Think of infrastructure and the time-tested investible option available in this space has largely been NHAI bonds. Direct exposure to stocks of infra companies have their pitfalls. InvIT or infrastructure investment trust is somewhere between a bond and equity. The underlying assets for InvITs are roads and power transmission projects and its a SEBI-regulated product, which in some cases are listed and work like a mutual fund. InvITs are special vehicles which help the infrastructure company monetise the asset. Here are key things to know about them.

How do they work

InvITs are a hybrid between debt and equity; they have stable and predictable cash flows like debt and they offer the scope of change in unit price which is a feature like equity. With 80 per cent completed assets transferred from the asset owner to the fund, it removes the project risk extensively and starts generating cash flows from Day 1.

InvITs also have a predictable cash flow because the assets which are underlying typically provide cash flows for long term generally for 15-20 years. The risk involved lies in the quality of cash flows, which generally is dependent on type of projects, road the traffic enjoyed by it, capacity utilisation and the tariff pricing.

InvITs are a play on volume. For revenue streams to increase more projects need to be added to the InvIT. The financial health, governance, and quality of the InvIT’s parent will play role in making the investment call.

InvITs must announce 90 per cent of net surplus cash flow as distribution and this should be distributed at least once six months. The distribution from the InvITs have basically three components-Interest (received from the underlying projects), dividend (yielding on equity invested in the projects) and income accrued at trust level which is neither interest income nor dividend.

InvITs vs. REITs

REITs (Real estate Investment trust) can be called as a sister instrument of InvIT. Both are quite similar in principle, though REITs work on commercial real estate properties such as offices, malls, industrial parks, warehouses, hospitality, and healthcare centres.

Like InvITs, REITs are also required that 80 per cent of underlying assets are income generating and have relatively stable cash flows. InvITs can be traded publicly or can be privately listed whereas REITs must be traded publicly.

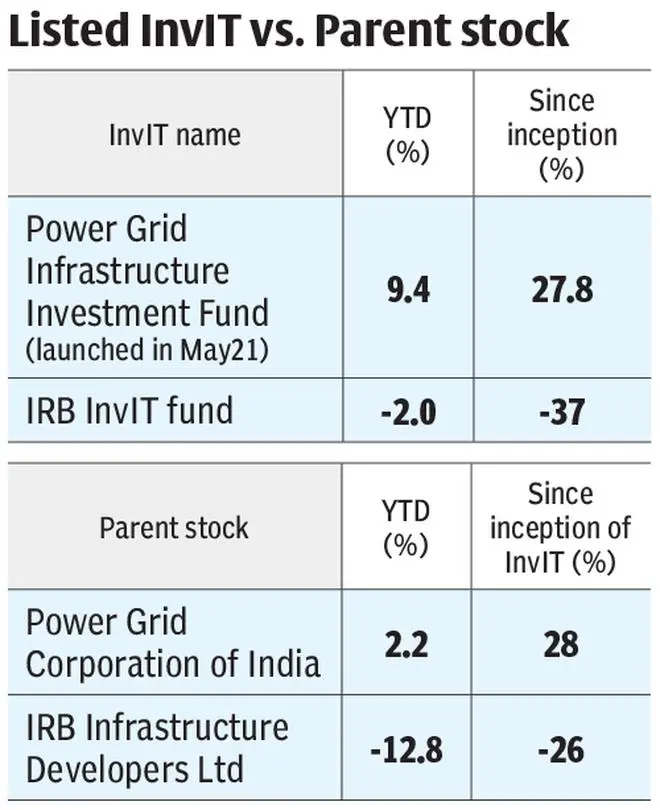

Listed InvITs returns

The India Grid Trust has given a 45 per cent return till date from its inception, Power Grid Infrastructure Investment Unit has given a return of around 28 per cent since inception whereas IRB InvIT Fund has given a negative 37 per cent return since inception.

Most of the IRB InvIT Fund’s underlying assets have been loss making and the distributable surplus is primarily comprised of the interest income and this could be a reason why it has given negative returns.

Taxation

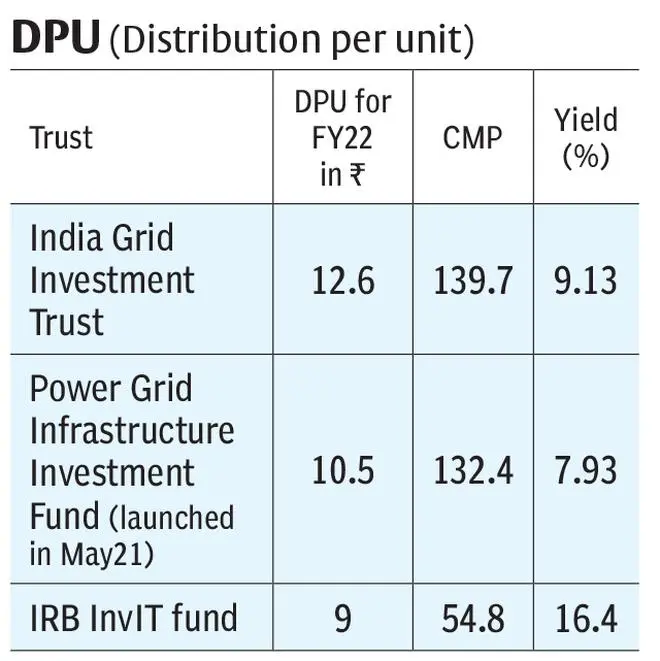

The interest component of distribution per unit (DPU) is taxed at the slab rate, while the dividend component is exempt if the underlying project SPVs have not opted for concessional tax regime.

InvIT/ REIT are subjected to 10 per cent withholding tax.

For India Grid Trust, interest income accounts for a major chunk of the distributions and had opted for concessional tax for all except one of its SPVs and therefore dividend income is also not exempt in the hands of the investor.

In case of Power Grid four out of its five underlying projects have opted for concessional tax regime and therefore there will be taxable dividend and exempt dividend for the investor. For FY 22, the DPU by Power Grid ₹ 2.5 is taxable dividend and ₹ 1.08 is exempt dividend. Although, in terms of exemptions Power grid InvIT looks good now, but the scenario may change once more projects are added.

Who should go for it

InvITs are best suited for high-net-worth individuals (HNIs). Even as the minimum investment amount has been reduced from ₹1 lakh to ₹10,000 to ₹ 15,000. However, InvITs are at an early stage and the regulations are still evolving. Just like with AMC stocks, InvIT stocks may also be susceptible to regulatory changes. Understanding of the infra sector and the underlying projects to assess the revenue visibility and growth (including capital growth) is a must and this makes the product best positioned for the niche investors.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.