The energy crisis, in the aftermath of the Russia-Ukraine war, has put global economies in jeopardy. Supply disruptions, following the war, has pushed energy costs to a new high, over the last couple of months. Natural Gas price (US) for instance, peaked at $9 per mmbtu, from $3 per mmbtu at the start of 2022, almost a 3x jump over a nine-month period. However, higher gas inventories helped moderation of the commodity price to $6.2, currently.

Similarly, the prices of spot liquified natural gas (LNG) rose to an unprecedented over $40 a mmbtu, in the last few months, thereby leading to a significant jump in the cost for India. Further, issues at Russia’s Gazprom also impacted supplies to India by about 9 mmscmd (million metric standard cubic metre per day). All of these are likely to have an impact on the gas sales volume for 2QFY23.

Hence, the performance of gas utility companies – GAIL India, Petronet LNG and Gujarat State Petronet is expected to remain tepid in the September 2022 quarter for two reasons. One, volume is expected to be lower in September quarter given the supply disruptions due to Gazprom issue. Second, demand is likely to have moderated a bit due to high gas prices in Q2 of FY23. However, the moderation in the natural gas prices and higher gas inventory in Europe and US, can prevent any further increase in the near term. That said, any adverse development in the ongoing Russia-Ukraine crisis, can lead to an upswing in gas prices.

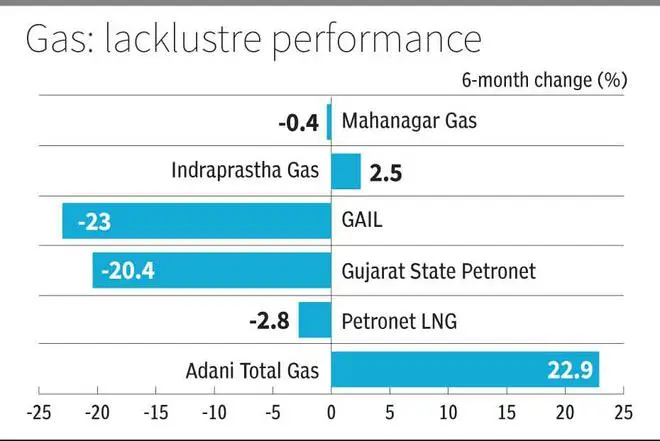

Stock price performance

City gas distribution to fare better

For companies in the Compressed natural gas (CNG used as fuel) and Piped natural gas (City gas distribution) segment such as Indraprastha Gas and Mahanagar Gas, revision in domestic gas allocation policy should provide some respite in Q2FY23. The domestic gas supply to city gas distribution companies (CGDs) has been increased by 2.4 mmscmd to 20.7 mmscmd. This will likely reduce the domestic gas shortage in Q, compared to Q1FY23. Companies with significant presence in City gas distribution and domestic piped gas segment such as Indraprastha Gas (~81 per cent of revenue) and Mahanagar Gas (87 per cent of revenue) are beneficiaries of lower gas cost (by about 25 per cent) due to higher allocation of cheaper domestic gas. This should help them post moderate revenue and profit growth in September 2022 quarter, compared to the previous year.

Further, Indraprastha Gas has further increased CNG and PNG prices by ₹3 a kg in Delhi and surrounding areas, due to steep increase in price of imported LNG. The benefit of which will flow only in Q3FY23. However, the company still has not passed on the price increases fully.

Gas price holds key

The medium-term performance of gas transportation and utility players is contingent on the global LNG price. A fall in gas prices will provide respite to these companies, as they are currently unable to pass on the price hike so far to the end customer fully yet. Further, moderation in gas prices will also support volume growth for these companies. Alternatively, any further increases in gas price, can risk profits

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.