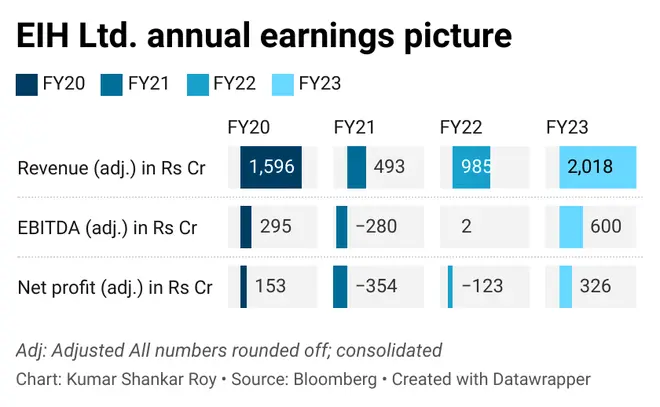

Premium hospitality operator EIH Ltd., the flagship of Oberoi Group, has reported robust Q4 and FY23 earnings. Consolidated revenue from continuing operations more than doubled on a year-on-year (y-o-y) basis to stand at ₹637 crore for Q4 and ₹2,018 crore for the full year (against FY23 analyst expectations of ₹1,840 crore) as robust demand in the hotel industry ensured occupancy and average room rates remained strong. Here is a deep dive into the results.

Margins, profit

Consequences of the Covid-19 outbreak on the company’s and its subsidiaries’ business for the year ended March-2022 had been severe.

Promoters hold 32.85 per cent in EIH., which also counts ITC (13.69 per cent) and Reliance Strategic Business Ventures (18.83) per cent) among public shareholders, has over 4,200 rooms (keys) across 30+ hotels worldwide. It has three hotel brands – Oberoi (luxury), Trident (5-star), and Maidens (heritage). It has recently launched a casual dining venue, Cou Cou.

The premium hospitality major clocked adjusted EBITDA of ₹204 crore for Q4, and ₹600 crore for FY23 (against analyst expectations of ₹530 crore), helped by seasonally strong second half.

Adjusted EBITDA margin for Q4 was 32.1 per cent, and for full year came in at 29.7 per cent (90 bps ahead of analyst expectations of 28.8 per cent). Hotels being a high operating leverage business, the nearly 30 per cent margins reflect the company’s ability to use synergies across its operations.

Fourth quarter adjusted net profit was ₹84 crore (over four-fold y-o-y rise) while the full year number at ₹326 crore (against ₹123 crore net loss in FY22).

Operational show

EIH’s numbers continued to show the underlying momentum that the hotel industry has experienced in the past few quarters. For instance, Q4FY23 revenue per available room (RevPAR) for EIH-owned hotels and domestic hotels (including managed) jumped to ₹15,284 and ₹14,289 respectively, helped by impressive show by cities such as Bengaluru, Shimla/Chandigarh, Mumbai, Hyderabad, and Delhi/NCR.

This compares with ₹6,432 and ₹6,188 for Q4FY22. After hitting the lows of ₹400-500 in Q1FY21, RevPAR has been on an upswing. Pre-COVID RevPAR used to be in ₹8,000-10,000 range.

As business and leisure travel sustained buoyant trends, quarterly occupancy and average room rates for domestic hotels (including managed properties) stood at 80 per cent and ₹17,963 in Q4FY23 compared to 56 per cent and ₹11,438 in Q4FY22. Strong growth was seen in F&B revenue (₹222 crore domestic hotels and ₹82 crore flight catering and airport lounges).

Inbound international travel has not touched pre-Covid levels, as trend of foreign room nights shows. It is expected foreign tourist travel will pick up pace from October 2023, thus boosting occupancies and room rates further.

Upcoming projects

EIH is in active discussions for three Oberoi hotels, seven Trident hotels, and one serviced apartment. For FY24, there are no expansions announced (except a restaurant in Mumbai).

Oberoi Rajgarh Palace (48 keys) and Oberoi Bandhavgarh (24 keys) carry under construction status for FY25 while the same is true for Oberoi Kathmandu (84 keys) and Oberoi Wadi Safar Saudi Arabia (60 keys) for FY26.

Oberoi Bardia (18 keys) and Trident Tirupati (100 keys) are under planning status for FY25 and FY26 respectively.

Oberoi hotels generates higher return on capital employed (45 per cent) compared to Trident hotels (22 per cent).

The company has brought down its borrowings (incl. lease liabilities) to Rs 208 crore as on March-2023, which means the debt/EBITDA is less than 0.5 (indicating financial comfort). The company reported cash and cash equivalents (incl. other bank balances) of Rs 458 crore as on FY23-end.

Stock performance

Shares of EIH have climbed 44 per cent in the last year, lagging bigger rival IHCL (up 62 per cent), but in-line with smaller hotel chains such as Chalet Hotels (up 44 per cent) and Lemon Tree Hotels (up 48 per cent).

EIH stock trades at a one-year forward price to earnings of 38 times (EPS: ₹5.30), at a discount to IHCL (one-year forward PE of 42 times, FY24 EPS of ₹8.75). Compared to a 23 per cent EPS rise for Indian Hotels Co. Ltd, analyst expectations of EIH’s FY24 bottomline pencil in flattish growth.

Hotel stocks are susceptible to risks such as black swan events like Covid, weak global macros that will impact both corporate travel etc.

Although EIH. Ltd results are good, we believe Indian Hotels Co. Ltd (IHCL) offers a better investment opportunity given its larger scale and earnings growth prospects.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.