Malini, a single parent aged 42, wanted to check her financial position to understand whether she would reach her goals.

Her daughter, Shreya, is 13. She wants to pursue a career in sports. Malini is not sure of her daughter’s success and so wanted to assess how much she could allocate from her savings towards Shreya’s training and other related activities. She also wanted to explore ways to fund her daughter’s ambition without compromising much on her current financial status.

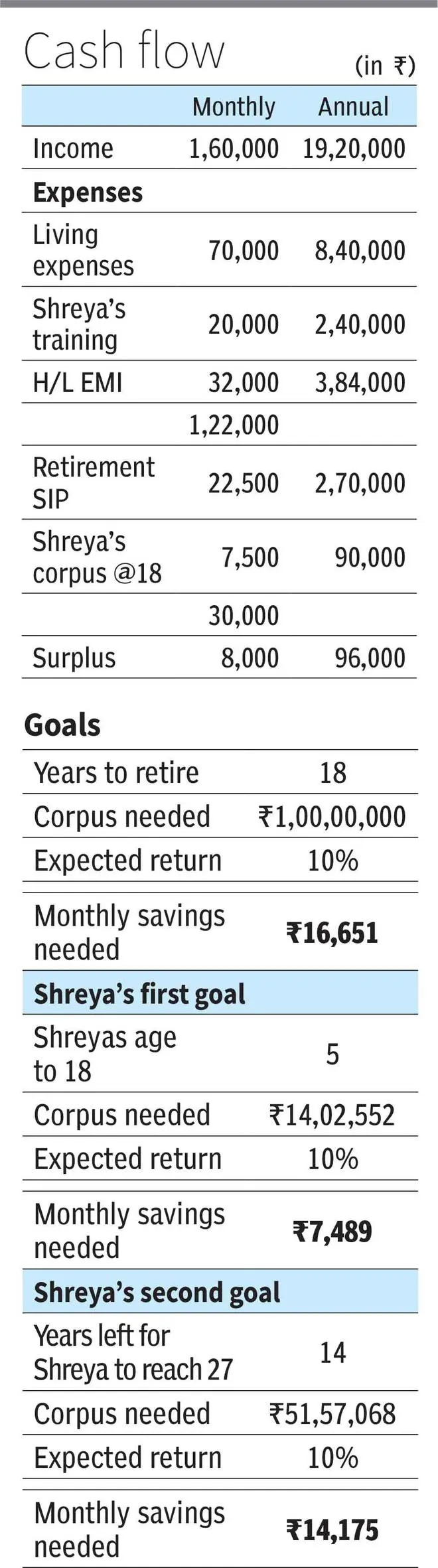

Malini is employed as an HR Professional and her post-tax salary is ₹1.60 lakh per month. She had accumulated ₹35 lakh, in the last 12 years of her working life, in EPF.

She owns a house worth ₹65 lakh in Chennai. She has a loan with an outstanding of ₹16 lakh for which she is paying an EMI of ₹32,000. Her household expenses are ₹70,000 per month. She has ₹15 lakh in fixed deposits and ₹5 lakh in equity mutual funds.

Malini’s goals are listed below

· To spend around ₹20,000 per month towards Shreya’s coaching expenses for the next 2 years. It may increase further, depending on Shreya’s progress.

· To set aside 6 months of expenses as emergency fund. Look forward to closing the housing loan at the earliest.

· To retire at 60 with a retirement corpus to take care of her monthly expenses of ₹40,000 post retirement adjusted for inflation at 7 per cent per annum

· To build ₹20 lakh by the time Shreya turns 18, to fund her college studies or for her career expenses; Malini is sceptical about a career in sports for Shreya, hence wants to ensure additional corpus of ₹20 lakh by the time her daughter turns 27. At 7 per cent inflation, the corpus requirement in next 5 years is ₹28 lakh and ₹52 lakh in 4 years from now.

· To build wealth of ₹1 crore in the next 18 years which will be inherited by Shreya later if not utilised by Malini for any purpose.

· To take care of any health-related expenses both for herself and her daughter

Her risk profile is moderate, and she did not have any experience in the investments side except for recent investments in mutual funds during Covid. She understood that luck was on her side as she invested when the market was attractive. She is keen on a disciplined way of investing to build wealth over the long term. She is hence advised to opt for 40:60 asset allocation in Equity:Debt as the maximum limit at any point of time.

Review and recommendations

· Malini has been advised to set aside ₹7.5 lakh towards Emergency fund from fixed deposits and another ₹2.5 lakh towards Shreya’s additional requirement, if any, in the next 2 years. This needed to be allocated from her fixed deposits.

· Her housing loan would be fully repaid with the current EMI of ₹32,000 at an interest rate of 7.9 per cent in the next 60 months. As a single parent and without any other support financially, she wanted to foreclose the housing loan at the earliest. Hence, it was recommended to prepay ₹5 lakh from her current savings. This will help in closing the housing loan in the next 40 months.

· She needs to accumulate ₹3.62 crore towards her retirement at 60 to get a monthly pension of ₹40,000 at current cost, adjusted for inflation of 7 per cent till her estimated life expectancy of her age 85. Expected return post her retirement would be 8 per cent per annum.

· Her regular contribution of ₹16,000 per month in EPF will fetch ₹2.27 crore without accounting for increase in contribution in the next 18 years. Balance can be accumulated by investing ₹22,500 per month at an expected return of 10 per cent per annum in the next 18 years of her working life. This will fund the deficit of ₹1.35 crore at her retirement.

· She was advised to focus on building a corpus of ₹28 lakh towards Shreya’s education/career fund in the next 5 years. She needed to allot ₹5 lakh of her current MF investments towards this. In addition, she has to set aside ₹7,500/- per month. This will help her accumulate ₹14 lakh in the next 5 years, approximately 50 per cent of the corpus required at an expected return of 9-10 per cent. The deficit would have to be funded based on increase in her income.

· Once housing loan is closed, the EMI could be diverted to savings to build wealth at an expected return of 10 per cent in the next 13+ years. She can withdraw ₹52 lakh when Shreya turns 27, towards her support fund. By continuing the investment of ₹32,000/- per month till her retirement, she would have a corpus of ₹50.65 lakh towards her wealth need.

· Though this investment plan does not ensure reaching all her goals, it will enable her to move in the right direction. Any increase in her savings and investment as and when her income increases will help her to reach desired corpus. She has the potential to reach her goals without much difficulty if she continues to invest 30-35 per cent of her monthly surplus in the next 18 years.

· She was advised to opt for a term insurance of ₹1.5 crore to ensure Shreya’s goals are reached

· It is recommended that both mother and daughter go in for a private health cover of ₹5 lakh and a super top-up health cover of ₹20 lakh immediately in addition to her employer provided provide health cover.

As a single parent, she needed to put a check on her expenses and training expenses for Shreya and to operate within the set limits. At the same time, she might find it difficult to create wealth with limited resources. A systematic approach to savings and investments without compromising on secure lifestyle will ensure reaching her goals slowly over a period of time.

The writer, Co-founder of Chamomile Investment Consultants in Chennai, is an investment advisor registered with SEBI

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.