In the past week, the benchmarks Sensex and Nifty 50 gained 1.9 per cent and 2 per cent, respectively. All the sectoral indices closed on a positive note. BSE PSU gained the most at 5.5 per cent, followed by BSE Realty (4.9 per cent), BSE Capital Good (4.8 per cent) and BSE Power (4.7 per cent).

Notably, the week saw many stocks move up without being backed by any news-flows or fundamentals. Markets were buoyed by positive sentiment. Among the BSE 500 stocks, Indian Railway Finance Corporation (IRFC), MMTC and Cochin Shipyard were the top gainers.

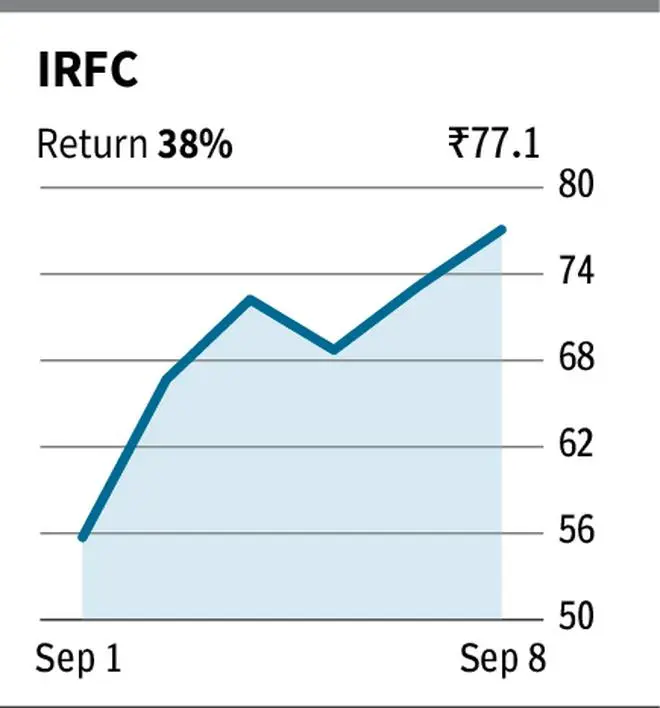

IRFC

The stock of IRFC returned 38 per cent for the week ending September 8,2023. The stock recorded its highest single day gain (17 per cent) on September 4,2023. The railway stocks have been in limelight for some time due to increased budgetary outlay.

However, the rally last week was due to a report which mentioned that the US, Saudi Arabia and other nations are discussing a possible infrastructure deal that could reconfigure trade between the Gulf region and South Asia, linking West Asian nations with India using railways ports, per the US officials aware of the conversations. Besides, a new plan of Ministry of Railways to seek ₹5.25-lakh approval from cabinet to fund projects between FY24 and FY31 boosted the sentiment.

The trailing PE of the stock is 15.9x whereas its trailing price to book (PB) is 2.22 times.

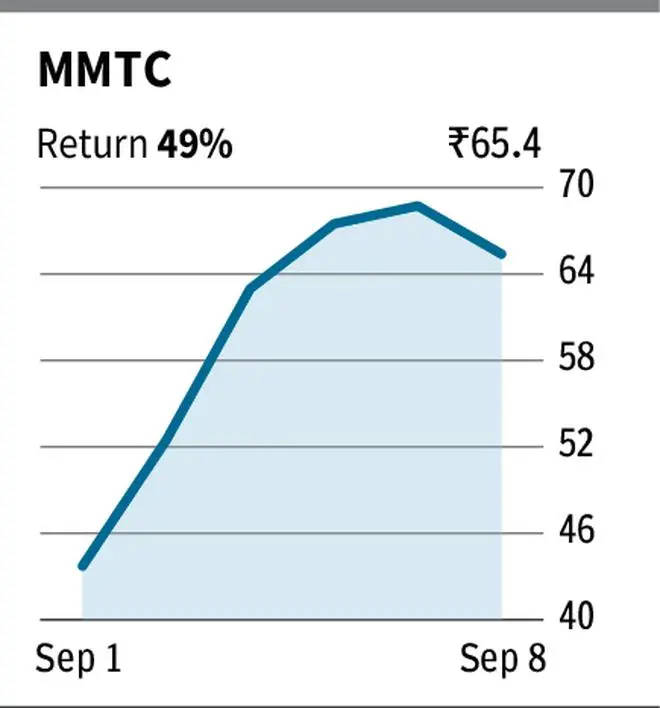

MMTC

The stock of mining PSU MMTC shot up by around 49 per cent last week driven by its strategic positioning in the India’s mine trading and exploration sector.

The sentiment was fuelled by India’s plan to mine rare minerals such as lithium, cobalt and silicon which are critical to achieve renewable energy. Government’s plan to auction mining sites in Jammu and Kashmir can present MMTC with an opportunity to secure mining rights.

As these measures will take long time to play out, the buzz in the stock appears more due to sentiment than fundamentals. The stock is trading at a trailing P/E of 6.28 times

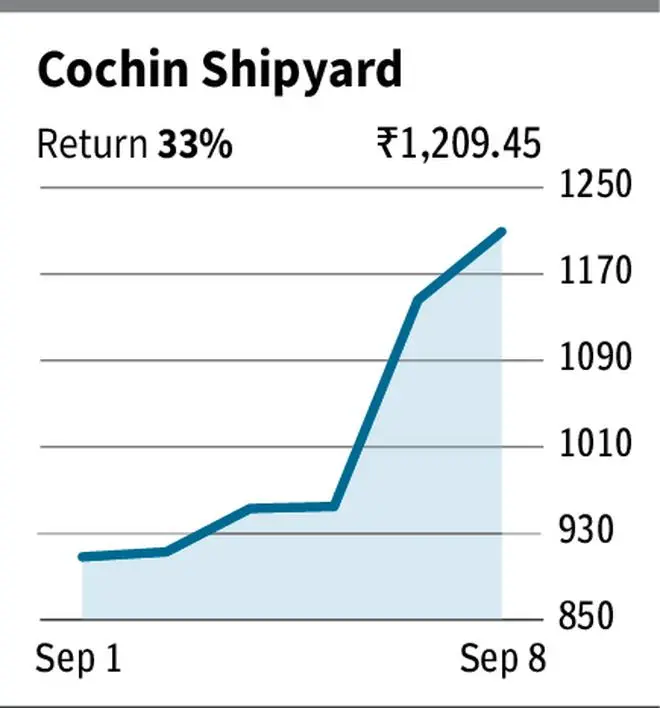

Cochin Shipyard

The stock of Cochin Shipyard surged around 33 per cent in the last week on account of strong momentum expected in order inflows.

The company has signed a contract to build the country’s largest Trailer Suction Hopper Dredger (TSHD), a 12,000 cubic meters vessel for the Dredging Corporation of India (DCI) in collaboration with IHC, a market leader based in the Netherlands. Additionally, its subsidiary Hooghly Cochin Shipyard in West Bengal, has secured orders in inland and short sea/coastal segments.

The stock of Cochin Shipyard is trading at a trailing P/E of 52.22 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.