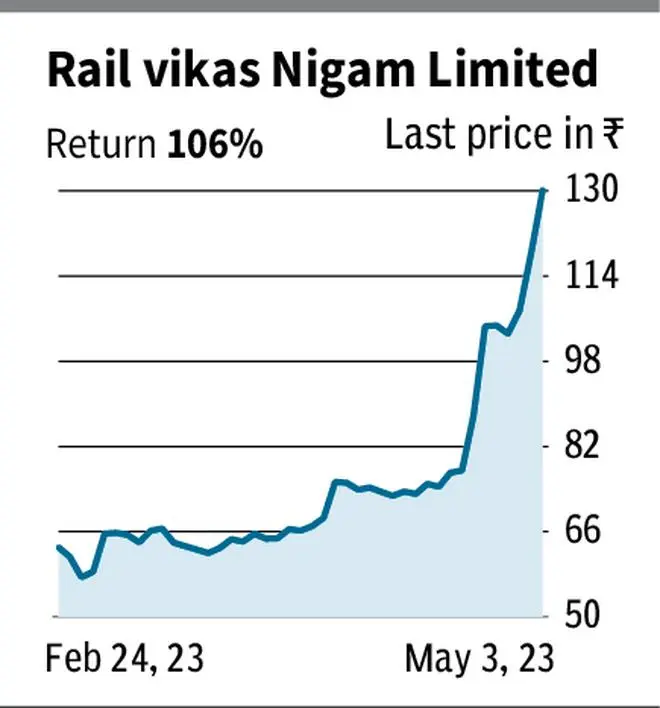

The stock price of Rail Vikas Nigam Limited (RVNL) has gained about 106 per cent since our last recommendation to accumulate the stock. In our edition dated February 26, 2023, when the stock price was ₹63.10, we recommended to buy the stock on dips.

While the stock initially dipped 7 per cent providing an opportunity, it has subsequently rose to over ₹130. It would be prudent for investors who bought at the levels we recommended to book partial profits now.

What drove the stock?

Here are the factors that worked in favour of RVNL in the last two months.

The company has received orders worth ₹1,792 crore between February 26, 2023 and to May 3, 2023 and has emerged as L1 bidder for many other contracts.

Also read: Maruti Suzuki: Is this stock a good buy in current times?

Some of the key orders bagged by the company are construction of six-lane elevated Kona Expressway from 0.145 km to 7.337 km in West Bengal for approximately ₹721 crore, construction of 6-lane greenfield Varanasi-Ranchi-Kolkata Highway from 184.700 km to 222.000 km for ₹623 crore (RVNL share in consortium), upgradation of Ahmedabad-Bagodara-Rajkot road for ₹100 crore (RVNL share in consortium) and a project from North-Central Railways for the provision of E1-based automatic signaling for ₹121 core.

Besides, the Union Cabinet’s approval of Navratna status seems to be another trigger. The Navratna status gives central public sector enterprises enhanced financial autonomy. Navratna companies can invest up to ₹1,000 crore without seeking approval from the government.

Thirdly, investors confidence in PSU stocks has favoured the RVNL. Some of the PSU stocks have gained more than 100 per cent over the last one year and the BSE PSU index has gained 17 per cent, while the benchmark BSE Sensex has gained only 7 per cent during the same period.

What should investors do now?

The company had an orderbook of ₹55,000 crore as on 31 December 2022, which is 2.38 times its FY22 revenue. The top- and bottom-line have been growing at a healthy pace. Between FY19 and FY22, RVNL’s revenue grew at a CAGR of 24.4 per cent, EBITDA grew at CAGR of 31.21 per cent and the net profit grew at a CAGR of 18.8 per cent.

The trailing PE of the company is now 18.85x. Although the overall business prospect of the company looks bright, the current valuation of 18.85x is expensive against historical five-year average of around 8 times. The Q4 results and management outlook will be keenly watched for the way forward.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.