Rising power demand, favourable policies and increased capex planned for renewable energy have led to renewed investor interest in the power sector post-Covid. In the wave of sector turnaround, thermal power major JSW Energy has been one of the beneficiaries. While the BSE Power Index has grown two-fold since its March 2020 lows, the stock of thermal power major JSW Energy has shot up by more than 500 per cent since then.

Though JSW Energy has seen its fundamentals improving in recent times and is having one of the best margins in business, its stretched valuation, tapered estimated revenue growth and weakened merchant power tariffs make a case to maintain ‘sell’ the stock, for investors. In the BL Portfolio edition dated December 5, 2022, we recommended that investors book profits in the stock at the then ₹320 levels and currently we maintain the stance. The stock is priced at around 27 times its one-year forward earnings (Bloomberg consensus estimates). By this, the stock is commanding one of the highest valuations among the major power generation companies even when revenue growth has been a concern for the company.

Business

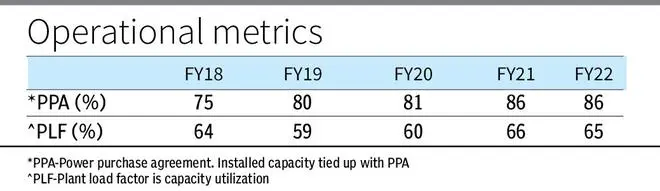

JSW Energy earns majority of its revenues from power generation and has an installed power generation capacity of 4.8 GW. In the power generation space about 86 per cent of its installed capacity is tied up under long-term PPA (power purchase agreements) with state distribution companies (discoms) and group captive providing revenue visibility with majority of PPAs earning cost-plus based tariff. The rest 14 per cent of revenues are based on short-term merchant power tariffs by selling power on exchanges.

About 66 per cent (3.16 GW) of its total installed capacity comes from thermal power generation. Within the thermal space, about 34 per cent of its capacity (Barmer facility) earns complete cost pass-through based tariff ensuring full recovery of variable (fuel cost) and fixed (capacity) cost, provided normative technical parameters are met. Here, the company sources lignite through its pithead captive mines under long term fuel supply agreements, thus providing cost-competitiveness. The rest thermal capacity is imported coal-based which sources coal from countries such as South Africa and Indonesia.

Unlike other players such as Tata Power who have gone for solar as an alternative source, JSW Energy has 29 per cent of its capacity based out of hydro. Under hydro, it has more than 95 per cent of its capacity tied to long-term PPAs.

Renewables’ strategy and outlook

In order to increase the power generation portfolio, the company aims to increase its installed capacity to about 10 GW by 2025 from 4.8 currently, with the renewable portion expected to increase to 61 per cent, up from current levels of 31 per cent. This target will be aided by completion of the company’s acquisitions of Mytrah energy’s generation assets (1,331 MW of wind and 422 MW of solar) and under-construction stressed 700 MW plant of Ind-Barath, the resolution of which has passed by NCLT. Further, the company has ventured into the energy storage space by winning SECI tender of setting up 1GWh battery energy storage system.

Performance

JSW Energy saw its thermal PAF and PLF at 79 per cent and 70 per cent respectively in H1FY23, which is lower than that of 85 per cent and 74 per cent respectively on a Y-o-Y basis primarily due to shutdown of part-capacity at its Ratnagiri plant. Further, the company currently has an untied capacity portion of around 14 per cent, which is exposed to volatility of merchant tariffs. However, this number has been reduced from 25 per cent in the last five years due to tying up capacities with various discoms and group captive (i.e. JSW group) resulting in increased earnings visibility.

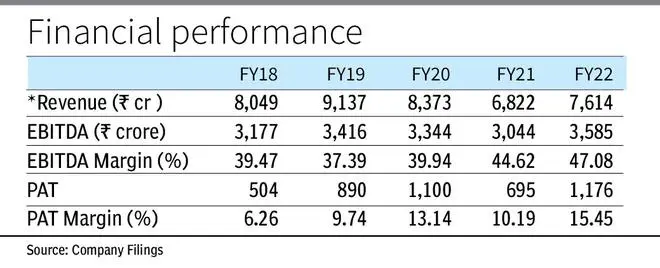

During H1FY23, the company posted ₹5,712 crore revenue with about 40 per cent growth on a y-o-y basis which led to about 20 per cent increase in EBITDA. However, its estimated revenue growth (Bloomberg) in FY24 is comparatively lower i.e. 9.2 per cent The company’s EBITDA margin contracted to 39 per cent from 47 per cent during the period on account of plant shutdown, increased fuel cost, lower volumes and tariffs in merchant space. Further, the company has seen its cash position strengthening with decreasing leverage over the past few years from Net debt-to-EBITDA of 3.5 times in FY18 to 1.77 times (TTM) currently.

Valuation

While JSW Energy’s operating performance has improved over the years, its valuation is stretched, making risk-reward unfavourable in the stock. Risks from impact of global slowdown on Indian economy, higher cost of capital from higher interest rate regime, are not discounted at current levels. The company’s one-year forward P/E is 27 times (Bloomberg consensus estimates), which is about 35 per cent higher than its five-year historical average P/E of 20.5 times. Its one-year forward EV/EBTIDA stands 11 times, 22 per cent above its five-year average of nine times. The stock of JSW Energy currently trades at a significant valuation premium over most of its industry peers considering revenue growth has also been a concern for the company.

Over the last few years, the company has increased its revenue and earnings visibility by tying up some of its untied capacity, strengthened its balance sheet and has good project pipeline in place. However, the valuation jump has outpaced the improving fundamentals, leaving less room for investors to earn positive returns at current valuation levels. Hence, we maintain our ‘sell’ recommendation, considering heightened valuations and management guidance on unfavourable merchant tariffs in near future.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.