Tata Steel stock price has returned 280 per cent from Covid lows, riding on an elongated steel cycle in the period. The recovering global demand post-Covid, hampered by supply restrictions in the wake of the pandemic, and later the Russia-Ukraine war, have allowed favourable pricing in the sector. The spreads in the sector (price realisation minus costs) have reached significant highs and later corrected as input price inflation surprised the industry; and continue to be on the higher side.

The stock is now trading 25 per cent below last 5-year average one-year forward EV/EBITDA while discounting a correction from peak spreads in the next two years. In such a scenario, we recommend that investors can hold the stock. The cost side outlook looks even grimmer in the short term, but structural factors of limited steel supply globally can support steel prices in the longer term.

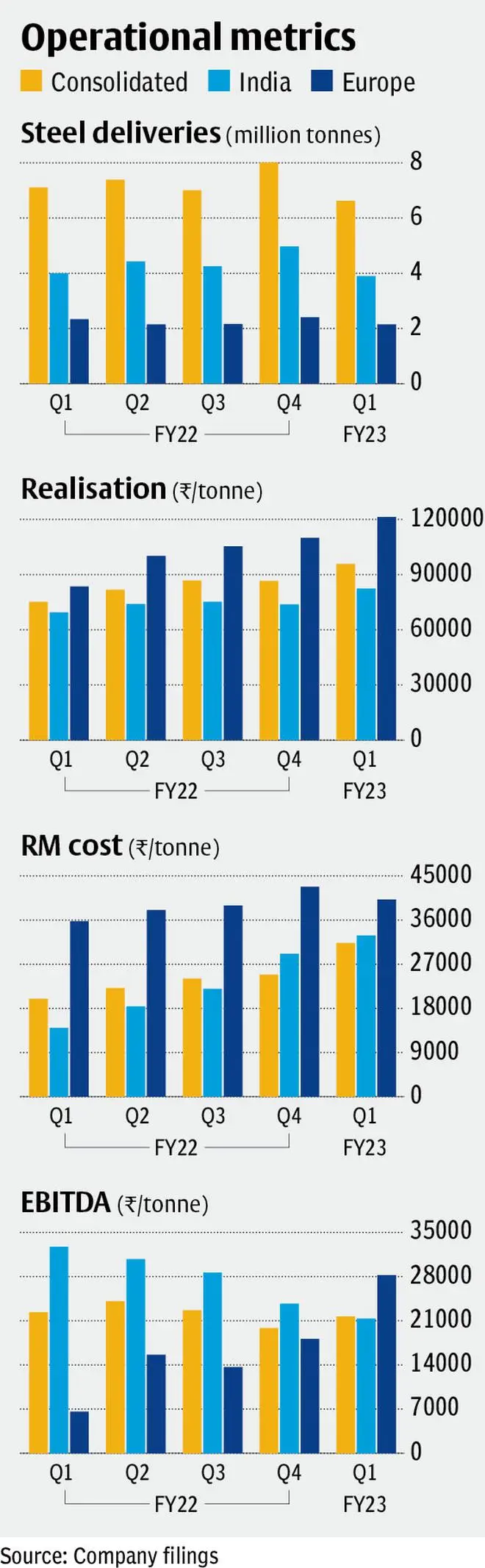

Tata Steel operates from two primary regions, Tata Steel standalone contributing to 53 per cent of FY22 revenues and 79 per cent of EBITDA and Tata Steel Europe (37 per cent revenue and 19 per cent EBITDA). The company operates from Thailand as well.

Rising realisations

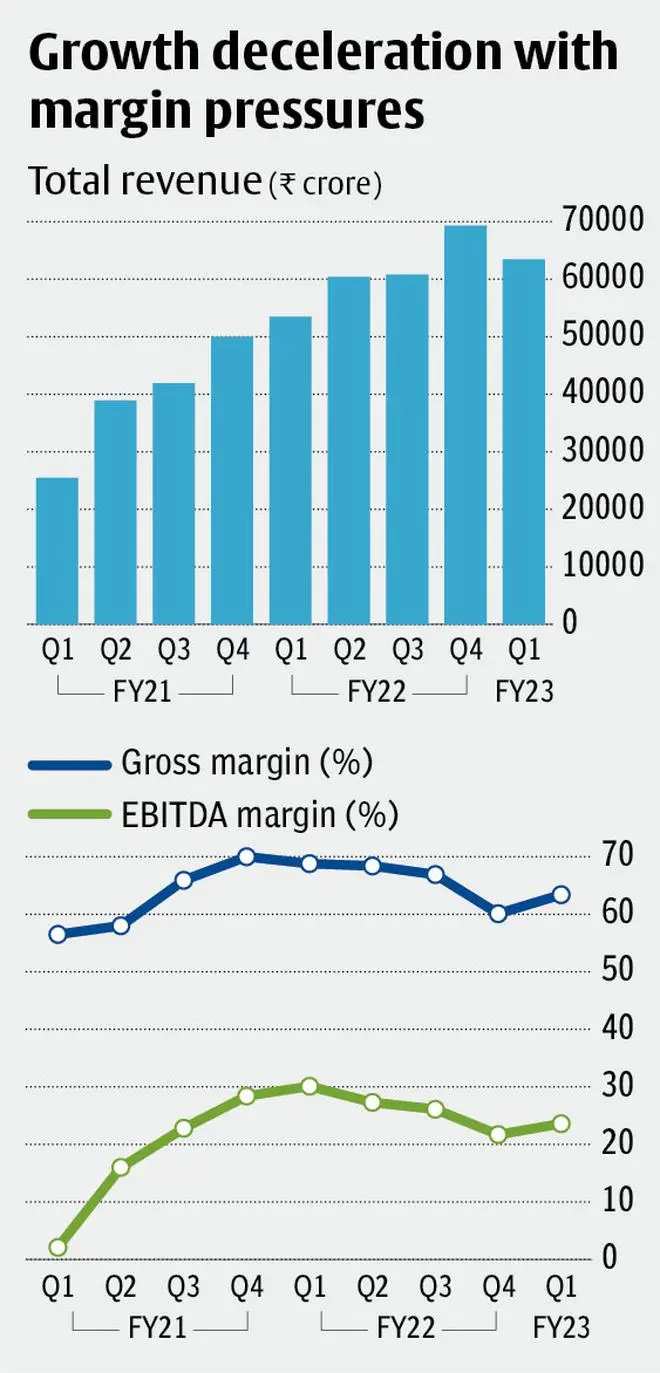

Tata Steel’s consolidated realisations have nearly doubled from ₹47,331/tonne in Q1FY21 to ₹95,816/tonne in Q1FY23, which was also 11 per cent QoQ growth from Q4FY22. The domestic steel prices were tracking international trends which, over the last two years, saw robust demand in steel as core sectors of infrastructure and capital goods benefited from stimulus packages announced across economies. China, which accounts for half of global steel industry, and Europe, were on a path of decarbonisation, which further impeded the availability of steel in the international markets. Russia and Ukraine, both of which also have strong contribution to steel output, saw their volumes decline in the last phase of the two-year period.

Steel realisations are expected to correct 15-20 per cent from the peak in the next two years. Domestically, steel prices may have already corrected 15-20 per cent from Q1FY23 as new export duty limits announced will impact prices realised in the market. With recovering domestic demand from auto and infrastructure, and tracking international prices, further decline in realisations is not much expected. Internationally, input prices have started correcting which should lead to a correction in realisations as well. On the supply side, either by European decarbonisation (using fossil fuels to be made prohibitively expensive) or by self-regulated limits on production in China, strong export market flooding is a remote possibility compared to the previous decade. The high cost of ‘green steel’ production should sustain above average realisations internationally.

Spike in input costs

The primary input costs are iron ore and coking coal. The spike in coking coal has been consistent with rise in steel prices in the last two years but has spiked significantly in the last two quarters. Driven by energy costs, raw material cost per tonne has increased to ₹35,000 range in Q1FY23 from ₹20,000 in Q1FY21. The industry has witnessed coal prices nearly tripling to $600 per tonne from an average range of $200 per tonne. This is in comparison to steel prices in the range of $800-1,000 per tonne and coking coal required at 0.7-1x of steel production.

The recent spike can again be attributed in part to Russia-Ukraine war. With restricted supply from Russia to Europe and the strain shared by all other sources of energy (gas, LPG and nuclear), energy costs, especially in Europe, will remain elevated. The region’s energy stockpiling, to last through the upcoming winter, will pressure energy prices globally, which may have started receding from the peak at the end of Q1FY23 (expected to be reflected with a lag). Despite the near-term relief, coal prices are expected to be elevated.

Financials and Leverage

Tata Steel net debt has come down from ₹1 lakh crore in FY20 to ₹54,500 crore in June 2022, which is 0.87x net debt to EBITDA. The company continues to target $1 billion (₹7,800 crore) in debt reduction every year and has so far managed to exceed the targets. The company has completed a ₹12,000-crore acquisition in Neelachal Ispat and expects to reignite the 1 MTPA capacity in the next three months. Tata Steel operates capacity of 30 MTPA currently and plans to increase the same to 40 MTPA in the next decade.

The company’s Kalinganagar facility has 3 MTPA capacity which it plans to increase by 5 MTPA. Tata Steel sees additional 4 MTPA capacity that can be unlocked in Neelachal capacity as well. The company reasons that with much of the growth sourced in-house, the company can phase out the expansion without getting overleveraged again if the steel cycles turn.

In the midst of a steel cycle the company is trading at 4.3 times FY23 EV/EBITDA. The consensus estimates have also factored in unfavourable raw material prices, going forward, with only a mild contraction in revenues with 6 per cent CAGR decline to FY24 and 22 per cent EBITDA decline. Investors can hold the stock trading at such lower valuations and with much of negative commodity impact priced in. Any recovery in steel or input price commodity, along with capacity growth execution, can be a positive surprise at these levels.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.