Mahindra & Mahindra Financial Services (M&M Finance) is the second largest vehicle financier in the country and the lender is well-placed to capture the demand rebound for vehicles – whether commercial, passenger including utility vehicles or tractors. Also, the largest vehicle financier — Shriram Transport — is in the midst of a corporate rehauling which could force it to ease up on the growth pedal. This could be an opportunity for M&M Finance to up its game.

Trading at 1.5x price-to-book, the stock is 21per cent lower than its five-year historical valuation. With asset quality of the lender on the mend, long-term investors may consider accumulating the stock. One could use any likely correction in its share price to buy the stock.

Business overview

M&M Finance started off as a 100 per cent captive financier for automobiles major Mahindra & Mahindra, also its parent company. Ever since its listing in 2006, it has brought down the share of assets financed to M&M (tractors and passenger cars) and presently at 45 per cent, M&M Finance holds leadership in the utility vehicles lending space. Over years, the company has turned into a wholesome financier with exposure to passenger cars, tractors, commercial vehicles and pre-owned vehicles. Lately it has forayed into the consumer lending space as well, and in the next three–five years, the share of non-vehicle loans is expected to touch 20 per cent of its overall loan book. While this is as part of its diversification strategy, at core it will remain a vehicle financier.

Covid-related pressures

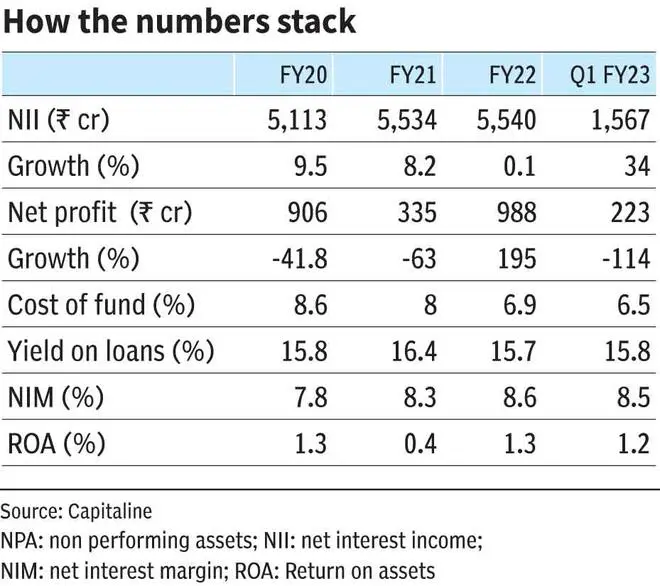

During FY12–FY20, M&M Finance grew its loan book from ₹17,500 crore to ₹65,000 crore or at 15.7 per cent CAGR, surpassing the industry performance. In FY21, for the first time in about decade, it had to shrink its loan book (down 7.7 per cent year-on-year) owing to the pandemic. At ₹73,900 crore of loan book as on September 30, 2022 (Q2 FY23), up 16 per cent year-on-year (as per latest exchange filing), M&M Finance seems to have crossed the sluggish growth phase.

Asset quality

M&M Finance is among the few NBFCs yet to reclaim their pre-pandemic levels in the bourses. Two factors led to its derating — shrinking loan book and asset quality. Now, with loan growth-related concerns subsiding, combined with broader market recovery from lows, the stock has gained over 60 per cent from its 52-week low price. The next leg of re-rating would depend on an improvement in asset quality.

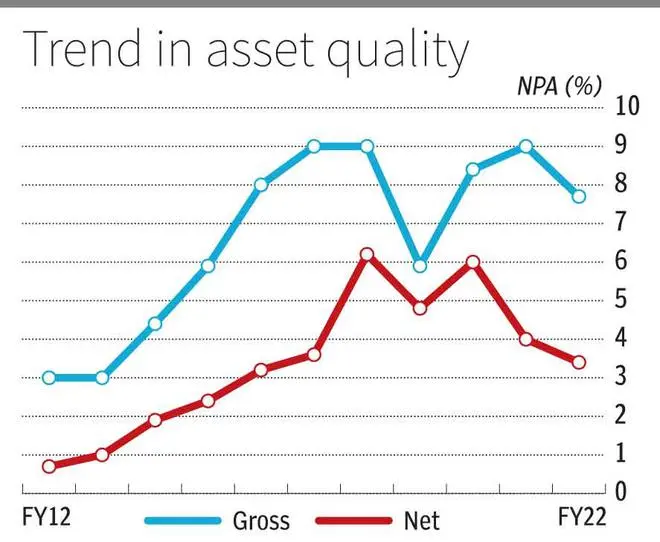

As per latest data, gross stage-3 assets or gross non-performing assets stood at seven per cent in Q2 FY23, down 100 basis points (bps) sequentially and nearly 500 bps year-on-year. Therefore, numbers are directionally positive.

M&M Finance’s NPA numbers historically have been higher than peers mainly because its exposure to rural and semi-urban markets is higher by at least 15–25 per cent. Hence, M&M Finance’s performance is linked to the vagaries of monsoon and monsoon is an important purchase guiding factor for borrowers in the non-urban markets.

M&M Finance’s average gross NPA has been around 6.3 per cent during FY12 – FY20. While recent data shows improvement on this front, going back to the pre-pandemic range could still be 12–18 months away. That said, with much of the provisioning accelerated in Q1, explaining for the year-on-year fall in net profit, there shouldn’t be unexpected jolts on this front.

Risks to consider

On a monthly basis, the lender repossesses 4,000–5,000 units of defaulted assets (classified as gross NPAs). It expects the number of repossessions to fall temporarily post RBI’s ban on using third party agencies for recovery of loans. In September RBI banned M&M Finance from hiring third party entities for repossession of loan assets for recovery. This was after an unfortunate incident during recovery process by company’s third party agent. The sentiment on the stock turned sour post this and it corrected by nearly 20 per cent in two trading days post this ban. The stock has, however, seen some recovery since, and the company has also clarified this is not expected to have material impact on financials.

With a provision coverage ratio of 58 per cent on gross NPAs and 100 per cent on assets defaulted for over 18 months, the likelihood of incremental impact on M&M Finance’s asset quality shouldn’t be severe. Provisional data for Q2 indicates an improvement on this front. However, the medium- to long- term impact of this ban needs to be watched,particularly on the cost of operations front, given that it’s a standard industry practice to outsource the recovery process.

Much of M&M Finance’s rerating draws support from an improvement in demand offtake. However, as the pent-up demand and low-base effect fade, whether demand would sustain given the inflationary pressures needs monitoring. Yields have already come under pressure for M&M Finance (15.8 per cent, down 30 bps sequentially), as is the case with the industry, though its net interest margin (or profitability) at 8.5 per cent remains one of the best in the industry. If demand turns tepid, the lender may face pricing issues. While cost of funds remained sanguine in Q1 at 6.5 per cent, this may change by December quarter.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.