Tata Steel reported a stronger final quarter for FY23 after its weak third quarter results. The company beat consensus estimates on revenue and EBITDA (Bloomberg consensus) by 4.26 per cent with an EBITDA Margin of 11.5 per cent (206 basis points beat). Realisations led by India, which accounted for 54 per cent of Q4FY23 revenues (Europe 35 per cent contribution), improved. But overall margin expansion stole the beat.

The quarter-on-quarter softening of input raw materials – coking coal, iron ore, and energy prices led to the improvement in margins with scope for further softening. The company reiterated its capacity expansion plans to 40 MT in India by 2030 but the continuity of UK operations are expected to reach decisive stage in next 12-24 months.

Softer commodity prices

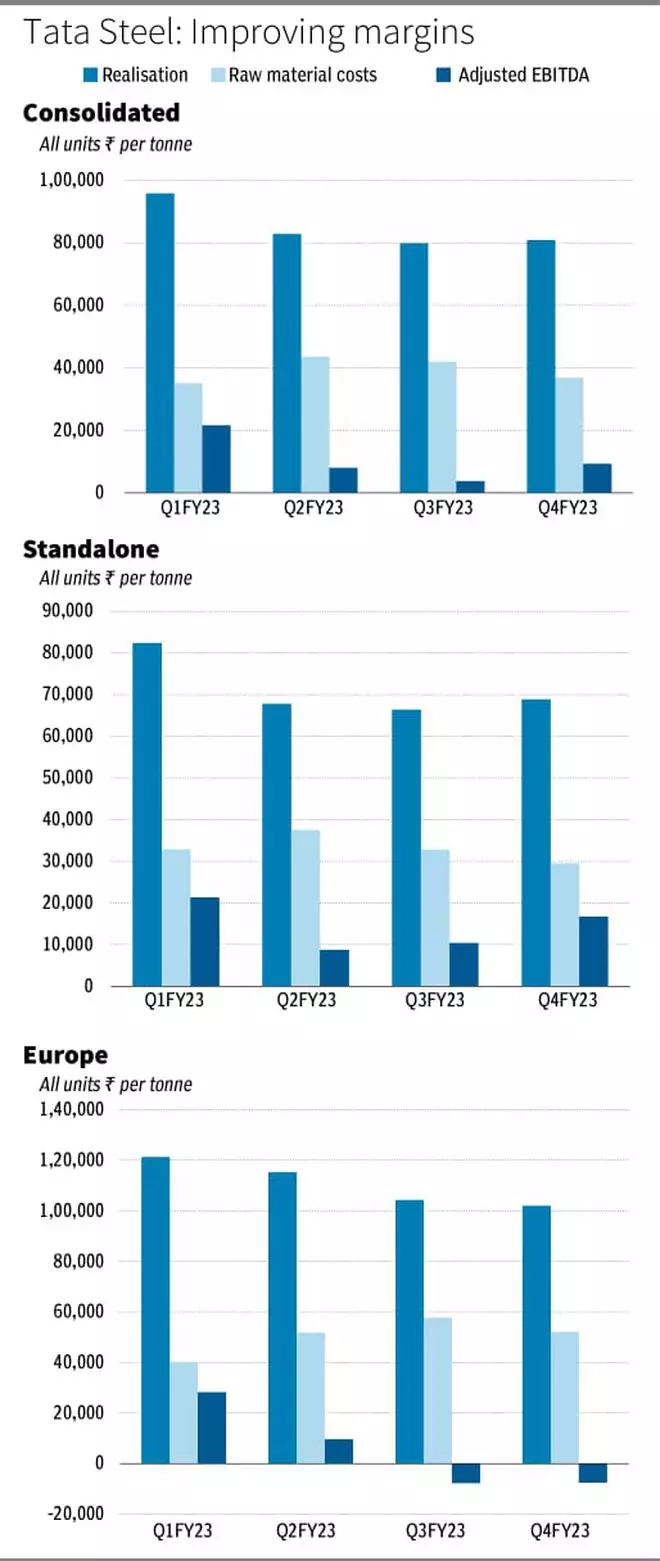

Tata Steel India reported a 4 per cent QoQ improvement in realisations to ₹68,825 per tonne in Q4FY23 which aided the 1 per cent QoQ improvement in consolidated realisations (₹80,928 per tonne) as Europe reported 2 per cent QoQ decline (₹1,02,019 per tonne). The reversal of export duty in late Q3FY23 aided domestic prices while the sharp increase in Europe steel prices last year is still unwinding. Management expects a 1 per cent improvement in realisations for the ongoing quarter in both regions.

The company reported a 710 basis points QoQ improvement in gross margins to 54.5 per cent in Q4FY23 driven by softer commodity prices. Raw material costs per tonne declined by around 10 per cent in both regions, driving the improvement. Concerns on demand from an expected slowdown in global economic activity drove lower energy prices.

The company is expecting even more expansion in margins going forward. A higher hedged cost of gas in Europe and higher coking coal costs from inventory can reverse in the next two–three quarters. But the impact on steel price realisations, based on slowing economic activity, may be an offset.

Other expenses marginally blunted the pass through of gross margin gains. Higher expenses from forex, royalty and handling in India, and emission costs in Europe impacted EBITDA margins which expanded by 670 basis points QoQ to 11.5 per cent.

Also read: Why this Tata Steel experiment made the world take notice

The company reported a spread (adjusted EBITDA per tonne) of ₹9,288 in Q4FY23 (+143 per cent QoQ/-53 per cent YoY). Domestic operations led the large part of the expansion with a spread of ₹16,719 per tonne (61 per cent QoQ/-29 per cent YoY), offset by a loss in Europe of ₹7,610 per tonne which is flat QoQ. The product mix in Europe was affected by upgradation in Netherlands which will impact in next two quarters as well.

UK plant status an overhang

Tata Steel India reported a spread of ₹28,680/₹14,020 per tonne in FY22-23 compared to European spreads of ₹13,470/₹5,680 per tonne. This points to a strong contribution from India, despite the higher realisations in Europe. The company is expanding in India as well spending ₹16,000 crores this year primarily for capacity expansion of 5 MT at kalinganagar plant expected by FY25-26.

The company has already added Neelachal Ispat by acquisition last year and the capacity is at 1 MT annualised now. The capex for FY24 also includes the upgradation planned at Netherlands which can be financed by its own cash flows.

Tata Steel’s UK operations which account for close to half of Tata Steel Europe are nearing the end of life in the next 12-24 months. The plan to redevelop the plant with an emphasis on decarbonisation cannot be supported by the plant’s cash flows and needs UK government funding which is not encouraging, as per the company.

The plant has been impacted by high energy costs, and carbon emission costs in the UK and has been loss-making, contrary to Netherlands operations. Despite capital allocation geared towards India and Netherlands which is returns accretive in the long run, the UK plant status will be a short-term overhang on the stock price.

The stock declined by 0.5 per cent on Wednesday despite the beat and improved margin expectations on account of the same. The stock is trading at 6.2 times EV/EBITDA (trailing) which is at the higher end of the historical range. Despite recovery in margins, the UK plant overhang and upper end of valuations may impact the stock price. We reiterate our previous stance where we earlier recommended investors hold the stock,.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.