For pharmaceutical manufacturers who derive a chunk of their revenues from the US, ANDA (Abbreviated New Drug Application) approvals, which add new products to their existing generics portfolio, are a critical component in the growth equation. In an industry where yearly price erosion ranges from 6-10 per cent, volume and mainly new products act as offsets.

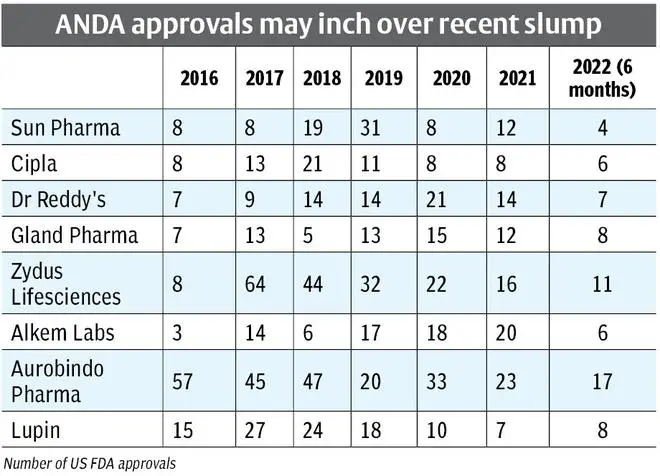

Beginning 2016, leading Indian pharma players witnessed a strong surge in ANDA approvals. This coincided with a period of unusually higher price deflation as well. But this has since tapered off, for reasons including the pandemic outbreak. Key pharma players may need to break this trend and ramp up their ANDA filings to achieve new product growth.

For this analysis we have considered top pharma companies by market capitalisation, which have a sizeable US generics portfolio of at least 50 ANDA approvals. Eight companies make the cut. Aurobindo Pharma, and to an extent, Zydus Lifesciences and Lupin, fall in the category of players which rely on the number of approvals for growth; Sun Pharma and Cipla are players who rely on complex approvals. Dr Reddy’s is a mix of both. The list also includes Gland Pharma and Alkem Labs.

Aurobindo, Zydus and Lupin trail earlier peaks

Following the pandemic, Aurobindo saw the number of approvals declining from over 57 per year in 2016 to 23 in 2021. Plant issues did not help either. With 17 approvals in 2022, Aurobindo’s approval rate may be improving. Lupin with only 8 approvals so far in 2022 is behind its peak of 27 in 2017, and has been declining since.

Aurobindo Pharma, even with plants under duress, may resume its strong filing momentum. But with close to $1.4 billion in revenues from the US, a strong suit of more than 50 approvals per year may be required to overcome price erosion. This implies that Aurobindo would need a strong second half. Lupin may be eyeing biosimilars and respiratory in limited competition products, but as the approval criterion gets tougher in complex products, a robust generics portfolio will be required to sustain revenue growth.

Gland Pharma seems to be on an upward trajectory with eight approvals in 2022 so far, compared to 12 in 2021, 15 in 2020 and an average approval rate of 10 in the previous four years (2016-2019). That these are in the injectables space, which provides better pricing power, is also favorable to Gland Pharma.

Dr Reddy’s has shed a large part of its ‘proprietary portfolio’ but still intends to lace its launch plans with a good mix of limited competition products. The company also needs a strong second half to regain its peak of 21 approvals in 2020, compared to only seven approvals in 2022.

Sun, Cipla chart a new course

Sun Pharma may have transitioned to a specialty pharmaceutical company, which explains the decline in approvals for Sun Pharma. From a high of 31 in 2019, the company delivered around 10 per year in 2020 and 2021 and has secured only four approvals so far in 2022. The company is making big strides on the specialty front, with close to half-a-billion dollars from one product alone (Ilumya), a pipeline with additional indication for the same, and two more in Phase-II (Psoriasis and Osteoarthritis pain). Similarly, Cipla peaked in 2018 with 21 approvals, which decreased to just eight in 2021, but has improved to six in 2022 so far. Cipla’s primary focus is on bringing its respiratory portfolio to the US, including its generic Advair launch in the next one year.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.