Bank of Baroda is the second largest public sector bank with a balance sheet size of over ₹8 lakh crore as on September 30, 2022. It was one of the first experiments of consolidation among PSU banks and the merger helped it displace Punjab National Bank from the second spot in the pecking order. In the last 5–6 years, concentrated efforts have gone into strengthening the balance sheets of PSU banks and one of the biggest beneficiaries has been BOB.

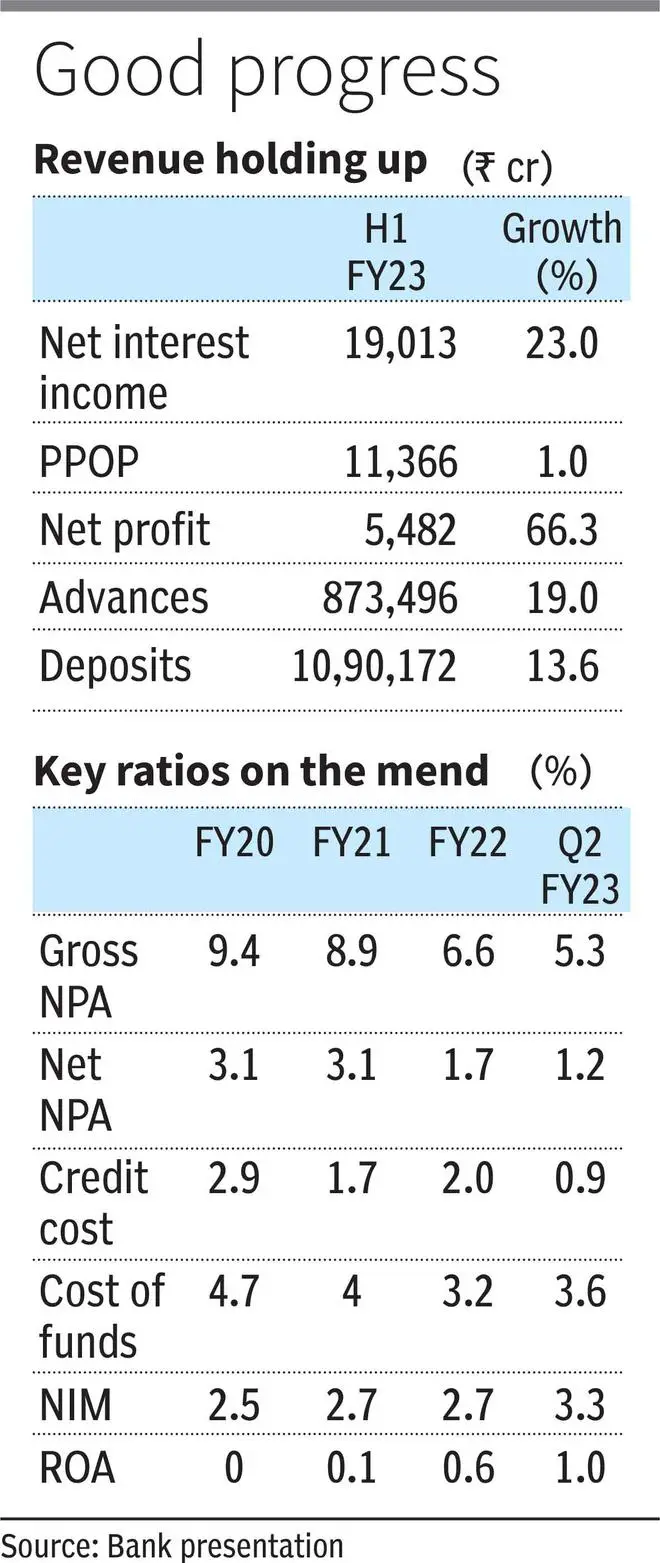

Its net NPAs have fallen to 1.16 per cent in Q2 FY23, down from 3.13 per cent in FY20. Likewise, its slippages ratio, contained at 2 per cent, is a remarkable improvement from FY20 levels of 3.4 per cent.

While the entire PSU banking space seems to be in vogue currently, we are bullish on BOB stock for two reasons.

Despite the sharp run-up in the stock price, BOB’s valuations at 0.8x FY23 estimated book are still in the comfort zone, especially in comparison to SBI’s 1.2x FY23 P/B valuations. Likewise, the room for further improvement in asset quality also seems broad in BOB as against SBI. SBI’s net NPA plunged below a per cent (0.9 per cent in Q2 FY23), while that of BOB stood at 1.16 per cent.

Also, the bank is in the process of strengthening its credit cards operation, possibly by roping in an investor and has initiated a full-divestment of Nainital Bank. At 15.68 per cent capital adequacy, while BOB nearly has no immediate capital requirements, the efforts with the subsidiaries should release some capital, thereby augmenting its balance sheet.

Investors with a long-term perspective can accumulate the stock of BOB. Any significant corrections (10 per cent or more) may be considered as good buying opportunities.

Progress over the years

BOB was one of the first to get a lateral hire from the private sector to head the bank as its MD & CEO. It was also the first experiment among PSU banks in the consolidation process.

Just when it had completely absorbed the changes brought into its system since 2016 and the merger, it was hit by the pandemic. But it took advantage of the pandemic and the then prevailing low interest rates to make a splash in the retail lending market. At one point and perhaps till about the cycle started reversing by mid-2022, BOB’s retail loan rates were among the lowest and this played a very important role in helping the bank reorient its loan book in favour of retail loans, including agri and MSME loans.

Today, they account for 54.5 per cent of the total loan book, up from 48.6 per cent in FY20 and bulk of the growth including in Q2 FY23 was driven by the retail segment.

Given that the green shoots in demand from corporates aren’t strong yet and that banks (especially PSU banks) haven’t reached the comfort zone to go big on corporate loans as seen during FY10–FY13, retail may remain an integral pillar of growth. What’s also comforting is that the share of restructured accounts is contained at 2.1 per cent of total loans (₹17,700 crore). With the overall trend in slippages revised to 1.5–2 per cent of total assets (as against 2 per cent earlier), the restructured book is unlikely to throw untoward surprises.

What could put some pressure on the financials is the treasury losses incurred due to repo rate hikes. However, unlike the earlier cycles, PSU banks haven’t slipped into net losses due to this factor as healthy loan growth is acting as an equaliser. With cost of funds at less than 4 per cent, even if deposit rates increase in subsequent quarters, it may not impact the bank’s profitability significantly (see table).

Change in guard

Apart from the increased focus on retail loans, the approach of most banks towards lending practices has also undergone some changes in recent years. The top 2-3 private banks are seen as the benchmark, whether in terms of growth, underwriting standards or service delivery standards. On these parameters, BOB has witnessed some changes and this is reflected in the strong numbers posted by the bank after its consolidation, which took time till FY20 to reflect positively. The bank trimming its overseas operations and renewing its interest in some of the key verticals, including credit cards, reiterate that its focus on the core lending business has sharpened.

For investors, this is a big positive and dispels some of the basic fears that one would have on public sector banks.

BOB is due for a change in its MD & CEO. Usually, it ropes in someone from other PSU banks, though once it has had a leader from the private sector. Usually, change in leadership entails some kitchen sink cleaning. However, with BOB now in a much stable position, that risk seems to have abated. Provision coverage ratio at 90 per cent also instils confidence on this aspect. To sum up, the downside risk in BOB stock appears well-contained.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.