Stocks go up the stairs, and come down the elevator. This time it is the turn of LIC to learn this maxim.

Till a few months back it appeared the insurance giant had been smarter than peers in the investment space by riding the over two-year rally in Adani Group stocks.

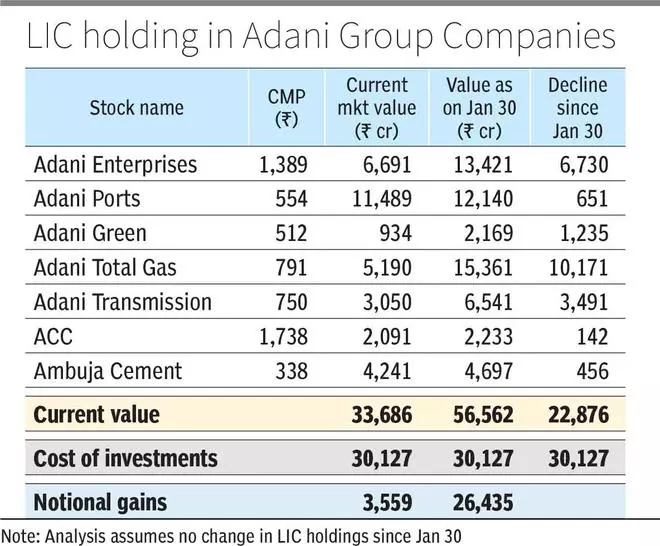

LIC had put out a statement on January 30, that it was still sitting on ₹26,000 crore of gains in their Adani Group investments even post the few days of rout following the release of the Hindenburg report. This is not to mention the fact that the notional gains were nearly at ₹50,000 crore at the end of December 2022.

Since then, the gains have been more or less washed out. Based on the prices of Adani Group companies at close on February 23, those gains have dwindled to a little over ₹3,000 crore. The value of its investments in the Adani Group, now stands at ₹33,686 crore as against the cost of investments of ₹30,127 crore.

The decline in investment value in Adani Total Gas and Adani Enterprises has been the biggest contributor to the erosion of total gains.

Challenges ahead

At the time of clarifying investments in Adani Group companies last month, LIC had noted that its overall equity exposure in Adani Group shares ‘is not that significant.’

Well here is the catch, the more the Adani Group stocks fall, the less significant it becomes.

While as of the end of January, the Adani Group investments were less than 1 per cent of LIC’s total investments and at around 5 per cent of equity investments, the percentages will be lower now as Adani Group stocks have fallen much more than the broader market.

But the challenge for LIC and investors is that LIC may have to make investment calls based on volatility in Adani group stocks — whether they should add to current holdings or sell. If they chose to sell, this can create more pressure on Adani Group stocks and accentuate the current trend.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.