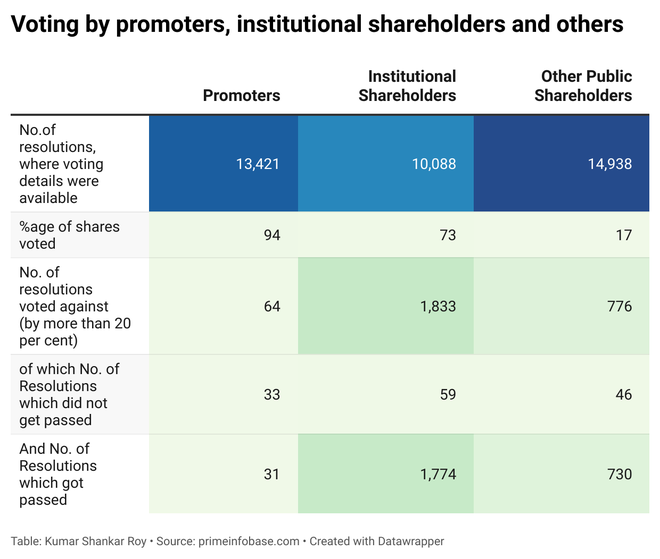

Shareholder meetings in FY23 saw a surge in advocacy by institutional shareholders who made their voices heard by voting against several resolutions proposed by management. The number of resolutions where more than 20 per cent of institutional shareholders expressed their dissent, increased by a huge 44 per cent to 1833 in 2022-23 in companies listed on NSE (main board) from 1256 in 2021-22 (and 636 in 2020-21), according to a primeinfobase.com report dated June 29. Here are the details.

Rise of advocacy

Resolutions where more than 20 per cent of Institutional Shareholders cast a negative vote, for companies belonging to Nifty 50 increased by 35 per cent to 73 in number (as compared to 54 last year). This list in FY23 included Adani Enterprises, Bajaj Auto, Bajaj Finserv, Britannia, Coal India, Grasim, Hindalco, HUL, ICICI Bank etc.

This may be an indicator of increase in advocacy on the part of institutional investors, thanks to stewardship codes brought about by regulators. It is also attributable to a greater role being played by proxy firms as also a steady increase in institutional holding as a whole, according to primeinfobase.

Of the above 1833 resolutions though, a huge 1774 (or 97 per cent) still passed, mostly owing to high promoter holding in the companies (see table).

In 2022-23, a total of 15,232 resolutions (excluding 22 resolutions that were withdrawn/not put to vote) were proposed to be passed in 3,254 AGMs, EGMs, Postal Ballots, and Court/NCLT Convened Meetings of 1,832 companies which were listed on NSE (main board) as on March 31, 2023. This is up from 12,708 resolutions in 1,736 companies in 2021-22, a rise of 20 per cent. As can be seen, almost all resolutions were voted in favour by Promoters.

The number of ordinary resolutions proposed were 9,970 (or 65 per cent of the total) while the number of special resolutions were 5,262 (35 per cent). While 62 special resolutions failed, 40 ordinary resolutions also failed.

Most number of resolutions related to ‘Board Changes’ at 6,138. This was followed by resolutions relating to the auditors, remuneration, and financial results.

How MFs voted

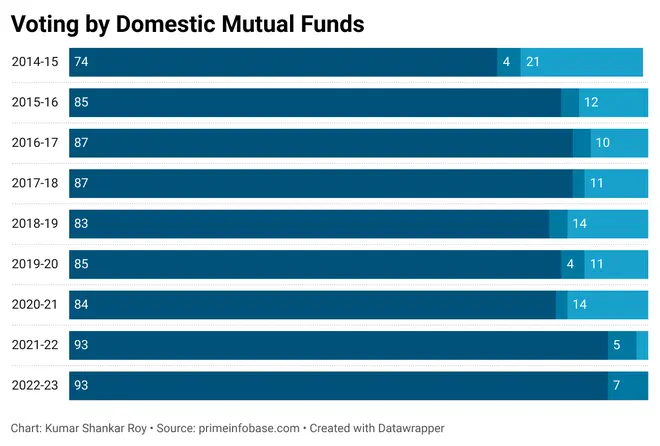

47 Domestic Mutual Funds, as a whole, voted in favour in 93 per cent of the cases and against in 7 per cent of the cases (abstained in 0 per cent cases in FY 2022-23). SEBI making it mandatory for Mutual Funds to vote on all resolutions with effect from April 1, 2022 has resulted in the abstinence number becoming nil.

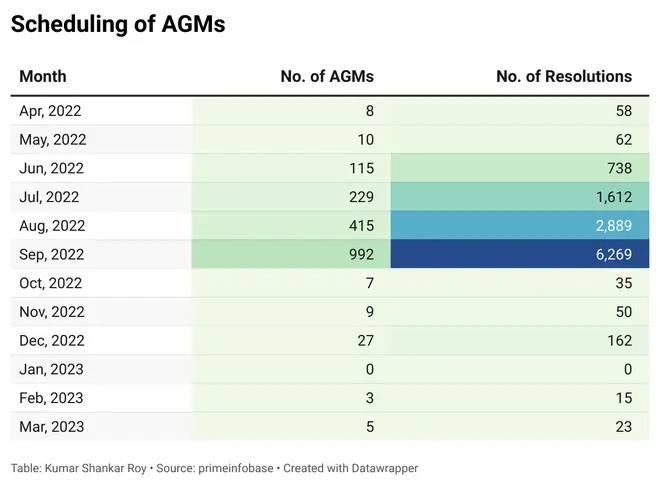

August, September see huge number of AGMs

The maximum number of AGMs took place on September 30, 2022 (204). As always, bulk of the AGMs happened in September, especially in the last week of September.

Only companies whose equity shares are listed on NSE main board have been considered for the purpose of this study. Companies which are exclusively listed on BSE or whose only debt is listed or companies on the SME platform of NSE and BSE are not covered.

In case an AGM or EGM is adjourned for some resolutions (while some resolutions are passed) which are then taken up on a future date, the subsequent shareholders meeting of the company shall appear as a fresh EGM record.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.