India Inc Q1 results started off in all earnest in the second week of July with companies like TCS and HCL Technologies reporting their results at the start. Since then many other bellwether companies like Infosys, Reliance Industries, HUL, Nestle, HDFC Bank,SBI and listed companies of Adani Group have all published their results. Many of the mid-cap and small-cap companies have also reported their results. Atbl.portfolio we thought now would be a good time to assess how India Inc results have fared in aggregate, and below are our findings from our analysis. `

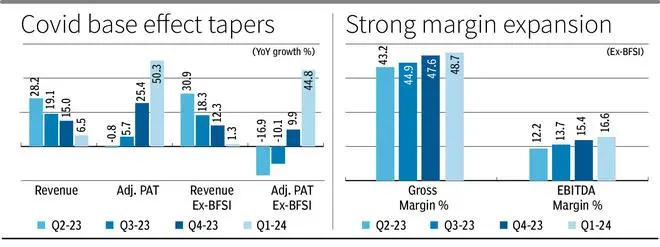

Based on the 1,505 companies that reported results by August 9, revenue growth has slowed to 6.5 per cent y-o-y (year-on-year) in the first quarter of FY24 from an average 20 per cent growth in the last three quarters.

The advantage of a weak comparable base wrought by Covid is no longer available to buffer topline growth. But the adjusted Profit After Tax growth at 50 per cent y-o-y has driven earnings and sentiment along with it, as PAT margins rose 303 bps y-o-y to 10.6 per cent.

Gross margins (ex-BFSI) expanded 509 bps y-o-y to about 49 per cent as the raw material cost inflation subsided, but EBITDA margins ( ex-BFSI) rose only 303 bps y-o-y to about 17 per cent as other operating expenses offset material cost savings.

Overall, while the market cheers the earnings momentum, the fact that this growth has come from lower costs, rather than volumes, must be taken note of.

Growth drivers

Banks continued to report strong topline growth while it turned negative for refineries and the power segment which track crude oil prices. Banks sitting on higher NIMs (net interest margins) and credit growth can expect marginal contraction in interest spreads following the Reserve Bank of India’s hawkish monetary pause.

Compared to windfall gains on refining margins last year, refineries are reporting normalised growth. Excluding thees two, revenue growth continued to be at 6.8 per cent y-o-y in Q1 for all the remaining sectors combined.

Also read: Zee Sony Merger: Here is why Zee investors can look forward to better times

Autos drove discretionary growth, with a strong order book, increased average selling prices, exports, and product mix contributing to a 31 per cent y-o-y increase.

Pharma rebounded in the US on valuable launches and controlled price decline, resulting in 16 per cent growth, despite Indian growth being impacted by NLEM pricing adjustments.

Also read: Debt Investment Strategy: Fixed or floating interesting rate?

The FMCG sector saw 9.4 per cent growth (average of 15 per cent y-o-y over last three quarters). Volume growth was hit by price adjustments, but rural volume recovery was noticeable.

Cement growth eased to 12 per cent on stable-to-slightly positive prices, while the steel sector achieved 6 per cent y-o-y growth, aided by price rebound. Commodity price cool-off aided gross margin (GM) expansion, but the fact that India Inc is investing in operations for future growth tempered margin pass through.

Companies are spending on operational lines to increase or grab market share in a period of lower commodity costs and stagnating volume growth. Employee costs, as a percentage of sales, were higher by 110 bps y-o-y and other expenses, which include selling, advertising and other costs, increased 306 bps. This despite power and fuel expenses slowing 50 bps y-o-y.

Cautious outlook

The fact that gross margin expansion has led to earnings growth rather than revenues or operational leverage implies a price-based growth rather than volume-based growth.

Volume participation, or demand, should be a key monitorable going forward. Rural volumes are gaining strength as indicated by commentary across sectors.

However, this nascent recovery post Covid will be in doubt if cost inflation bounces back. The interest coverage ratio declined to 5.4 times in Q1FY24 ( ex-BFSI and power) from 6.2 times last year.

Though the RBI has paused now, the interest rate trajectory needs a constant watch.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.