From a discovered price of ₹261.85 a share to Friday’s closing of ₹212.25 a share, the stock of Jio Financial Services has had its brush with reality. It is understood that institutional investors, mainly mutual funds owning the stock are dumping it, causing this fall. The 18 per cent decline in share price is being termed as ‘technical adjustments’. The question is, fundamentally should JFS stock excite you?

History of JFS

In October last year, Reliance Industries announced the demerger of its financial services business, which was housed under Reliance Strategic Investments Limited. RSIL was incorporated in 1999 when there was an alteration in RIL’s shareholding structure. RSIL was chosen to be the entity to hold some of the residual or treasury shares that emerged in the process. It was never an operative entity with a slated business plan. In July 2023, RSIL was rechristened as Jio Financial Services.

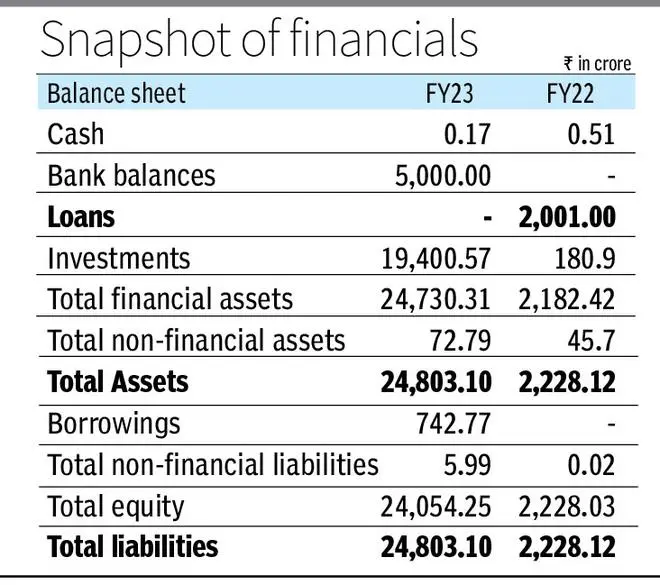

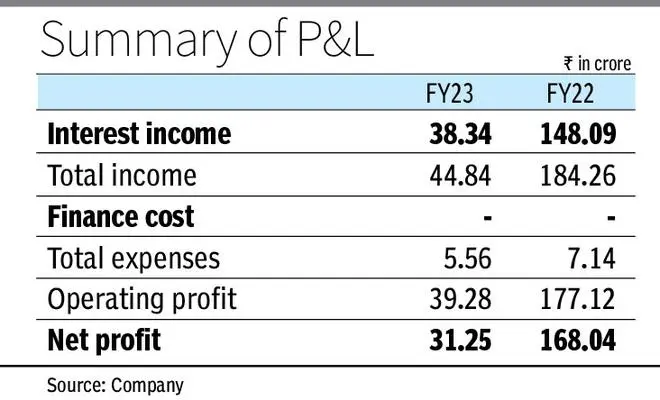

Financial composition

Unlike an NBFC, it did not have loan assets in FY23, neither did it have significant bank borrowings or a liabilities structure usually seen in NBFCs. It is only over the course of FY24 that investors may get a handle of what JFS’s financials could like. To be sure, JFS will have six subsidiaries and an associate company, namely Jio Payments Bank, whose business model hasn’t taken off since inception.

Business proposition

JFS is expected to make a splash in the consumer lending space, largely catering to unsecured loans. It has indicated its intention to foray intothe insurance sector (life and non-life) and in partnership with BlackRock recently announced its entry into the mutual funds industry. BlackRock in its earlier association with DSP was focused on the equity MF, but globally its forte is the thin-margin passive funds segment. With JFS what would be its strategy or earnings profile will be known only when products hit the street, time lines of which are not known yet.

As for the lending business which is talked about as JFS’s key domain, other than having a shiny board including KV Kamath and skeletal team of 29 employees headed by former ICICI Bank oldtimer Hitesh Sethia, there is little to demonstrate its on-ground business plan. Note that unlike telecom or textiles, flooding the market on pricing or freebies may be difficult in the lending business because there is a floor or minimum cost of borrowing involved.

Based on the information memorandum, JFS’ networth based on latest financials may allow it to have a loan book or assets under management of about ₹80,000 crore (4x the book value). Seen against Bajaj Finance’s AUM of over ₹2-lakh crore, often cited as the entity which could face the brunt of JFS’s disruption, or even Chola Finance’s AUM of ₹1.13-lakh crore, the newly-floated company has a long way to go to find a place in the league table. It is pertinent to appreciate that RIL’s previous forays, including the DE Shaw partnership, didn’t help the company make a splash in financial services. Likewise, except for the disruption in the telecom industry, its ascent to the top hasn’t been fast or without a tough fight in other ventures; example: Reliance Retail.

Should you buy JFS stock?

Fundamentally, there’s not much to support JFS’ investment thesis. It may have a fabulous business model but that’s still on paper. The execution and collection teams, which are key for the lending and insurance businesses, remain the critical missing pieces. While JFS may be trading at a valuation of 1.5x FY23 price to book (market value of treasury shares considered for valuation purposes), there is very little data to suggest how the numbers could move. It is prudent for investors to wait for a few quarters to get a grip of its financials to consider the stock.

That said, once the technical rebalancing concludes (expected by September 1), the pricing imperfection may settle down. Investors willing to take a long-term approach with high appetite for risk and reasonable investible surplus could then consider JFS stock. But that’s at your own risk.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.