The initial public offering (IPO) of wind-based Operations and Maintenance (O&M) company Inox Green Energy Services Ltd (IGESL) is open for subscription from today and closes on November 15, 2022. The company is an O&M subsidiary of listed wind turbine manufacturer Inox Wind (part of Inox GFL group). The total offer is ₹ 740 crore, of which ₹370 crore is a new issue while the rest ₹370 crore is an offer for sale. Out of ₹370 crore, around ₹270 crore will be used for re/pre-payment of debt. Post-issue, the promoter’s shareholding may be around 56 per cent.

Investors need not subscribe to the IPO for the following reasons: The company still carries legacy issues on the parent company in its books. The company has debts in its books unrelated to its O&M business, and investments in its power generation subsidiaries. There is also no clear timeframe for when and how legacy factors will be addressed. Two, EV/Revenue being around 15.6 times suggests a steep valuation when revenue growth has been static in the last three years. Three, the company has not been making profits at the net level. According to the management, since the EPC business with high depreciation has been demerged now, profitability will improve. But investors can wait and watch as to how it trends. Investors are not getting the flavour of a pure-play O&M business as the company comes with entanglements which must have ideally been addressed prior to IPO.

Business

The company is primarily involved in the business of O&M of Wind Turbine Generators (WTGs) and common infrastructure facilities such as substations and transmission lines, which support power evacuation from WTGs. The company’s revenue currently depends entirely on Inox Wind Ltd (IWL)’s 2,792 MW WTG customers as it provides O&M services on a long-term contract basis ranging from 5 to 20 years. These contracts can either be comprehensive, including O&M services of WTGs and common infrastructure facilities or non-comprehensive - which includes O&M services of only common infrastructure. It earns around ₹8 lakh per MW from the former and ₹2-5 lakh per MW from the latter annually. IWL has an order book of around 1,488 MW, the O&M contracts of which can be passed on to IGESL. Further, the company plans to tap the opportunity of getting contracts for those WTGs manufactured by inactive players and currently served by independent service providers.

Pure play O&M is an asset-light business with no material capex resulting in lesser debt requirement and a steady flow of income and cash flows. The incremental revenue growth here depends on the sales of WTG business which in turn relies on favourable government policies relating to tariffs earned by customers upon selling power. However, post-change in tariff regime from feed-in-tariff to reverse auctions during 2017, the WTG manufacturing business took a massive hit. During the time, it was the O&M business which served as a saving grace for such companies due to its stable cashflows.

Legacy Issues

Along with O&M, IGEL is carrying legacy business in its books - wind power generation SPVs which it aims to transfer to customers. Also, EPC (erection, procurement and commissioning) of common infrastructure was a part of Inox Green which has now been transferred to IWL’s subsidiary Resco Global Wind Services as IGEL now aims to shift to an asset-light model. Because of these unrelated businesses and restructuring, the company has a net debt of around ₹ 863 crore with a net debt-to-equity ratio of around 1.1 and net debt-to-EBITDA at an uncomfortably high eight times despite O&M being an asset-light business.

According to the management, such debt accumulation can be attributed mainly to two reasons. One, post tariff regime change, banks were more comfortable providing debt to IGESL due to its stable income rather than the WTG manufacturer IWL which led to loans for the whole wind business taken at the IGESL level. Two, while selling off the EPC business to Resco, majorly intangible assets such as business information, accounts receivables, intellectual property, and contracts were demerged. In contrast, the infrastructure-based assets remained in the books of IGESL. Covenants put by banks restricted the transfer of such assets. Hence, the debt associated with the same also remained in the books of IGESL.

Financials and Valuation

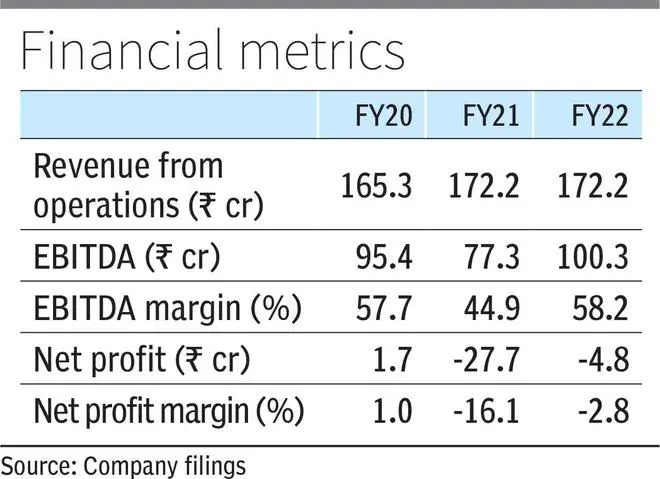

The company’s revenue from operations has remained stable in the last three years at around ₹ 170 crore level, and EBITDA margins consistently have been in the range of about 50-60 per cent. However, the company has not been profitable at the net income level due to high-interest costs and depreciation.

At the upper band of the price range ₹61-65, the company is valued at around ₹1,900 crore. Hence the company is valued at a very pricey 11 times the FY22 sales, while the EV/ Revenue is even more expensive at close to 15.6 times.

A comparison with Suzlon, which has both 0&M and WTG businesses, gives a perspective. If the same multiple of IGESL is applied to Suzlon’s O&M segment (30 per cent of total Suzlon revenues), that business alone is valued close to ₹28,470 crore, whereas the whole of Suzlon is valued at just ₹11,133 crore on an EV basis. Given that Inox Green aims to be a pure play O&M service provider, the superior margins in such businesses seem to have driven the high asking price.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.