Unnikrishnan and Shyamala live in Bengaluru. They wanted to check if they could maintain their current lifestyle and reach their financial goals comfortably.

Unnikrishnan, aged 42, works in a software company that provides services to the banking and financial services industry. Shyamala, 39, works in a pharma company back office, in a senior position. They live in a rented apartment. They have two daughters, Megha and Aara, aged 8 and 5 respectively.

Their primary concerns were:

1. As they were paying rent of ₹60,000/- per month in Bengaluru, “is it wise to continue to stay in a rented apartment or buy a new house in the same locality”? They may need ₹3.5 crore to buy a similar house in the same locality. They preferred the same locality due to multiple reasons. They were very confident of moving to Thiruvananthapuram, their native place, after retirement.

2. Both kids are currently studying in an international school. “How to ensure adequate funding for the children’s education”? was the second concern they had.

Related Stories

Simply Put: Sovereign Default

While it is rare, sometimes countries have defaulted on local currency bonds also3. Both Unnikrishnan and Shyamala were expecting inheritance in Kerala. A substantial portion of their retirement fund could be met if the inherited property could be liquidated in time. In addition to this, “How do we accumulate wealth”? was their third concern.

4. Both are receiving RSU as part of their CTC. They were seeking proper mapping of such a resource to their key goals, which was their fourth area of concern.

Assessment and planning

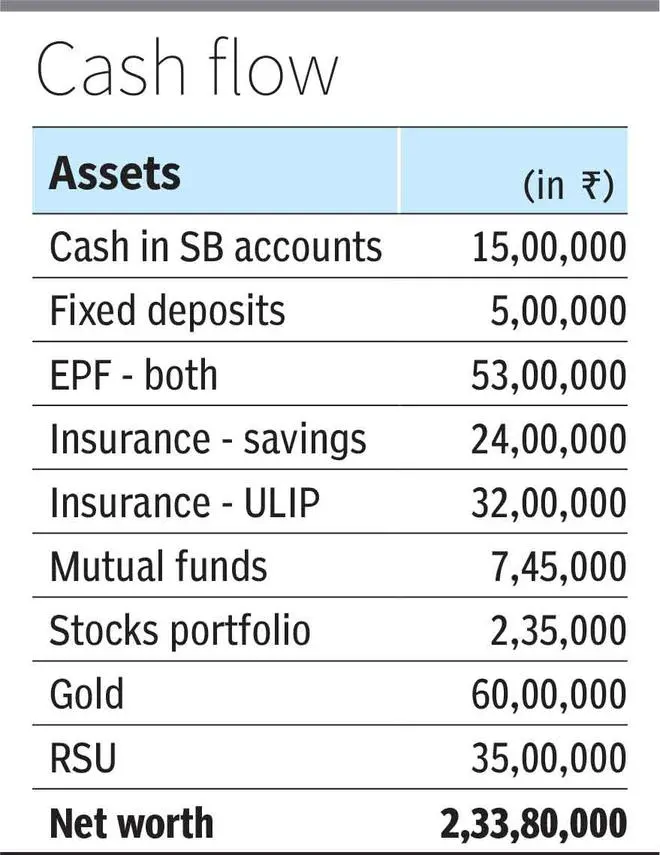

Risk assessment showed that both had appetite for aggressive investing. They were willing to commit investments for the long term. They expected an inflation-adjusted, growth-oriented investment portfolio. Both will be working till the age of 60-65.

Review and recommendations

1. It is appropriate to allocate ₹8.8 lakh as emergency fund, covering three months of living expenses, along with rent, annual school fees and travel to native expenses. This fund needs to be maintained as ₹5 lakh in fixed deposits and the balance in liquid funds. This can easily be funded with cash in the savings account.

2. It was explained to them that their investment in savings plans from insurance companies did not yield inflation-adjusted returns. They bought the conventional insurance plans for getting tax-free maturity benefits. These plans do not match with any of their goals’ tenure — such as kids’ education or marriage. These maturity benefits were mapped for their retirement goal. Some of the policies may be converted to paid-up policies in future. This will help them reduce the annual premium commitment in case of strain on future cash flow.

3. Investments in Unit-linked insurance policies were realigned to match their risk profile. As the premium payment terms are getting over in the next 5-7 years, the premium committed may well be redirected towards more suitable instruments.

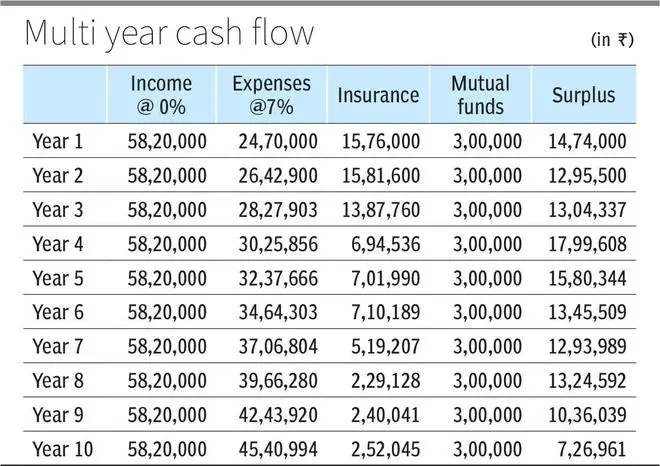

4. They have a positive cash flow for the next 10 years if they maintain the same lifestyle without considering any increase in income. Unnikrishnan expects his income to jump to 25 per cent in the next 2-3 years and Shyamala expects her income to go up by a minimum of 100 per cent in the next 5 years in absolute terms. If they focus on their career, the income growth will help them to build substantial wealth in the next 15-20 years of working life.

5. The current cost of education fund for each kid is assumed to be ₹60 lakh based on the course fee in a private law college in India. This may cover the cost of college education in India with wider options for any course in India. At 10 per cent inflation, they need ₹1.55 crore and ₹2.07 crore for their daughters at their respective age of 18.

Related Stories

Bajaj Finance FD: Is this a good option to park surplus funds?

Bajaj Finance recently hiked its interest rate offered on 3–5-year deposits by almost 40 basis points to 8.05 per cent for depositors below the age of 606. Kids’ marriage expenses are not their primary goal as this will be managed based on the available surplus at that point of time. Both are not keen to spend too much money on the wedding. They would rather prefer to focus on transferring wealth to the children at an appropriate age.

7. They were advised to opt for 60:30:10 in Equity: Debt: Gold/Cash allocation to their investment portfolio with an expected return of 10-12 per cent post tax CAGR. It was recommended that they focus on liquidity, growth and stability in portfolio construction and management.

8. They were advised to opt for 10 per cent of basic towards NPS contribution as part of tax optimisation. EPF and NPS accumulation would be part of their debt allocation along with insurance savings plans.

9. They were directed to use mutual funds towards equity allocation along with unit-linked insurance plans. RSU allotments could provide them with international exposure in the Pharma and IT sector. They were advised to invest in mid and small-cap mutual funds and sector funds for long-term wealth creation. Once they accumulate adequate wealth, they can diversify their investments to other asset classes.

10. Sovereign Gold Bonds and Gold ETF were recommended as part of the gold allocation. This may help the portfolio with stability during the market downcycles.

11. This portfolio can help them manage their education goal at the right time and transfer wealth to the next generation with minimal effort.

12. They are adequately covered for life and health insurance. They need to focus on wealth creation.

They were advised to invest systematically through mutual funds. They were used to very good savings habits and investing or saving 30-35 per cent of their income in various instruments and in different asset classes. They both understand the long-term growth potential of investing in financial assets. They were not right in the selection of suitable products to match their risk profile. This is where a different perspective from an advisor helps. A sound financial plan based on one’s needs and ability to understand and take risks clears many concerns or doubts that persist in the minds of investors, especially in this world of information overload.

Though they participated in the ups and downs of the market cycle in the last 7-8 years, they have not made decent returns on their portfolio. It needs to be understood that choosing the right products, managing the right asset allocation, regular review of the investment portfolio and rebalancing the portfolio to suit the investment climate are the keys to building wealth. Lastly, but more importantly, behaviour coaching by an investment guide adds more value to withstand volatility in the long run.

The author is a SEBI-registered Individual Investment Adviser. Refer www.financialplanners.co.in

The article is not representing any real person and is provided only for educational purposes

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.