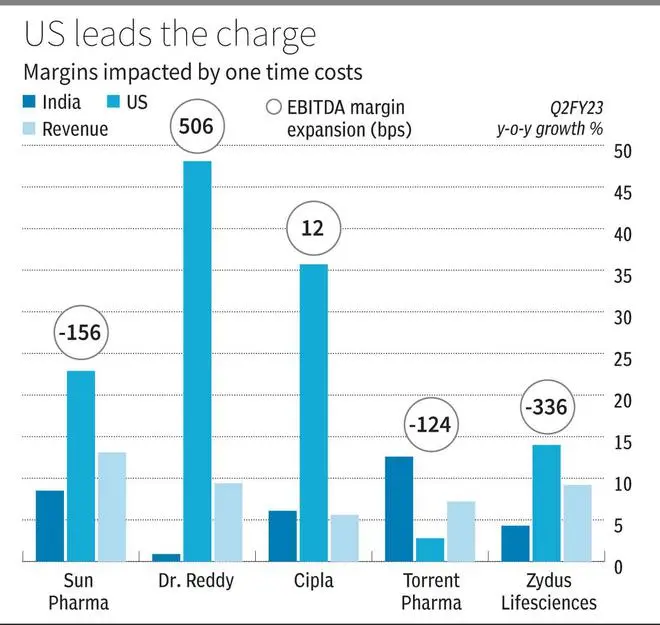

Indian pharma reported strong results for the second quarter. But it was US led performance that delivered in the quarter against the normal trend of domestic sales and emerging market exposure that led revenue growth. Q2FY23 results, even with a unfavourable base effect, continued positive momentum, reaffirming our earlier expectation of impending good times for the sector. US segment, which has been a drag on growth, turned around aided by generic Revlimid launch. Margin benefit from product mix was limited as cost inflation and (one time) write-downs restricted margin growth.

Positive contribution from US generics

Generic Revlimid sales have started for a handful of firms (Natco, Dr. Reddy, Cipla and Zydus Lifesciences) while Sun Pharma and Aurobindo are on track for launch. Realisations may have varied among firms between USD 30 – 100 million USD in the quarter from the product, accounting for 5 – 20 per cent of their quarterly US run rate. Expectations of consistent sales from the product, atleast over the next year, were reaffirmed by the companies.

While the momentum remains positive for now, at the start this week, the product came under a cloud after Walgreen Boots, a US-based pharma retailer, named Natco as one of the defendants in an antitrust lawsuit. This essentially threatens the high cash flow assumptions for the next year from US from generic Revlimid. How this transpires will require a close watch.

Companies commentary on US price erosion, the primary headwind in the segment, ranged from ‘within normal range’ to ‘mid-single digit year on year’, which is an incremental positive in the quarter. Investors may wait for more data points on the issue, even as the industry essentially pivots to a value-added portfolio for US. Sun Pharma, Cipla, followed by Dr. Reddy, Aurobindo and Zydus are increasing their R&D allocation to a value-added mix from plain generics. There was more positive news on the US regulatory front as Zydus’s Moraiya plant and Aurobindo’s Hyderabad facilities received end of inspection reports and Torrent Pharma’s Indrad facility received three observations after a revisit.

India and emerging markets

India and other emerging market sectors reported single digit growth on a year-on-year basis. That the companies managed to grow over Q2FY22, which had boost from Covid sales, is a positive for both regions. The higher inflation numbers allowed for better pass through, either from drug pricing control route or price unrestricted portfolio. The loss of exclusivities in diabetes (DPP-IV and SGLT-2 pathways) also helped the companies. Trade generics or unbranded generics aimed at Jan Aushadhi stores and consumer wellness portfolio are gradually increasing their contribution to India sales as well. API revenue trends are still lagging last year peaks for most companies.

Margins tempered

Overall revenue growth continued to be driven by India and Emerging markets, while US segment provided a positive surprise in the quarter. This should have translated to margin performance as well but was tempered by inventory write-downs, input cost inflation and R&D cost expansion. The inventory write-down on account of Covid products was significant across Cipla. Dr. Reddy, Zydus Lifesciences and others, but should not be high going forward. The general commentary by companies on input cost inflation was not encouraging as they were not expecting a significant decline. Logistics costs continued to be higher for companies. While general cost inflation may be trending flat to lower in other sectors, Pharma cost inflation is tied to Chinese supplies in key starting materials and intermediaries which are affected by internal lockdowns in the region.

R&D investments expanded as percentage of sales but only marginally for companies as higher development costs in speciality divisions are being met by lower allotment for plain generics. This is driven by industry wide shift towards quality from quantity in development projects in US and other regions as well.

The sector continues to trade at higher valuations as captured by a PE of 33 times trailing earnings for Nifty Pharma index against last year average of 34 times. The correction in the past two days from 36 times has been on account of concerns over generic Revlimid sales and sector’s ability to drive higher margin growth.

Overall we reiterate our positive view on the sector led by Dr. Reddy, Zydus Lifesciences and Sun Pharma given strong product pipeline prospects.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.