The IPO of Protean eGov Technologies (Protean) is open during November 6-8. The ₹489-crore issue is entirely an offer for sale by existing investors. The company is diversely held with no promoter group. Largest shareholder is NSE investments with a 24.77 per cent stake, while financial institutions such as SBI, HDFC Bank, Axis Bank, Bank of Baroda, Deutsche Bank AG, HSBC, PNB, BOB and SUUTI own low to mid-single digit stakes in the company.

Originally incorporated in 1995 as National Securities Depository Limited, the company was rechristened as NSDL eGov Technologies (NSDL eGT) after demerger of its depository business into a separate independent entity (NSDL Depository Limited). NSDL eGT was later renamed as Protean eGov Technologies in 2021. In its present form, the company is not related to or associated with NSDL anymore.

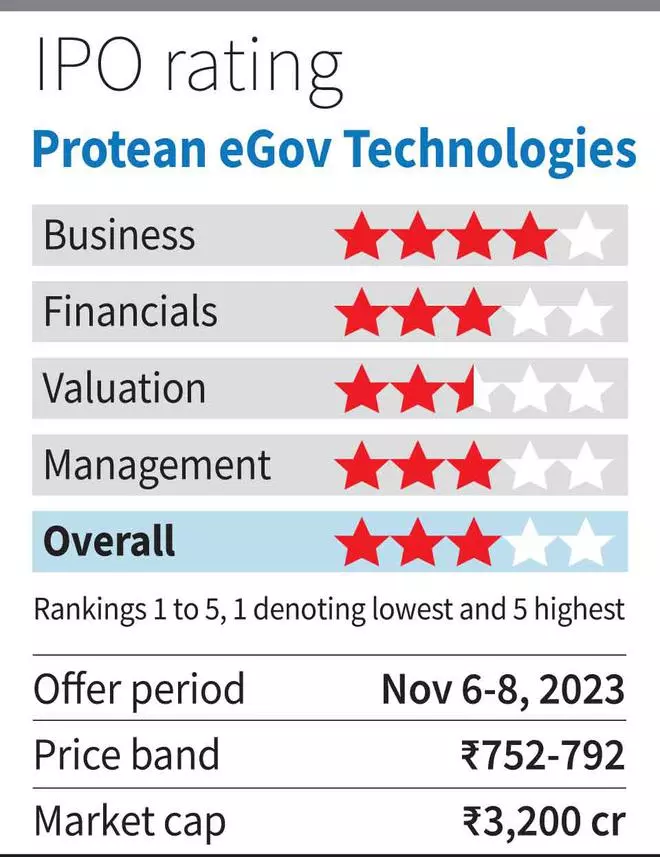

Its current operations are a play on growing e-governance projects and digitisation trends in India. At ₹792 per share, the IPO values the company at a FY23 PE of 30 times. However, it needs to be noted that there is significant other income component in its overall profits. Adjusting for this (explained below), its FY23 PE works out to around 33 times. This may not be cheap if one looks at FY21-23 revenue/earnings CAGR of 11 /8 per cent. Nevertheless, the company has a long runway ahead, given the scope for growth in its core business ( it did do well in Q1FY24), as well as new initiatives, which hold potential.. We recommend a subscribe for investors with high risk appetite.

Business and prospects

Protean is an IT-enabled solutions company engaged in conceptualising, developing and executing nationally critical and large-scale greenfield technology solutions. By virtue of its long- term collaborations with governments (Central and State), the company has extensive experience in creating digital public infrastructure and developing citizen centric e-governance solutions. Since inception, it has implemented and managed 19 projects spread across seven ministries and autonomous bodies, enabling transformation in public delivery of services. At present, three segments have scaled up well, accounting for almost its entire revenue and representing its core business.

PAN Issuance and TIN systems: The company has been an active partner with the government in modernising the direct tax infrastructure in India through projects such as PAN issuance and setting up Tax Information Network and its technology infrastructure for Aadhaar authentication and e-KYC services. It has 45 per cent market share in the PAN issuance segment and 58 per cent in filing of TDS returns through TIN systems (FY23). This is largely a B2C business where customers pay the company for using its service to get a PAN or filing TDS through TIN systems.

Based on details provided in its RHP, it is estimated that cumulatively 657 million PAN cards have been issued in India till FY23 and it is likely to reach 890 million by FY27. This implies potential for volume growth of 8 per cent in this business (assuming the company maintains its market share). Revenue growth will depend on how the pricing trends. While exact revenue contribution from each of these sub segments is not available, it appears PAN issuance (one-time business) is the major contributor in this segment. There is scope for higher growth from recurring businesses like filings through TIN systems and online PAN authentication for transactions.

Central Record Keeping Agency for NPS: CRA acts as an operational interface between PFRDA and other NPS intermediaries. CRA is responsible for establishing the IT infrastructure, handling administration and customer service functions for all NPS subscribers. It maintains centralised records of all relevant details and provides reports to all NPS stakeholders. Although this segment is open to competition, Protean virtually has monopolistic share in this segment, with 98 per cent share of NPS subscribers (99 per cent in terms of AUM) and 100 per cent share in Atal Pension Yojana (APY).

The management believes there is a long runway of growth in this segment with only around 1.5 crore NPS subscribers as of June 2023 as compared to around 28 crore EPFO accounts. As per estimates by CRISIL in the RHP, the NPS and APY subscribers are expected to grow at a strong CAGR of 17 per cent during FY22-27. This segment encompasses revenue from B2G (government NPS accounts), B2B (private NPS managers) and B2C (NPS subscribers).

e-authentication: The company’s IT infrastructure network and relationships with multiple stakeholders enable it to be a key player in e-authentication of transactions for enabling digital transactions. For example, when a KYC process needs to be completed using Aadhaar for opening a bank account, this is enabled by services provided by the company and the company,in this case,will be paid by the bank per transaction. As financial inclusion expands and digital transactions continue to grow, this segment’s contribution to overall revenue of the company can increase. While segment detail are not available, currently this segment’s revenue is much lower than the above two.

New Initiatives

Given its entrenched relationships, software expertise and IT hardware infrastructure, the company has been investing to expand its offerings. One of the key initiatives here is its involvement and collaboration with various stakeholders in the widely popular ONDC or Open Network Digital Commerce. ONDC is the digital project of the government to develop a holistic nationwide standardised e-commerce market place on the scale of what UPI is for online payments. Protean is one of the key and early contributors to the open source community and protocols that are powering ONDC. It appears well-positioned to tap this opportunity when it gains scale.

Another opportunity the company appears keen on is the potential for account aggregator or AA ecosystem to broaden financial inclusion in the country. Under the AA ecosystem, Protean will be a financial information provider (with consent from NPS subscribers) to banks/NBFCs that they can lever for their loan processing or other business decisions. Another business it is eyeing is managing and providing cloud infrastructure services to enterprises, based on expertise gained from owning and operating data centres for its proprietary business.

These new initiatives are optionalities that are not quantifiable now, but hold potential, given the company’s past track record, expertise and digitisation trends.

Financials and valuation

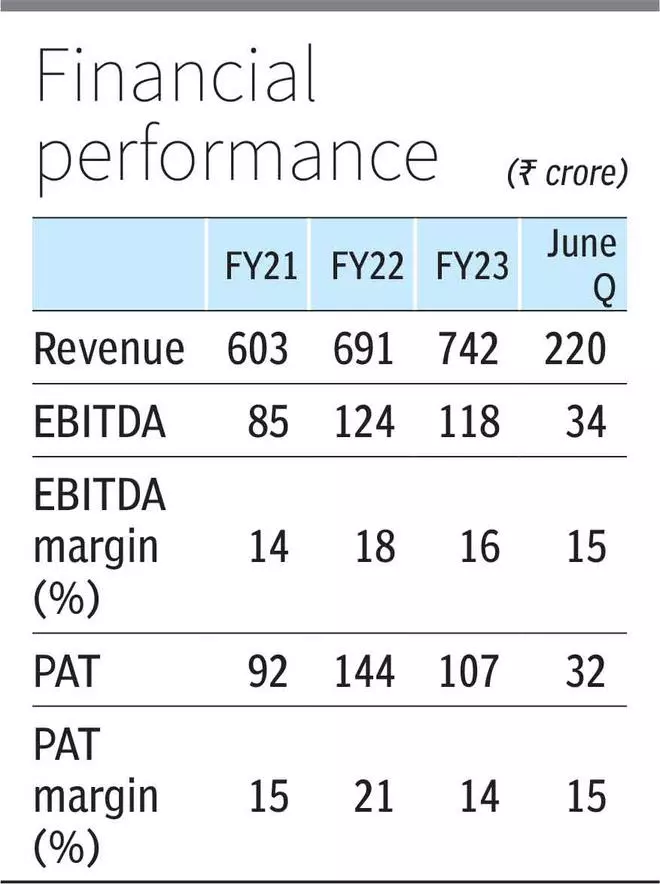

During FY21-23, the company’s revenue grew at a CAGR of 11 per cent, while EBITDA and Net profit grew at a CAGR of 18 and 8 per cent respectively. However, the company saw acceleration in growth in June Q of FY24, with revenue growing 41 per cent Y-o-Y while EBITDA and PAT grew 57 and 52 per cent respectively. According to management, this was driven by accelerated traction in its core businesses, such as PAN issuance.

Protean has a pristine balance sheet with net cash of around ₹700 crore, which is approx 22 per cent of its market cap at upper end of price band. This also positions it well to invest aggressively if required to tap opportunities in its new initiatives.

The core business of the company (reducing net cash from market cap; and reducing post tax other income from net profit) is valued around 33 times. Successful scaling up of new initiatives is essential to justify this valuation. In the meantime, strong balance sheet, stable core business and good execution track record can provide support.

While there are different competitors for different businesses of the company and many of them unlisted, amongst listed players companies like KFin Technologies and Computer Age Management Services that provide record keeping and related services for the mutual funds industry trade at FY23 PE of 40 and 43 times respectively.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.