There is a saying that goes “The more things change, the more they remain the same”. However, when comes to performance of benchmark index Nifty 50 in 2022 and the underlying sectors, the more things remained the same, the more things actually changed.

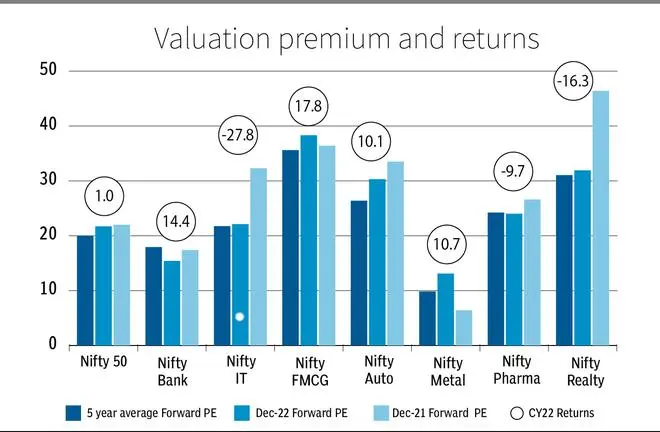

The index trading at 12 per cent premium (to five-year average) in December 2021 may have been one reason driving the near flat performance in the year (1 per cent returns in CY22 against 24 per cent in CY21).

However, looking beyond the headline index number reveals sector rotation in play with changes across sector performance compared with 2021. Among sectoral indices, there were many ranking reversals from last year. The current year’s outperformers — Nifty Bank and Nifty FMCG — were the worst performers in CY21, while Nifty Metal has been a leading performer in CY21 and CY22.

Outperformers

Similarly, Nifty IT and Nifty Realty, which are among the weakest performers in CY22, were the leading performers in CY21. Nifty Pharma showed weak returns in CY21 and CY22. Being able to pass on inflated commodity costs and barely protecting margin decline, Nifty FMCG returned 18 per cent in CY22 against only a 9 per cent return in CY21. Valuation premium has inched up to 8 per cent currently from a 3 per cent premium last year.

Nifty Bank has delivered strong returns of 14 per cent in CY22, while currently trading at 14 per cent below its average valuations.

The banking segment is facing a heady trifecta of net interest margin (NIM) expansion, credit growth and lower credit costs following a long period of asset quality issues. Metal prices rallied in CY21-22, aided by easy monies, following Covid stimulus, fanned further by geopolitical issues. Nifty Metals trading at 38 per cent valuation discount in CY21 also helped the index return 11 per cent in CY22 following 69 per cent returns in CY21.

Apart from banks, FMCG and metals, Nifty Auto index has returned an average 14 per cent in each of the last two calendar years. This reflects the optimism underlying the industry after a tepid five-year period.

Underperformers

Nifty IT entered CY22 with valuation premium at 63 per cent and after having returned 58 per cent in CY21, based on stronger digital revenue streams. With developed economies slowing down, wage inflation and attrition eating into margins, and a high valuation base, the index corrected 28 per cent.

Nifty Pharma gained 60 per cent in CY20; the index barely sustained the momentum with a 9 per cent gain in CY21; however, it gave up those gains in CY22 (-9 per cent). The return of FDA plant inspections and US price erosion have impacted the sector. Companies with differentiated portfolio and India focus have managed to surpass their peers in the index though. Any further news on Covid resurgence that surfaced last week can bring the focus back on healthcare.

Outlook

With Nifty 50 trading at a 9 per cent premium to five-year average, and with looming risks of recession in developed economies in 2023, sector rotation may continue to be the way to play markets in 2023.

Hence, sectoral earnings growth and valuation premiums versus historical average may remain key aspects to look at when investing in 2023.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.