If globally the business of telecom has been a tough nut to crack, the business in India should rank as the toughest nut. With probably the lowest survival rate of telecom players, the Indian telecom sector has been a severe test of endurance, with many players falling on the wayside or merging to survive.

Bharti Airtel ranks as the only private player to have survived in its original form, bracing all the upheavals of the last two decades. In the process, the company has solidified its dominant position in the sector to compete on par with Reliance Jio. Operationally and financially it remains well-positioned to capitalise on the next wave of 5G-driven growth and also market share gains as Vodafone Idea continues to fumble and remain a weak third player.

At bl.portfolio, we have maintained a positive view on prospects of Bharti Airtel for quite some time. Since our buy call on the stock of Bharti Airtel in our edition dated April 11, 2021, when the stock was trading at ₹533, the stock is up by 73 per cent versus the Nifty 50 up by 32 per cent in the same time span. We continue to have a positive long-term view on the company’s prospects, given many structural levers in favour of the sector/company in the current decade.

While 5G is long-term play and may not immediately reap gains as telcos will first have to invest heavily in initial years, the long-term prospects for telcos like Bharti to benefit from 5G-enabled themes like IoT, virtual reality/metaverse, industrial automation, autonomous cars, etc, are quite strong and vast.

However, post run-up in recent years, the stock may see a phase of consolidation over the next year or so as markets wait and watch for evidence of traction in 5G getting reflected in financials. Capex related to 5G impacting cash flows may also temper stock performance for the time being.

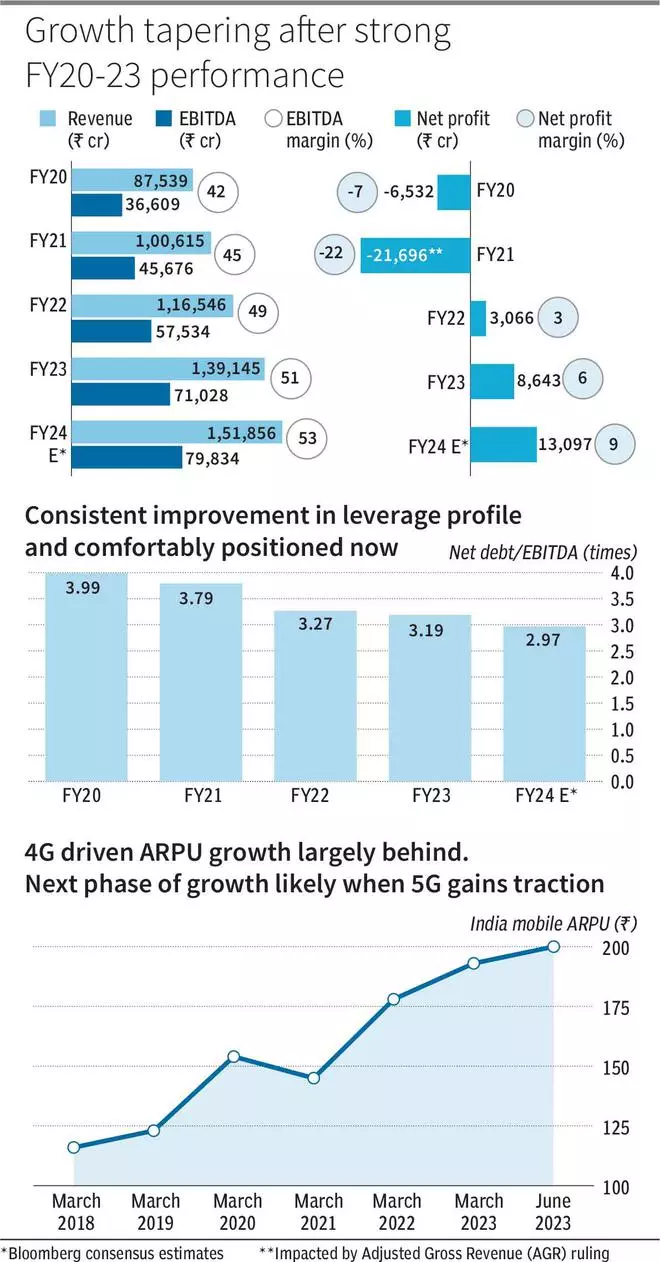

The stock is now trading at one-year forward EV/EBITDA of 9.1 times. At the time of our buy call in April ‘21 it was trading at 8 times. While valuation is not much higher as compared to then, the growth rate is tapering (base effect as well as pause/consolidation before next wave of growth) – as compared to FY21-23 EBITDA CAGR of 25 per cent, FY23-25 EBITDA CAGR is estimated at 11 per cent (Bloomberg consensus).

Thus, on relative basis vis-à-vis next two years growth the stock is not cheap or attractively priced like a couple of years back. However, neither is it too expensive, and given the long-term structural positives and with Bharti Airtel being the only strong and well-established pure-play telecom stock trading on the bourses which should give it a scarcity premium, we recommend that existing investors continue to hold the stock. Investors can hold through the consolidation phase for better returns in the long run.

Business and prospects

At a consolidated level, Airtel is the largest telecom player based out of India with operations in India (69 per cent of revenue), Africa (30 per cent) and South Asia (1 per cent). Its business encompasses mobile services (around 80 per cent of revenue), enterprise/business services (enterprise connectivity, submarine cables; around 14 per cent of revenue) and other services like DigitalTV/DTH, home services, etc.

India mobile services is the largest segment, accounting for 54/57 per cent of consolidated revenue/EBITDA respectively. It currently has around 33 per cent of the mobile subscriber market share in India vs Jio’s 39 per cent. As compared to two years back, Airtel has gained much of the ground ceded by Vodafone Idea, with market share increasing from 30 per cent, while Jio increased its market share by 1 per cent in the same period.

In last three years (post impact of disruption in industry after Jio’s entry and also subsequent AGR related issues in FY20) Bharti Airtel has seen significant operational and financial turnaround. EBITDA for the company has grown from ₹36,609 crore in FY20, to ₹71,028 crore in FY23 at a CAGR of 25 per cent. During the same time its revenue CAGR was 17 per cent. Thus its growth in EBITDA was driven by a combination of revenue growth, and operating leverage as company benefitted from economies of scale. While the company has seen growth across geographies and segments, India mobile services was the main driver, accounting for 68 per cent of the increase in EBITDA in this period. Leverage metrics for the company have also improved with net debt/EBITDA improving from 4 times at end FY20 to a comfortable 3.2 times now.

During the phase when 4G gained traction, India mobile ARPU saw substantial improvement from ₹116 in March 18 to ₹200 and India mobile services segment EBITDA margin too saw substantial improvement in this period from 32.6 to 53.8 per cent now.

Post the significant improvement of recent years, it is more likely that in the near to medium term ARPU will only see marginal increases, while margins are also likely to stabilise around current levels.

Till 5G becomes the next growth driver, growth will be moderate as compared to recent years. For example, consensus expects FY24 revenue growth at 9.2 per cent versus 19 per cent in FY23. Better growth is expected for the year from other segments like Airtel Africa and Airtel Business (enterprise connectivity). 5G may turn out to be a significant driver from FY26 onwards. Besides company investing in FY24 and FY25 to expand 5G coverage, for the theme to flourish the ecosystem will also have to develop. Things like cheaper 5G smartphones and development of other 5G use case devices are essential for the theme to gain traction. The stock could go through a consolidation phase in the interim.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.