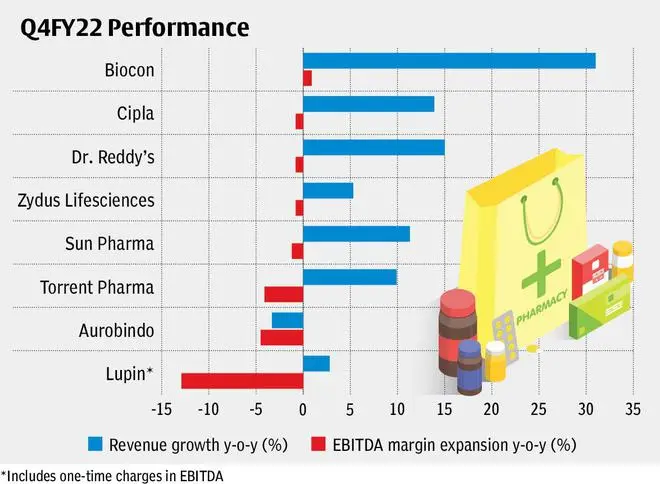

Pharma companies are slowly shedding Covid portfolios which provided higher growth across geographies and acted as a rising tide for all. As (Covid) revenues normalise and margin challenges emerge, performance in Q4-FY22 provides a diverging view across companies. In this analysis, companies with long-standing exposure to various geographies have been considered; Sun Pharma, Cipla, Dr Reddy’s, Aurobindo, Lupin, Zydus Lifesciences, Biocon and Torrent Pharma. While top-line growth has been strong and margin performance weak across companies, the quality of performance and the drivers of the same can be further dissected.

Revenue growth stays strong

The Indian market continues to power top-line growth for companies at an average 14 per cent year-on-year growth in Q4-FY22. Lupin, which had a higher Covid contribution in base period, delivered 5 per cent year-on-year growth. In other companies, Covid contribution now accounts for around 1-5 per cent of India portfolio, but growth was sustained by non-Covid portfolios. The primary drivers continue to be pricing growth along with new product launches.

A similar performance in emerging markets is also aiding top-line growth for companies. Dr Reddy’s, which has a sizeable presence in Russia, has reported business continuity for itself and, so is the case for other international players. But Ruble depreciation is a major offset. In other export economies, represented by Torrent in Brazil and South-East Asia, African branded market by Ajanta, South African markets by Cipla, and Rest of the World markets by Sun Pharma, revenue growth has been strong, similar to India.

The much-touted API sales have been lacklustre for most companies proving that the underlying theme of China +1 may not be as linear as witnessed in speciality chemicals and metals. Aurobindo has gained strong traction in the segment and is in plans for a Penicillin-G facility supported by PLI scheme.

US markets continues to struggle with price erosion which has escalated further since Covid. But companies which are in the growth stage for new products, Sun Pharma with speciality, Cipla with respiratory, and Dr Reddy’s with limited competition launches, have managed to overcome product erosion. These companies reported an average 15 per cent growth (including 2-4 per cent from Rupee depreciation) from US market. On the other hand companies with no significant new launches or high-value launches continued to report 5 per cent decline in US revenues; Aurobindo, Lupin and Zydus, for instance. Plant inspections and revivals of plant status expected for all the US-facing companies are critical triggers in the short term.

Overall at consolidated top line, Aurobindo (three per cent year-on-year revenue decline Q4-FY22) without formulations presence in India and Lupin (3 per cent) with a weak growth in India reported subdued revenue growth amongst companies which averaged 12 per cent in Q4-FY22.

Margin compression

Input price escalation and US price erosion have weighed heavily on margins. Few companies like Biocon, Cipla (on adjusted basis), Dr Reddy and Zydus Lifesciences have managed the preassures better. New product launches, improving product mix (lower API sales) and price pass through aided the same from these companies. But for others the EBITDA margins declined significanlty as freight in some cases was reported to be higher by 40 per cent in the quarter. However with Pharma companies having a larger portfolio of branded products in India, emerging markets are better placed to pass through the higher prices. The first quarter of FY23 when market tenders, new contracts and price revisions generally take place, companies can start recovering the higher costs which can be assessed in the next earnings season.

But with opening of clinical trial centres (as patients and centres open after Covid), high-cost trials will be back on budgets adding to the R&D costs. Cipla, Sun and Biocon, for instance, are chasing high-cost trials in Advair, Ilumya and next-generation biosimilars respectively and are expected to add 100-200 bps to costs. US generics filing cost and India marketing launches are continuing to add to other expenses with only Torrent rationalising the US filing cost.

Performance

Since May 2022 when the results season started, the Nifty Pharma index is down 8 per cent compared to broader Nifty’s 5 per cent decline. Aurobindo and Lupin have shed close to 17 per cent in the period, following weak results, while Biocon slipped 10 per cent despite better results, as impending consolidation of larger deals (Viatris and SII) and associated debt concerns weighed on the stock. Sun Pharma declined 8 per cent, in line with the index. Cipla and Dr Reddy’s fared comparatively better in the period gaining 1-2 per cent.

The results emphasise that a strong domestic performance can overcome weakness in US segment. Dr Reddy and Cipla are better placed amongst the lot. Dr Reddy’s recent plant clearance aids its US performance and domestic focus has been gathering strength. Torrent Pharma is also better placed with its Indian portfolio, subject to getting US FDA plant clearance in the near term.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.