After staying grounded for nearly two years, Indian citizens have started travelling abroad with the easing of international travel restrictions. As per a survey commissioned in April 2022 by online marketplace for holiday stays and rentals, Airbnb, about 75 per cent of 1,019 Indian respondents reported having plans for foreign trips in the near future. Alongside taking health-related measures, it is also important for travellers to optimise costs related to foreign exchange. They must also decide how they propose to carry overseas currency.

Modes of carrying forex

You can obviously carry foreign currency in cash. A visit to your local bank branch is enough. HDFC Bank and ICICI Bank offer currency exchange services in 22 and 14 international currencies, respectively. Further, one can look for RBI-authorised forex dealers nearby, order online through banks or platforms such as Thomas Cook and BookMyForex or at airport kiosks. Do note that one can carry a maximum of $3,000 in foreign currency as cash.

Two, certain premium debit or credit cards offered by the banks in India, such as Axis Bank Burgundy Debit Card, HDFC EasyShop Platinum Debit Card and Citi PremierMiles Credit Card have enabled transactions in currencies other than INR. However, do keep in mind that debit or credit cards denominated in INR used for transaction in foreign currencies are affected by foreign currency fluctuations. Also, all credit or debit cards don’t allow international transactions; so, do check if your card allows it before carrying the same.

Three, a forex card that works like pre-paid debit card filled with foreign currency of your choice can be used during foreign travel. There can be single currency or multi-currency forex cards, and these are offered by banks, online money exchangers such as Thomas Cook and BookMyForex and authorised forex dealers who also offer forex cards at their airport counters. One can withdraw cash from ATM through forex cards and also encash the remaining amount in the forex card in INR upon returning from the trip. Also, keeping forex card is a safe option as it is protected with PIN and 2-factor authentication.

Do remember that while exchanging currency, you will have to submit copies of documents such as Visa, flight, tickets, passport, and PAN card.

Costs incurred

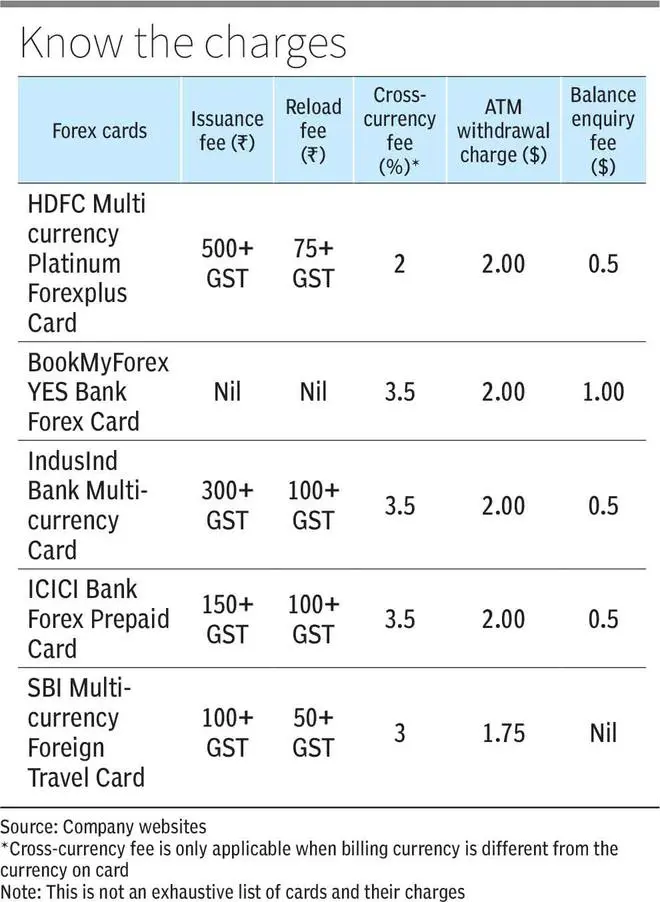

While exchanging currencies, there can be multiple costs to be considered, varying as per the modes of currency exchange. While using debit card or credit card allowing foreign currency transactions, you might be charged around 3.5 per cent currency mark-up fee and transaction fee in the range of 2.5-3.5 per cent of the transaction value. In case of forex card, there might be no cross-currency mark-up as long as the card is used in the same jurisdiction for which it has been loaded. If ATM withdrawals are considered, if done through forex card, around $2 per withdrawal is charged while in case of credit card currency conversion fee is also charged over and above the withdrawal fee. The other charges for forex card are issuance fee (₹150-300), balance enquiry (around $0.5), loading charges (₹75-100) and charge slip retrieval (not in every case). Currency exchange at airport might seem convenient but this convenience comes at a cost as the rates are exorbitant at the airport compared to other options as the charges might be in the range of 10-12 per cent of the transaction value.

What you should do

Ultimately, forex cards seem to be the most ideal way of holding foreign currency while travelling, given the cost efficiency, protection from currency fluctuations while transacting and security in case of theft. A forex card can be chosen after comparing rates among various options. Generally, you can get better rates by going for forex card through money exchangers and online platforms than banks. Currency exchange at airports in cash or purchasing forex cards over there should be the last resort as exorbitant rates are charged over there. Even though you are carrying forex cards, cash is always needed for petty expenses such as cab fares, meal at airports or any other such expense. You can get cash after comparing rates among different options. It is advisable for travellers to keep 20-25 per cent in cash and the rest of their requirement in forex card. Also, there is no harm in keeping debit card or credit card having access to transactions in other currencies, which can be used in case of emergency.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.