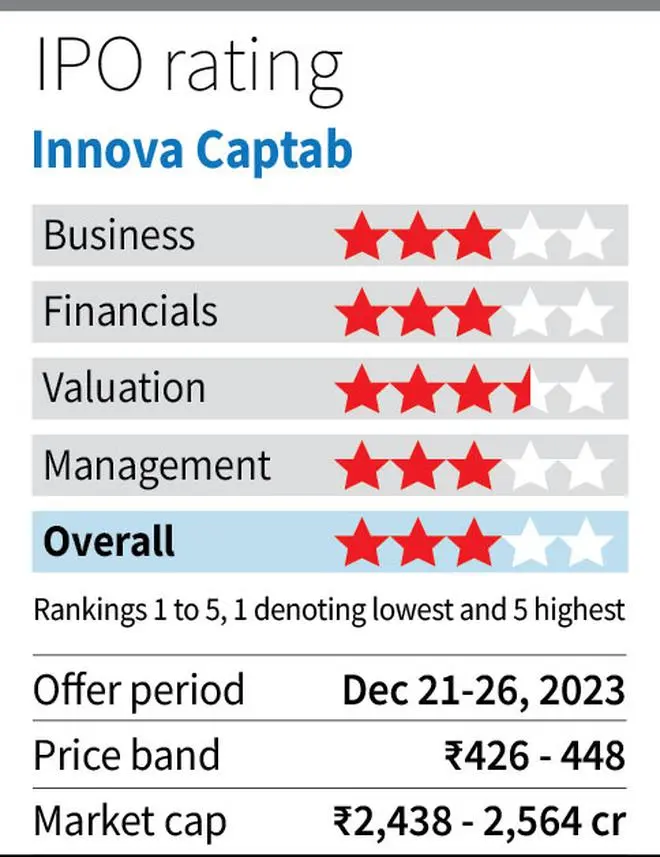

Innova Captab is a CDMO (contract development and manufacturing organisation) operator that contract-manufactures generic formulations and supplies to domestic pharmaceutical companies marketing them. The IPO (open till December 26) values the company at 25 times FY23 earnings — on a pro-forma basis, which includes earnings from a company acquired in June ‘23 Given expansion in Jammu and synergies from the acquisition, the valuation seems reasonable and investors with a long-term outlook can subscribe to the issue.

The offer includes a fresh issue of ₹320 crore (₹168 crore towards debt and ₹72 crore for working capital) and offer for sale of ₹250 crore. At the higher band of ₹448, the market capitalisation is at ₹2,500 crore.

Innova derived 60 per cent of FY23 revenues (pro-forma) from CDMO operations. The company granulates, compresses, coats and prepares the final formulation from APIs purchased from third parties. Close to 15 per cent of revenues is from branded generics of its own formulations and 7 per cent is from exports of branded generics to countries led by Kenya, Afghanistan, and Sri Lanka. The recent Q1FY24 acquisition of Sharon would have contributed 18 per cent to FY23 revenues assuming it was consolidated.

The clients include the large domestic pharma companies with which Innova has a long traction. In FY23, CDMO had 182 customers and Top 10 and the top client accounted for 56 and 14 per cent in FY23, indicating a moderate level of client concentration.

Expansion of operations

Indian CDMO is a highly competitive field with Innova gaining a market share of only 1 per cent in India in FY23 despite operating from 2006. In the CDMO division, differentiation is based on range of drug delivery capabilities, costing, service aspects and regulatory and financial stability.

The company’s drug delivery capabilities include tablets, capsules, ointments, dry powder injectables, and liquid orals. The upcoming Jammu facility will extend the capability to penem injectables and dry powder inhalation formulations, which are higher up on complexity scale, apart from adding to capacity in existing drug deliveries. The project, with an estimated cost of ₹350 crore, should double the current capacity of production in three years (current net fixed asset base of ₹300 crore) — one year for commercialisation and two more for validation and ramping up of customer base from new facility. As mentioned, a wider basket of drug delivery capabilities would differentiate Innova in CDMO markets apart from higher revenue potential.

Sharon acquisition

Innova acquired Sharon under the Insolvency and bankruptcy Code in June 2023. The company infused ₹195 crore into the firm which, along with existing FD of ₹60 crore, cleared Sharon’s debts. The target company is also into contract manufacturing of formulations, which accounted for ₹120 crore of the ₹193 crore revenue in FY23. Exports accounted for 75 per cent of total revenues of Sharon. The company manufactures APIs as well accounting for the rest, which may complement Innova as it doesn’t have API capabilities.

Innova may report higher growth in FY24 as Sharon’s operations normalise, but valuation of 25 times captures the growth. It is the synergies from this acquisition that are the incremental value addition which could take slightly take longer to materialise as it gradually evolves out, from under IBC. The synergies will be from scale of operations and possible improvement in margins to company-wide level (8 per cent EBITDA margins of Sharon in FY23 compared to 12 per cent for Innova). Sharon’s current utilisation at 50 per cent may also be improved to industry levels of 60-70 per cent, adding value.

If the acquisition is integrated meaningfully, Sharon, acquired at close to 1x price to sales, should be value-accretive to Innova, which has a price to sales of around 2 times.

Financials and valuation

With Indian pharma itself expected to sustain 9-10 per cent annual growth in the next decade, CDMO markets should witness a higher growth as scope of contract manufacturing increases. With focus on time to market, wider portfolio of products, complex generics in product portfolio and increasing regulatory oversight, organised CDMO, including Innova, can garner a higher market share compared to unorganised players.

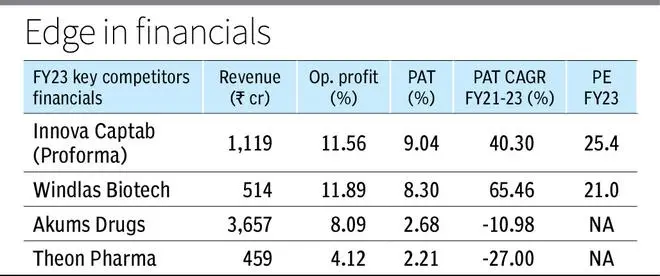

The company has industry-leading operating margins of 12 per cent in FY23. With Jammu expansion and Sharon-related synergies to play out, Innova can sustain higher growth. The company has a net debt to EBITDA of 2.9 times as of June ‘23, which can come down to 1.5 times with repayment from fresh issue proceeds, further providing comfort to valuations.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.