With improved prospects for pharmaceutical companies, the sector witnessed a strong re-rating in CY23. Glenmark Pharma has also gained 78 per cent YTD in the current rally, trading at 21 times FY24 expected earnings. Optimistic earnings growth assumptions of 30-35 per cent CAGR in the next two years, and premium valuations at 30 per cent premium to 10-year average, have driven the rally.

Along with meeting earnings growth, the company must resolve stake sale in Glenmark Lifesciences (most achievable), monetise its innovation platform, and clear its plants currently under FDA observations to clear its debt, along with contribution from internal accruals. We recommend that investors avoid the stock at the current levels of high optimism factored into valuations.

Strong execution needed

Glenmark generated revenues of ₹12,990 crore in FY23 of which India/the US/Europe and Rest of the World accounted for 31/24/14/19 per cent respectively and API – 11 per cent. API under Glenmark Lifesciences is listed and 83 per cent stake is held by Glenmark.

The company is ranked 2nd in India for Respiratory and Dermatology and 5th in Cardiac and 17th in Diabetes. The segment reported 3 per cent YoY growth in Q1FY24 domestic market as NLEM price revision and divestment impacted the growth and the two can be expected to play out in the next two-three quarters as well compared to base. The company also under-invested in sales force expansion compared to peers who have added 10-20 per cent in the last two years, which should increase competitive pressure in its addressable markets.

Pricing environment in US generics has improved, aiding Glenmark as well. But with Monroe, Goa and Baddi plants under US FDA scrutiny, new product launches will be limited, impacting overall US growth in FY24. The resolution of plants is critical. The company has gFlovent under development along with one more respiratory product for FY25 launch, and other limited competition products for FY25 and beyond. But product development, especially in respiratory, attracts a higher regulatory hurdle rate and has to be factored as risk to sales growth.

RoW and Europe have grown by a factor of 2x and 1.6x respectively from before Covid, on new product launches, post-Covid normalisation in dermatology and expansion into new markets. The two segments continuing high growth in FY24 is critical for the company to make the lower end of its stated consolidated revenue growth objective of 10-11 per cent growth. Ryaltris launch in these markets, along with market expansion, should sustain such growth. But the company will also face a high base for FY25 after such growth phase.

Ryaltris for allergic rhinitis and hay fever was developed by Glenmark. The product has been approved in 27 countries and marketed either directly or by partners (Hikma in the US and Menarini in Europe). The product generated sales of $20 million for the company worldwide, expected to ramp up to $120-150 million in next five years, and is a strong part of the sales growth across geographies.

Margins and innovation

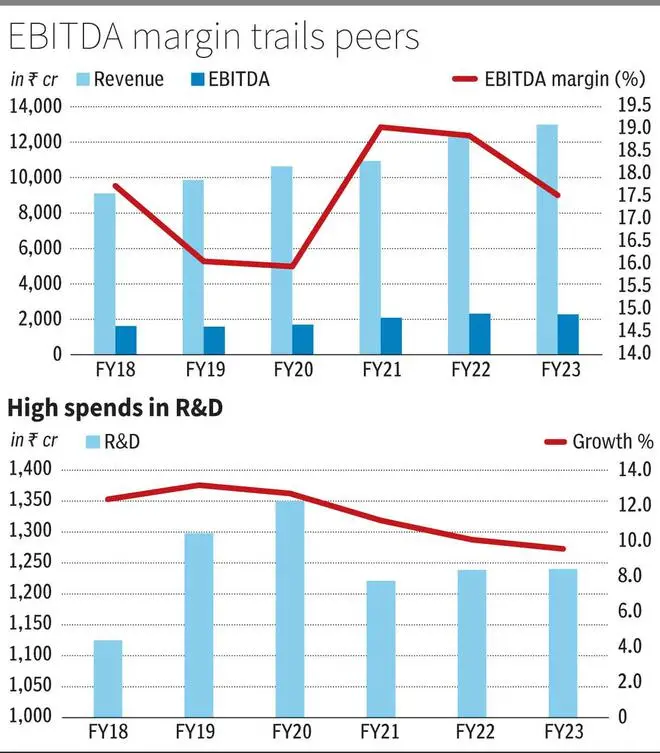

Glenmark reported EBITDA margins in the range of 16-19 per cent in the last three years, which is below peer range of 20-23 per cent even as gross margins at 65 per cent is industry average. Employee expenses at 21 per cent have been a factor despite 100 bps improvement last year. But R&D expenses at average 11 per cent in the last six years have been a drag on margins by a factor of 400-500 bps, compared to peers.

Glenmark invests extensively in Ichnos – the research arm of the company, at about ₹683 crore in FY23, which is half of the R&D budget. But product outlicensing or monetisation has been below expectations. Ichnos product ISB 880 has been outlicensed to Almirall, in 2021 and Ryaltris has also been a product of the department, but monetisation of several other products would only justify the investment. Glenmark has an immuno-oncology product and an inhalation product for COPD disease as lead and two more assets, which will have proof of concept study readouts in FY24. But the earlier product being studied alone or in combination with blockbuster products of competitors (Keytruda/Tecentriq), which is setting a very high bar for commercial interest. The later respiratory product has a high regulatory hurdle rate as well.

Financials and valuation

In any case Glenmark has stated its objective to restrict R&D expense to 8-8.5 per cent for FY24. Partnering R&D expenses or some form of monetisation is crucial to archive this optimally whereby generic US portfolio R&D can be bulked up. Plants clearance from US FDA is also crucial to achieve and sustain revenue turnaround but — with issues ranging from warning letter to import alerts — can be a tall task. The cost of remediation at $20 million in FY23 will also simmer.

The company has a net debt of ₹3,000 crore as of Q1FY24 which may not be high (2x net debt to EBITDA). But the foreign currency denomination and higher LIBOR rates on interest, remediation costs parallelly, penalty of ₹700 crore to be paid in next two years (anti-trust settlement in the US), turnaround in internal cash generation dependent on plant clearance — all of them add to debt overhang. But the 83 per cent stake in Glenmark Lifesciences of which a portion is expected to be sold (7-8 per cent stake implying ₹500-600 crore according to the company) is a strong offset to debt concerns.

The stock trading at 30 per cent premium to 10-year average one-year forward earnings — on consensus estimates that are at 30-35 per cent CAGR in FY23-25E (adjusted for anti-trust provision made in FY23 earnings) — is more than baking in the optimism of turnaround.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.