After touching a new high in 2022, the global crude oil prices have fallen over the past month, though the last two weeks have seen a mild pullback in the prices. Concerns over a possible global recession in 2023 and decline in global oil demand has led to the sharp fall in crude prices.

The crude oil benchmark Brent has shed over 23 per cent during the April–December 2022. What does this mean for upstream exploration and downstream oil refining companies? Our analysis of the historical performance of crude refining companies reveals that falling crude price is margin depletive for them. It further indicates that for oil marketing companies (OMCs), which bore the brunt of increase and decrease in prices too may cause pain beyond a point.

For companies such as ONGC and OIL India, which are into exploration of crude oil, the impact is quite straight forward. A lower global crude oil price means lower realisation for the explored oil and produced by these companies. Hence, the operating profit margin and net profit typically heads south when global crude oil prices are weak.

Refiners and oil marketing companies

For refineries, a falling crude is negative for two reasons. First, the refining margins will be lower when crude oil prices fall. This is because the realisation on downstream products such as petrol, diesel, and aviation turbine fuel (ATF) tends to be lower, dragging the overall refining margins. Second, companies will also incur loss on the high-cost inventory held by them, in a falling crude price scenario. As a result of this, their refining margins tend to be lower.

In addition, the profitability of oil marketing companies – Bharat Petroleum, Chennai Petroleum and Indian Oil Corporation is dependent on the retail sale price of petrol and diesel . Even in a falling crude price scenario, these companies may still manage to retain marketing margin, but only if the retail prices of petrol/diesel are not reduced. Conversely, if the retail prices are kept unchanged in a rising scenario, companies lose out on their marketing margin.

In the current year, for instance, the OMCs did not increase the retail price even as Brent crude price rose well past USD 120 a barrel. As a result, the gain on refining margin front was eaten up by marketing losses. To add to their woes, the Government had imposed special duty (windfall tax) on exported petrol, diesel, ATF to ensure domestic availability. Likewise, the Government had imposed a similar windfall on domestically produced crude when the crude oil price soared above USD 120 levels.

Impact of crude oil price change?

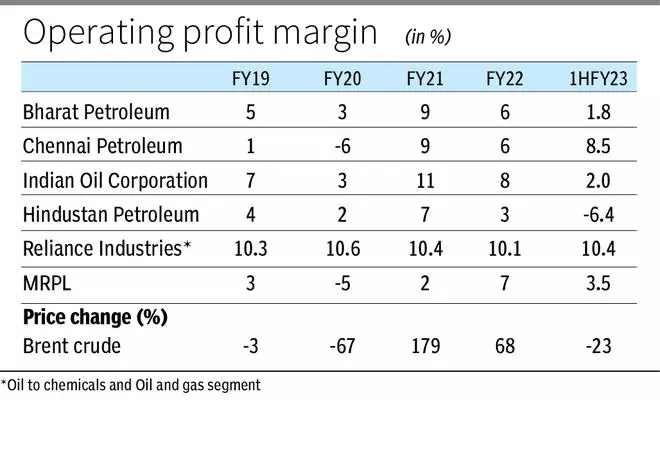

Indian Oil Corporation accounts for 28 per cent share in the market, making it the largest in term of refining capacity. In addition to size, IOCL’s margins traditionally have been higher than peers – HPCL and BPCL. For instance, in 2021, the company’s operating profit margin was higher at 11 per cent and interestingly crude trebled that year from USD 22 a barrel to USD 64 a barrel. The operating margins for competition such as BPCL and HPCL was at 9 per cent and 7 per cent, respectively. In the past, on occasions when the crude prices witnessed a sharp fall, IOCL’s margins also witnessed significant reduction. In 1HFY23, while the crude prices came off by 23 per cent, IOCL’s margin slipped to 2 per cent, still better than HPCL’s operating loss of -6.4 per cent and BPCL’s 1.8 per cent margin.

Earlier in 2020, when crude oil prices crashed by 67 per cent over Covid-19 fears, the company’s operating profit margin fell to 3 per cent from 7 per cent in FY19. However, operating margins have still been better than peers such as Hindustan Petrochemicals. That said, Bharat Petroleum’s performance has been comparable to that of IOCL, in years when crude has corrected. The company has managed to contain the downside better during bad times. For instance, in the 1HFY23, BPCL’s operating margin stood at 1.8 per cent. Likewise, during past downcycles such as in FY15, the company managed to maintain margin of 4 per cent, similar to the level in FY14.

For Chennai Petroleum, while the sensitivity of operating margin to crude price fall has been higher in the past, in the last six months, the company has managed to maintain it at 8.5 per cent. For Reliance Industries, the refining margins in 1HFY23 has been impacted more by the special duty (windfall) given that their exports are significant. Also, given that the company has negligible retail presence (petrol/diesel retail outlets), the margin impact is not as significant as that of OMCs.

Way ahead

While it is hard to predict how crude price will move from here, fact remains that falling crude prices are negative for refiners and OMCs. However, in the past, efficient players such as Indian Oil Corporation, Bharat Petroleum, and diversified plays such as Reliance Industries have still managed to contain downside even during such challenging times. However, other factors such as USD-INR exchange rate, refining margins, inflation (and hence the ability of the Government to pass on price increases) have also had a role in the past performance of refiners. That said, USD 70-80 per barrel has been a comfortable price point for refiners, as evident from the performance of refiners in 2017, when both the financial and stock performances of OMCs remained robust

Looking ahead, should the crude continue its downtrend and the benefit of lower crude prices be passed on to consumers by way of lower petrol/diesel prices, it may hurt the already-bleeding OMCs furthermore. However, if the retail petrol/diesel prices are kept unchanged, OMCs may be able to recover some of their marketing losses and this can partially compensate for lower refining margins.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.