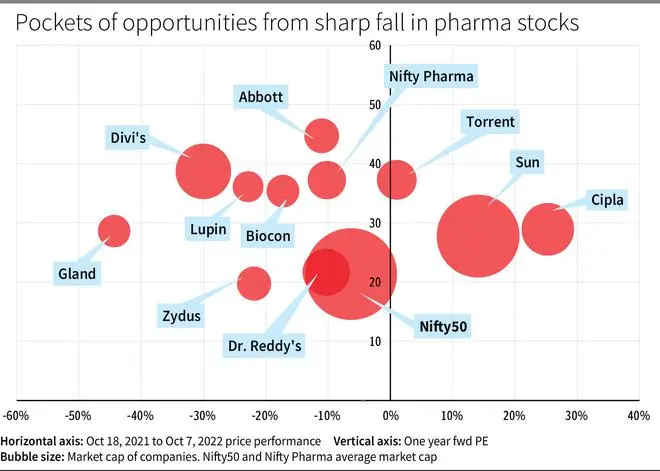

With the markets beginning to look nervous, pharma stocks are coming into the limelight. The Nifty Pharma has underperformed the Nifty so far from the October 2021 market peak, losing 10 per cent compared with the Nifty’s 6.3 per cent fall. Stocks constituting the pharma index (except Sun Pharma and Cipla) have fallen up to 30 per cent, predominantly on regulatory headwinds and concerns from price erosion in the US markets.

However, the corrections can provide opportunities in some pockets, considering that prospects remain sanguine. Also, as markets turn volatile, its tag as a ‘defensive’ play may favour pharma stocks from hereon.

India business looks good

US Formulations continue to face pricing pressure with companies reporting even 20 per cent erosion in base portfolio in Q1FY23. But pharma companies focused on India are in a sweet spot. While Indian Pharmaceutical Market (IPM) growth has stepped off from the 15 per cent revenue growth seen in the previous decade (2010-20), it still offers low double-digit growth opportunities currently. The top five companies with a diversified global presence - Sun Pharma, Cipla, Dr. Reddy’s Torrent and Zydus - reported an average 24 per cent growth in India compared to flat growth in the US in FY22. Sun, Torrent and Dr Reddy’s are also deploying a higher sales force to improve their reach.

Therefore, other players too are looking to improve the Indian market share in revenues considering the favourable prospects compared to the US. There is also another tailwind for the Indian markets. This year with WPI at 10 per cent, NLEM price growth restrictions (a consistent overhang) will not be a hurdle for the sector as the pricing growth matching WPI (10 per cent) can be applied. In the non-NLEM segment, pricing has been a key driver and will continue to be so.

Besides, the continued patent losses for innovator drugs in Indian chronic segment will continue to boost India sales with new launches. Emerging markets have shown strong growth for branded generics portfolios offered by domestic pharma companies. The primary gainers from all these drivers are companies with lower US revenue contributions - Alkem, Ajanta Pharma and Torrent. Cipla amongst the large caps also has a better India and emerging market contribution, but its US portfolio is also showing strong growth, thanks to its value-added products.

Value additions

That brings us to the second driver for pharma stocks currently, where companies are also improving profitability through value additions to their US portfolios. In the last year, Cipla and Sun Pharma have recorded strong US growth owing to differentiated US portfolio, explaining the gains made by these stocks in this period. Even as plain generics in US will continue to bleed, specialty portfolio (largely Sun Pharma), respiratory (Cipla and Lupin) and injectables portfolios (Caplin point, Aurobindo Pharma) can favor these stocks. Limited competition launches have dried up, but generic Revlimid is a silver lining for many players and has started contributions for Dr. Reddy’s. While Biocon has the lead in biosimilar portfolio, other companies are scaling up from India or emerging market biosimilars to eyeing regulated markets (Zydus and Dr. Reddy’s).

Pricing power

What can also help the sector is the ability to pass on cost increases. The sector faced a gross margin decline of 150-200 basis points in Q1FY23 due to higher API and key starting materials costs originating from China (facing sporadic lockdowns), as well as higher logistics costs. But going forward, even in a competitive market and with pricing restrictions (NLEM), companies could deliver 6-8 per cent pricing growth in FY23 driven by raw material cost pass through. Owing to non-discretionary demand, pricing power rests with the industry in close to half of the portfolio (India and emerging markets) allowing for this price pass through.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.