Mirae Asset, a global leader in the financial services industry, has launched ‘m.Stock’, an investing platform. The new product offers access to many trading and investment products under one roof paired with a zero-brokerage and no-commission model. Here is a quick review.

What's on offer

Mirae Asset Capital Markets (India) offers its online retail stock broking services under the brand m.Stock. The company received its SEBI stock broker licence in January 2018 and Category-I Merchant Banking Licence in March 2018.

The platform provides a single-window solution for investments in stocks, F&Os, currencies, IPOs and mutual funds. One can use the web portal or the Android and iOS platform apps.

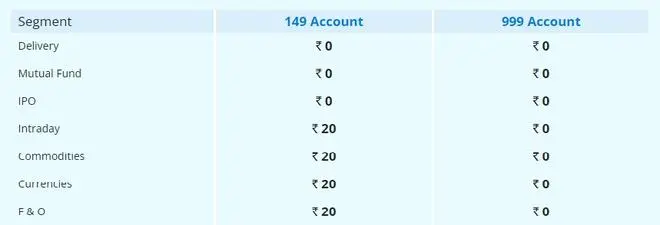

For the ₹999 account, you will be charged a one-time account opening fee of ₹999, where you get to trade across all products at zero brokerage. This is a not a recurring charge. Zero brokerage charges are not linked to any subscription pack, or a limited number of trades and this is not a limited-time offer. Add a payment of ₹999 (optional) at the time of account opening to have your demat maintenance charge also free for life. If you don't wish to go for this optional payment, ₹120 will be charged per quarter. GST and payment partner fee are extra.

Zero brokerage helps save substantial money for active traders, especially in the options segment. For instance, 20 orders daily for 20 trading days a month in the option segment at ₹10/order can mean ₹48,000 in annual brokerage. If the order rate is ₹20, then the brokerage amount doubles to ₹96,000 in this scenario. Zero-brokerage plans lower costs and are important for the long-term profitability of a trader.

For the ₹149 account, you will be charged a one-time account opening fee of ₹149. Subsequently, you will be charged at ₹20 per trade for intraday, futures and options, and currencies. Delivery-based trades, mutual funds and IPOs are zero brokerage/commission for this account as well.

Do note that additional levies such as STT/CTT, SEBI charges, stamp charges, DP charges, pledge charges, delayed payment charges, payment gateway charges (in case of net banking), RMS square-off-charges for open intra-day positions by system etc. will still be levied.

Apart from the disruptive pricing, m.Stock offers pre-designed index baskets, voice search for individual stocks and contracts, access to long-term historical data, one-click full exchange basket buy etc. The platform claims the capability to process more than one crore trades a day for more than 15 lakh customers at the same time.

We tried the account opening process on mobile and within one hour the m.Stock account (₹999) was activated successfully.

Our take

In a bid to attract new-to-trade and young investors, some stock brokers have come out with unlimited trading plans and zero-brokerage schemes. Mirae Asset's m.Stock has come out with attractive pricing. In recent times, Flattrade, an online brand of Fortune Capital Services, also introduced zero brokerage for its customers.

Technology allows new broking outfits to conduct trading operations at a scale. The zero-brokerage plan is not entirely new as the idea has already been successfully tested by brokers around the world. In this model, the brokers generate revenue through funding products and also through the exchange benefits by doing higher volumes.

Do note that low brokerage is no way linked to successful trading. If you are thinking of getting into trading, learn about its ups and downs.

While smart use of technology can solve certain problems, unrealistic businesses may not have the capital to maintain service standards. Only time will tell if zero-brokerage offerings in India can usher in the wave of disruption that the broking industry saw with discount broking.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.