If you are an investor looking for quick listing gain or price appreciation and not dividend income, you can pass up the upcoming IPO of Nexus Select Trust Real Estate Investment Trust (REIT). However, if you have a long-term view and are looking for alternatives to fixed income instruments that provide regular pay-outs and handle some yield volatility risks, you can consider subscribing to the issue.

Investors can take comfort from the following — an estimated pre-tax yield of 8.25 per cent (7.1 per cent post-tax); a growing portfolio of completed, high-quality (Grade A) and geographically diversified (14 cities) assets (leasable area of 9.2 million square feet) occupied by a mix of tenants (1,044 international and national brands, with a revenue split of 47:53 per cent); no single asset and tenant contributing over 18.3 per cent and 2.8 per cent of total rent respectively; committed occupancy of 96.2 per cent, with a potential for 8 per cent annual income growth in the next three years; and the sunny macro picture of India’s consumer consumption (which forms 58.4 per cent of the country’s GDP).

Unique story

Unlike the three currently listed REITs that own office spaces, Nexus manages retail spaces – a different asset type. For one, the weighted average lease expiry (WALE) is lower for retail – 5.7 years vs 9 years in the office segment. While lock-in reduces yield downside, in a rising interest rate environment, rents can increase earlier in retail, offering a different risk-return trade-off. For Nexus, besides the 12-15 per cent contractual rent escalations (over a period of three to five years), mark to market for rents when contract expires is estimated at over 20 per cent per year in the next three years.

Retail rentals also often include a revenue share linked to store sales — an upside potential beyond rent increase. Nexus has 88.3 per cent of its leases with Turnover Rental arrangements with 5-25 per cent of the tenant’s sale earned as rental revenue, beyond the minimum guarantee rent. Discretionary retail in India grew at 11.5 per cent during FY15-20 and is estimated to grow at 15 per cent during FY22-25. In the next three years, Nexus expects tenant sales to grow at 6-10 per cent per annum.

Office REITs have few large clients, typically from IT and financial services, while Nexus has tenants that include apparel, entertainment, F&B, footwear and departmental store brands. Also, 100 per cent of its assets are ready-to-rent — improving yield. Embassy, for instance, has 16 per cent of area under-construction.

Nexus can also be compared to Phoenix Mills, which has the second largest retail asset area (6.9 msf). The stock has had a strong run (up nearly 50 per cent in the last 12 months) compared to listed office REITs (down 8-18 per cent), thanks to strong recovery in consumption, post Covid.

Nexus is better positioned than Phoenix Mills in some metrics – Nexus’ tenants currently pay a lower share of their sales as rent (11.8 per cent) compared to those of Phoenix Mills (13 per cent). The favourable rent to sales ratio provides potential for higher rent increase.

Growth prospects

Starting in 2016, Nexus has acquired 17 high-quality retail assets, with 4.6 msf added since the start of FY20 through strategic acquisitions and accretive build-outs. Also, features such as food courts, atriums and facades were upgraded, improving user experience. Nexus has an inclusive hiring policy that supports people with disabilities, as per the management.

And having a pan-India presence and being backed by Blackstone positions Nexus as a landlord of choice for a growing number of brands. The Indian market is also under-penetrated — organised brick-and-mortar retail formed 7.3 per cent of overall retail in FY22. With just 100 Grade A urban consumption centres, the country offers 0.04 square feet per capita, compared to 0.69 in China. The segment is expected to grow at 23 per cent CAGR until FY25. That said, the consumer discretionary sector faces higher risks in case of economic slowdown.

Besides malls, Nexus also owns hotels, offices and renewable power plant assets, accounting for 10 per cent of the total property value of ₹6,499 crore. Debt is expected to be comfortable, at under 20 per cent of market value in the near term. Still, if the interest rate hikes do not pause, there would be pressure faced due to high financial cost.

The portfolio’s total net operating income (NOI) is projected to grow organically by about 8 per cent annually during FY24-FY26, from contractual increase, revenue share, re-renting at market rate and leasing vacant area. Also, while growth in online retail may not impact Grade A malls in the near term, Nexus is working on technology solutions (such as virtual malls) to capitalise on the trend.

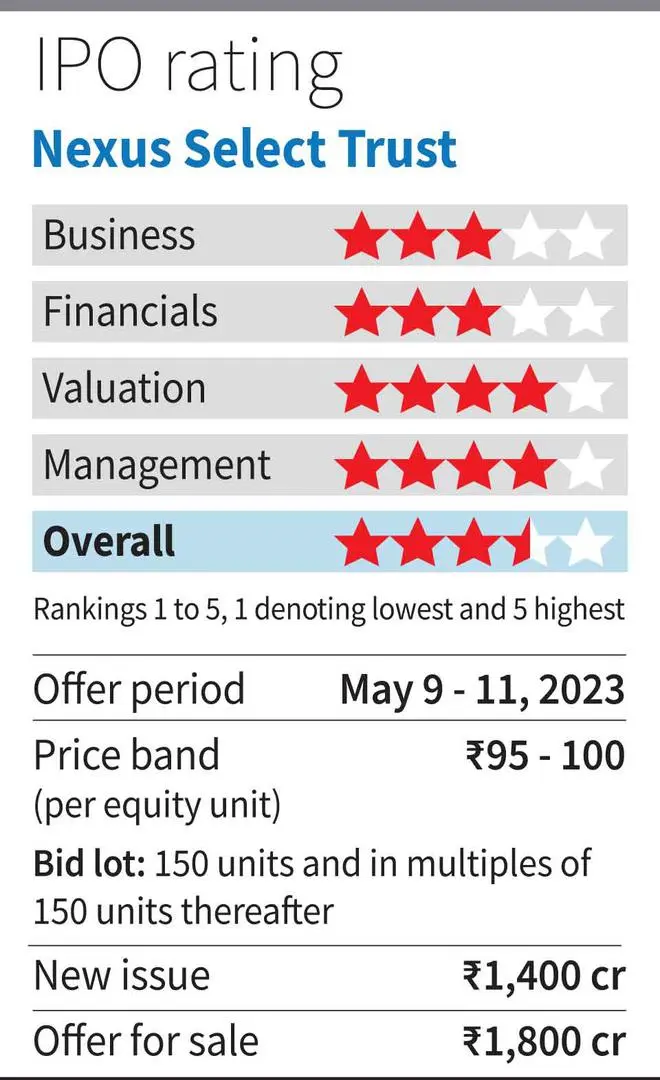

The offer of 32 million units will increase the outstanding units to 1,515 million. The offer price is at a 22 per cent discount to the Net Asset Value per Unit of ₹127.73 as on December 31, 2022. The proceeds will be used for loan repayment and asset purchase.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.