As interest rates harden, many NBFCs (non-banking finance companies) are coming out with NCDs (non-convertible debentures) to raise funds and are doing so at higher rates than regular fixed instruments of similar tenure.

Indiabulls Housing Finance’s NCDs are open for subscription and will be available till September 22, subject to pre-closure for early full subscription.

The NBFC is one of the leading players in the segment and offers retail mortgage loans, construction loans and loans against properties. It has been trying to strengthen its book by selling wholesale loan division and adopting an asset-light model of loan disbursal.

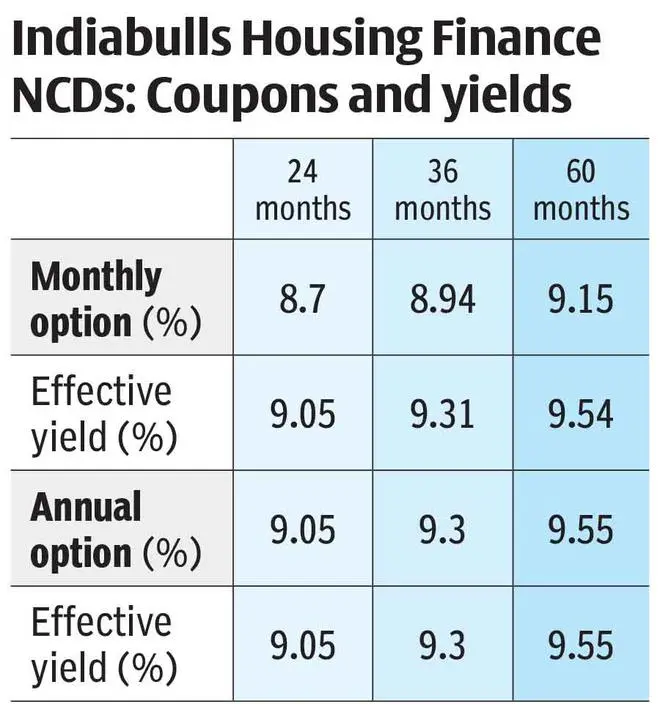

The coupon rates range from 9.05 per cent to 9.55 per cent for retail investors (see table). These NCDs are rated AA by CRISIL and ICRA.

Here’s what you must know before investing in these NCDs.

Company on the mend

Indiabulls Housing Financing has witnessed a fairly bumpy ride since late 2018. The NBFC planned to merge with Lakshmi Vilas Bank (LVB) in 2018, which was rejected by the RBI.

Then came the critical defaults of IL&FS in late 2018, which resulted in a long-drawn crisis for NBFCs.

A slowing economy from 2019 and with interest rates still being high at that time, NBFCs such as Indiabulls Housing had to contend with rising cost of funds and a liquidity crunch. The Covid-19 pandemic and the lockdowns worsened the situation with NBFCs witnessing muted credit growth.

In the aftermath of the IL&FS default crisis, Indiabulls Housing started cleaning up its books.

A weak real estate market has been persisting over the past several years. Besides, the merger with LVB did not go through. So, Indiabulls Housing decided to slowly run-down its wholesale loan book.

The company decided to pursue home loan and loan against property sales via the co-lending mode with entering into partnerships with banks, including HDFC. It is still in the middle of selling and running down its wholesale loans.

Indiabulls Housing will start an AIF (alternative investment fund) platform with three global funds. This will be a subsidiary for housing wholesale loans in the future. The company will contribute only 5-10 per cent of the capital for this entity.

The NBFC would take only a small portion of the loans on its own books (10-20 per cent) and the rest would be in the books of the co-lender and the AIF depending on the type of loan. The idea is to gain from the sourcing and processing fees while originating loans and not be burdened with non-performing assets on its books.

Key financial metrics

Indiabulls Housing Finance has reported improving numbers over the past few quarters.

i) As of June 2022, it has assets under management (AUM) of ₹73,047 crore, and the company hopes to grow by 10 per cent in FY23

ii) As it brings down its wholesale book, borrowings have decreased from ₹60,399 crore in June 2021 to ₹47,174 crore in June 2022. Net gearing is down from 3.1x to 2.5x over the same period

iii) CRAR (capital to risk weighted assets ratio) is at a healthy 34 per cent

iv) Gross non-performing assets (NPAs) are at 2.96 per cent, and has declined from the previous quarter. Net NPA is at 1.71 per cent

v) Stage 3 provisions (for loans 90 days past due) to gross NPA are high at 42 per cent, indicating some cause for concern. These provisions are much higher than regulatory requirements

vi) Cost of borrowing was relatively high at 8.1 per cent

vii) Yield on loans was at 10.8 per cent, indicating a reasonable spread

What should investors do?

Even as investors take stock of the slow improvement path that Indiabulls Housing Finance is taking, they must check if the coupons offered are attractive enough.

The company is offering NCDs in three tenures—24, 36 and 60 months. Monthly and annual interest payout options are available for all tenures. Going by the coupon rates for the three-year and five-year options with monthly payouts, we get effective yields of 9.31 per cent and 9.55 per cent, respectively.

Data from Citibank (prepared by CRISIL) indicates that AA-rated corporate bonds trade at a yield of 9.14 per cent (three-year bonds). For five years, the yield is 9.88 per cent.

Therefore, the spread for the three-year tenure as seen from the bonds data is not that attractive for the three-year option and is at a discount to the prevalent five-year yield for the five-year option.

But another key pain point is thrown up by the yields of the existing bonds of Indiabulls Housing Finance that are listed on the BSE and NSE.

For the bonds that mature in September 2024 (8.66 per cent coupon), September 2025 (9 per cent coupon) and April 2027 (9.25 per cent), the yields are 14.48 per cent, 15.09 per cent and 12.63 per cent, respectively.

These are based on the trades made in the NCDs of the company on the BSE. Yields are based on the last traded prices. Most of these bonds are traded infrequently or not at all.

It is clear from the secondary market yields that the current coupons are priced at a good 300-400 points lower. Higher yields may be an indication of greater risk perception.

Retail investors can therefore skip this issue and wait for better coupons for the underlying risks. Those with a stomach for very high risk can consider buying these bonds from the secondary market at higher yields, though getting it at the right price may not be easy, given the scanty liquidity.

In general, retail investors are better off not taking high risks on their fixed income portfolio, as that can be done with their equity portfolio.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.