The performance of city gas distribution companies in 4QFY23 was mixed. While the stocks of select City gas distribution companies, particularly Gujarat Gas and Mahanagar Gas have managed to clock positive returns so far this week, gaining 3.5 per cent and 2.3 per cent, respectively, stocks of Indraprastha Gas and Adani Gas have been underperformers. While the underperformance of Indraprastha Gas can be attributed to the March quarter results, Adani Gas, has been on a falling spree, shedding almost 27 per cent over the last two weeks, following the removal of the latter from the MSCI Index.

Both Mahanagar Gas and Gujarat Gas reported revenue and profit beat versus market expectations. Higher gas sales in volume terms helped Mahanagar Gas and Gujarat Gas, while the lower cost of imported LNG, which has now moderated to $11 per mmbtu, from more than $30 per mmbtu in October 2022, aided the profit performance.

Mahanagar Gas reported an impressive 49 per cent growth in revenue to ₹1772 crore, as the company decided to pass on the benefit from lower LNG prices to end customers, resulting in better volume growth. Operating profit grew by a whopping 81 per cent to ₹390 crore; operating profit improved by 3.8 percentage points to 22 per cent, compared with 18.1 per cent in 4Q FY22. This was aided by lower gas costs, thanks to the moderation in spot LNG prices in Q4 FY23.

Though Gujarat Gas reported a 18 per cent decline in operating profit, and a 14.7 per cent drop in revenue, the performance was better than expectation, as market had anticipated a significant drop in revenue and operating profit. The company’s industrial gas volumes witnessed an improvement in the March 2023 quarter, from 4.1 mmscmd in Q3 to 5.4 mmscmd helped by recovery in demand by the ceramic industry at Morbi.

However, the performance of Indraprastha Gas was mixed, as the company reported a 22 per cent drop in operating profit, even as revenue grew 68 per cent. Even as the company managed to grow gas volumes by 6.6 per cent, higher gas costs, which recorded an 84 per cent rise in the March 2023 quarter, compared to the same period last year, added to the pressure on profits. This is possibly due to the high cost of HPHT gas (High-pressure high-temperature gas).

Adani Total Gas reported a 38 per cent growth in net profit to ₹104 crore, from a 12.4 per cent increase in revenue for the March 2023 quarter. Lower material cost and salary costs compared to the same period last year helped the company retain much of its profits, despite the sharp rise in interest cost and depreciation.

Outlook

Going forward, city gas distribution companies should benefit from the reduction in the domestic gas price, with the implementation of the new pricing mechanism. The domestic gas price has already been lowered by about 8 per cent to $8.2 per mmbtu from about $8.6 per mmbtu last month. Further, gas from nominated fields will be capped at $6.5 per mmbtu and that will translate into significant cost reduction for city gas distribution companies. We have an accumulated rating on Mahanagar Gas and Indraprastha Gas and are optimistic about the business outlook over the next 2-3 years.

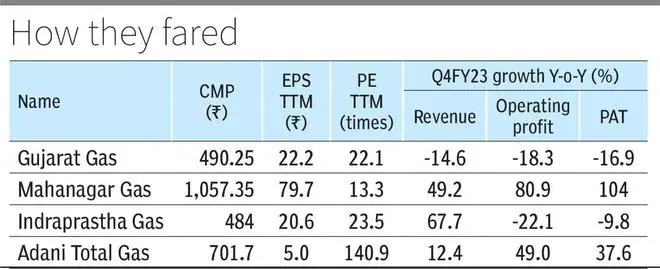

Adani Gas is the most expensive stock in the pack, trading at 141 times its trailing twelve-month earnings, while Mahanagar Gas trades at a tenth of its valuation of 13 times, given that the latter operates largely in Mumbai metro and surrounding areas. Other large players, Gujarat Gas trades at 22 times, while Indraprastha Gas’ stock trades at 23.4 times its trailing twelve-month earnings.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.