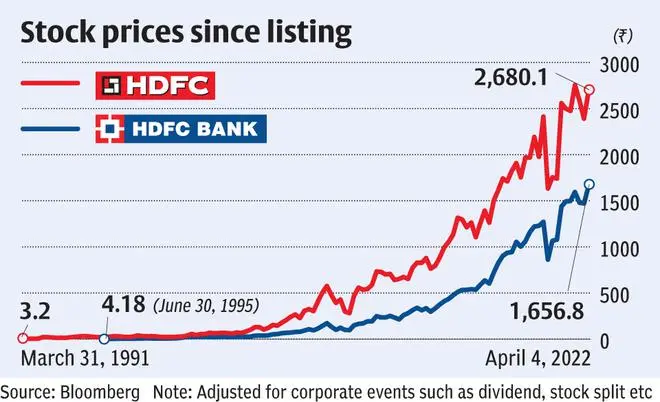

In all, with profitability set to take some knock and growth expected to cool off from the historic levels, it’s only fair that the bank’s valuation premium recalibrates to the new normal. Therefore, the near 10 per cent single day gains posted by HDFC Bank and HDFC Limited each, may be Street’s way rejoicing the decade’s largest merger. With more details emerging in the coming months, the exuberance may settle down.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.