In contrast to mainboard IPOs, calendar 2023 will stand out as a blockbuster year for SME IPOs . Over 80 SME IPOs have already mopped up ₹2,300 crore so far this year, beating the previous record of ₹2,287 crore in 2018 via 141 public issues. And there are five more months to go. It’s been annus mirabilis not just because of the number of issues or the funds raised, but also going by the money investors have made from these issues.

Listing gain 1-in-2 IPO

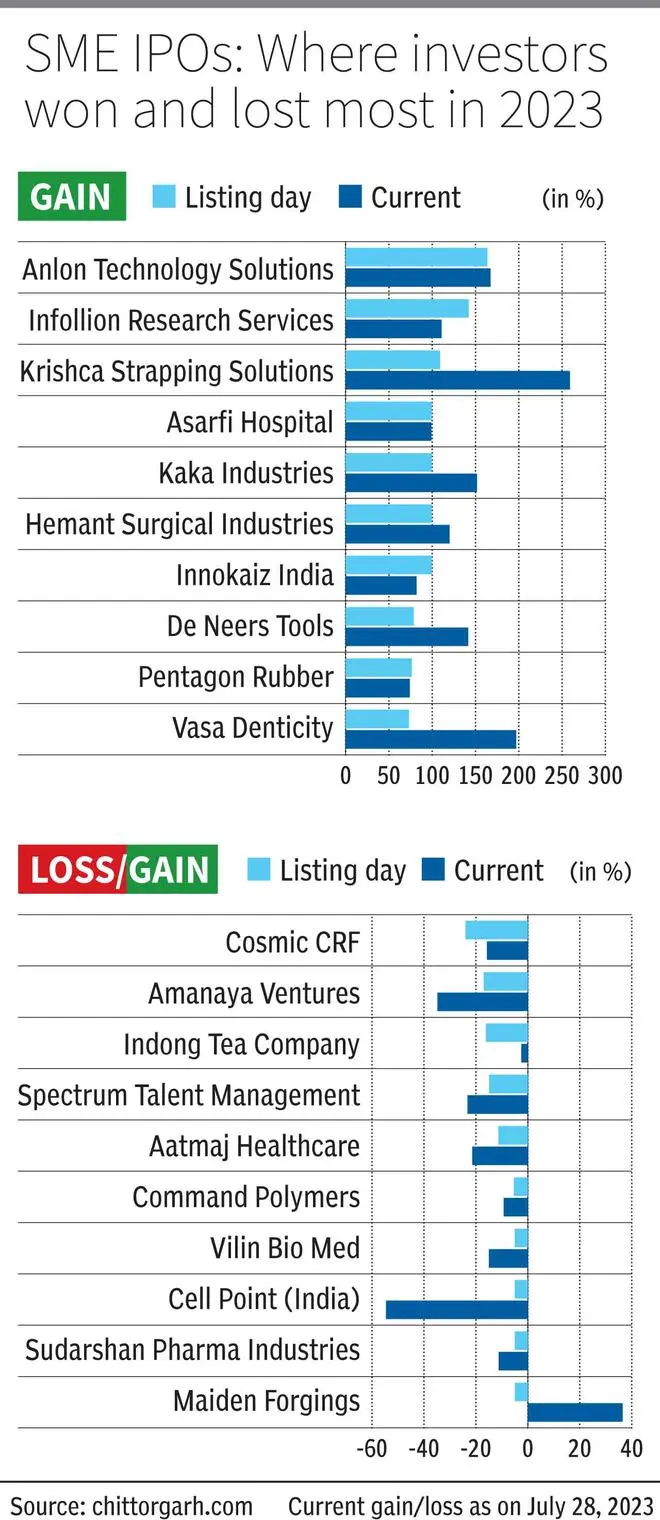

Of the 85 primary issues so far this year, 43 issues or more than 50 per cent helped investors gain quick money in the form of listing gains of anywhere between 10 per cent and 163 per cent. As many as 18 of the a total of 85 issues (that is, 21 per cent of the issues) fetched over 50 per cent gains on listing day. And, in just seven months, stock prices of as many as seven SME IPOs — Anlon Tech, Infollion Research, Krishca Strapping, Asarfi Hospital, Kaka Industries, Hemant Surgical and Innokaiz India — doubled on listing day. That’s a success rate of eight per cent.

In comparison, the share of SME IPO stocks that saw such stellar listing (listing gains of 100+ per cent) for full year was about seven per cent in 2022, five per cent in 2021, zero per cent in both 2020 and 2019 in the last five year period. Even in the bull market year of 2017, the stellar listing rate was merely one per cent for over 130 SME IPOs.

Flash in the pan?

In the case of mainboard IPOs , investors have often witnessed a flash-in-the-pan good short-term performance. While most of the seven stellar listings in SME IPOs of 2023 so far have held to their gains and some have even been gone up, there are duds too. As many as 17 SME IPO stocks or 20 per cent of them listed in the negative in 2023 so far – that is a one in five chance. And when market sentiment about a recently-listed stock is bad, there is rarely a quick turnaround. Of the Out of 17 duds, almost 88 per cent are still in the red.

- Also Read: Yatharth Hospital IPO subscribed 36 times

Even if you are a long-term investor, a buy-and-hold strategy may not work in SME stocks, given that they are smaller companies which who are more susceptible to the vagaries of business cycles and effects of rising competition intensity. While their size does give them the capacity to grow their earnings faster, the ultra-low revenue base and wafer-thin profitability in many cases can lead to quick deterioration in financial position.

About one-third SME stocks listed in each of the past few years have lost money as on date. For instance, 37 per cent of SME IPOs listed in 2017 are in the red with up to 97 per cent loss. As many as 35 per cent of 2018-listed SME stocks are in the red. The number is 33 per cent for 2019-listed SMEs , 35 per cent for 2020, 30 per cent for 2021 and 31 per cent for 2022.

Keep in mind

Investors lured by SME stocks should keep the following factors in mind. As a greater number of SMEs tap the IPO platform, the pricing could be getting richer, leaving less on the table for investors. Two, the quality of companies coming voluntarily or being brought to the market by investment bankers could be relatively weaker. Besides, liquidity of SME stocks once listed is also a lot lower than mainboard, making exits riskier. With broad lot size of SME IPOs being between ₹800 and ₹3,000 a share, you will be putting a lot more capital, thereby operating in the high risk- reward spectrum.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.