Grasim, the flagship holding company of Aditya Birla Group, has announced a rights issue to raise ₹4,000 crore, which is a 3.4 per cent dilution. The cements-to-finance holding entity has a viscose yarn and chemicals business in the standalone operation and is looking at ambitious paints business expansion, within the standalone entity.

The rights issue will be used to repay the debt and strengthen the balance sheet to finance the paints venture. With growth in sight, we recommend that investors (with shares on record date) exercise their rights at a discount and increase their stake. The rights entitlements (RE) are trading at a 30 per cent premium in the market. We analyse the reason for the RE premium and the company prospects supporting the ‘invest’ recommendation.

- Also read: Grasim’s consolidated profit up 15% in Q2

Rights offer

For every 179 shares held as on the record date (January 10) 6 rights will be offered. The rights issue will offer shares at ₹1,812 compared to cmp of ₹2,056 as on January 18, which is a 13 per cent discount. Investors subscribing to the rights will have to pay 25 per cent on application and the rest will be paid in three calls before March-2026. The shareholders as on the record must have received their REs in their demat accounts.

The RE now trading at ₹316 is at a 30 per cent premium to absolute difference in rights price to trading price. This premium can be ascribed in part to company prospects, the four calls which are spaced out over two years and related speculation. We recommend that investors subscribe to the rights issue or in the very least trade their existing rights if they are not interested in increasing their exposure to Grasim. The issue opened on January 17 and last date for renunciation of rights is January 23;the issue closes on January 29. The rights shares will be listed by February 12.

Expansion in standalone operations

Grasim plans to foray into paints business with six plants spread across India, with the first three expected to be commercialised by FY24 end and the rest three by end of FY25. Compared to current Indian paint capacity of 4.22 million KL amongst the top five players, Grasim’s planned capacity stands at 1.3 million KL or close to a third of the current market capacity. The ambitious plan is underpinned by the expected 10 per cent CAGR in 2023-28, according to the RHP.

Decorative paints (75 per cent of the industry) and industrial paints are expected to support demand growth on increasing home demand and growing economic activity. Of the ₹20,000-22,000 crore planned investment in paints in next two years, Grasim’s venture accounts for ₹10,000 crore and Asian Paints accounts for ₹8,750 crore. Grasim has spent close to ₹5,000 crore, by September ‘23, for paints expansion.

The industry is marked by intense competition despite five major players in the space. Grasim’s cement business (UltraTech, the largest cement player, is 57 per cent subsidiary of Grasim) does support positive expectations from the paints foray, considering a largely overlapping end-market.

On a conservative assumption, the company should be able to add 15 per cent to current standalone revenues on full commercialisation of paints business in the next two years (going by realisations of Asian Paints and assuming a 30 per cent discount).

Viscose and chemicals facing pressures

The current standalone business consists of Viscose and chemicals business where it is a market leader in both Viscose and caustic soda segments in the country. The two segments are facing slowdown in current period, leading to 9 per cent YoY revenue decline in H1FY24 for Grasim standalone.

Viscose, a natural fibre made from wood pulp, faced strong demand in FY23 as its substitutes, cotton and polyester, had high prices. With correction in substitute prices, Viscose demand is flat in the current period.

The chemicals segment benefitted from strong demand from channel filling in earlier periods by its customers (speciality chemicals and pharmaceuticals) who themselves benefitted from strong channel in their end markets . With easing of demand following normalised inventory levels across the supply chain, prices of caustic soda are down 40 per cent from October ‘22 to October ‘23. As the price decline is expected to stabilise, and demand from end-users recovers, prices and revenue in chemicals is expected to bottom out.

The two segments, contributing 59 and 32 per cent respectively to H1FY24 revenues, are expected to recover with recovery in demand and prices after the current cyclical slowdown.

Margin of safety in valuations

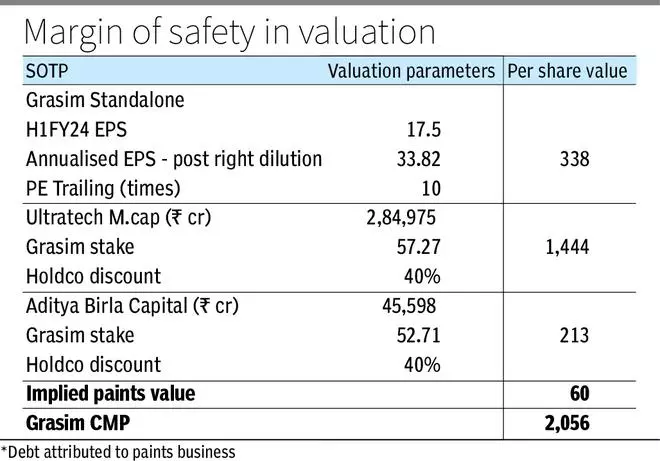

There is good margin of safety in valuations of Grasim by way of SOTP valuation of the standalone entity, Ultratech and Aditya Birla Capital stake and the implied valuation of the paints business. The standalone entity at 10 times annualised H1FY24 earnings is valued at ₹338 per share. The value of stakes in Ultratech and Aditya Birla Capital after assigning a sizable 40 per cent Holdco discount to their current prices, adds upto to ₹1,657. This, combined with standalone entity, is worth around ₹1,995 per share. This is against current Grasim share price of ₹2,056.

This implies that the paints business is valued at ₹60 per share or 2 times FY25 EV/sales. Compared to Asian Paints’ and Berger Paints’ FY25 EV/Sales of 7.6 and 5.3, the current Grasim valuations are baking good margin of safety. This also excludes any relief from lowering of leverage and finance costs on the standalone entity with repayment from rights issue or a recovery in viscose and chemicals business after the cyclical slowdown.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.