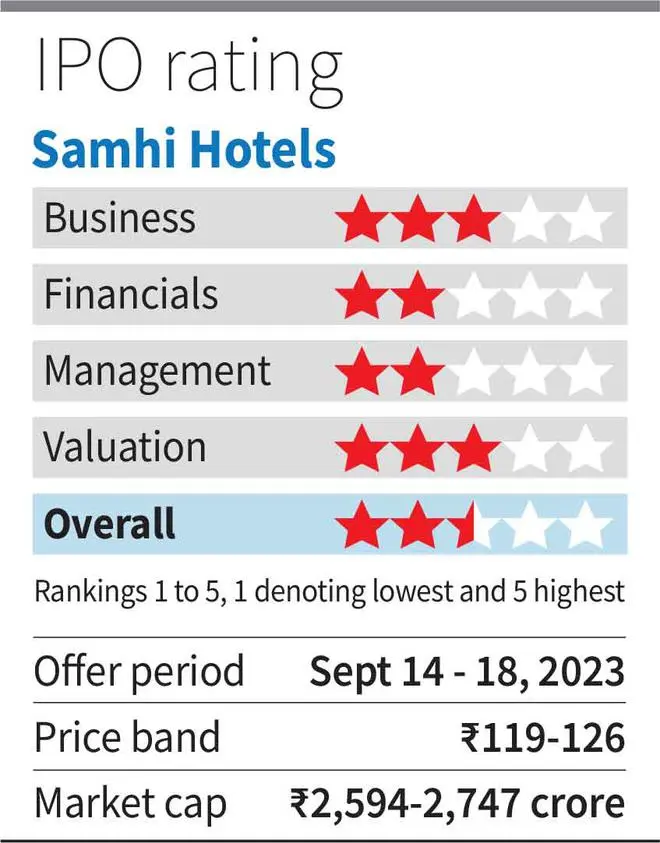

Branded hotel ownership firm SAMHI Hotels has the third-largest inventory of operational keys in India. Its hotels typically operate under long-term management contracts with global hotel operators such as Marriott, Hyatt and IHG. SAMHI is tapping the public market to raise around ₹1,370 crore (OFS: ₹170 crore and fresh issue ₹1,200 crore) in the price band of ₹119-126/share. The m-cap at the upper price band will be about ₹2,747 crore. The IPO ends September 18 and has been subscribed 13 per cent so far. The company raised ₹616.50 crore from anchor investors ahead of the public issue.

The IPO asking price values the loss-making hotel owner at about 16 times EV/EBITDA, a good discount to prominent listed hotel stocks in India. The company can repay over 40 per cent of borrowings with the IPO proceeds. Hotel stocks are in a sweet spot on account of sector tailwinds in the up-cycle. While SAMHI could potentially benefit from earnings jump thanks to sustained topline growth, margin upside and paring of debt, so far it has scaled up with losses. Thus, we wait to see sustained profitable growth from the 13-year-old company’s strategy of acquiring and turning around primarily business hotels. Investors can wait and watch for now.

Positives

With 31 hotels (including 6 from ACIC hotel portfolio acquired in August 2023), SAMHI is one of India’s fastest growing hotel asset owners. It is also the 3rd largest (4,801 keys) among hotel owners after IHCL and Lemon Tree. In terms of diversification, SAMHI has 22 per cent exposure to upper upscale and upscale, 45 per cent in upper mid-scale and 33 per cent in mid-scale segments. Note upper upscale and upscale contribute a substantial share of the company’s income.

We like 3 things about SAMHI: strategy, recent growth and valuation.

Strategy: The company’s business model encompasses 4 key pillars. One, its acquisition and turnaround-led approach, resulting in lower cost per key vis-a-vis average for hotels in India. Two, SAMHI leverages the power of strong hotel brands. For instance, SAMHI has over 43 per cent share of all Fairfield by Marriott and 71 per cent of Holiday Inn Express hotels. While it outsources day-to-day operations of hotels to operators, it controls material aspects. Three, SAMHI’s demand base for business is good, thanks to presence in high density micro-markets (operates in 12 key urban consumption centres), with under-development hotels in Mumbai and Kolkata. Four, the company’s proprietary tools help drive performance. This allows it to identify trends and patterns to improve performance, support acquisition benchmarking and tools to integrate new acquisition efficiently.

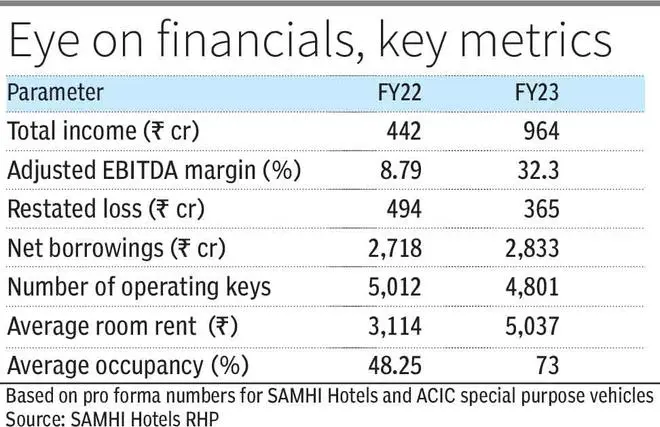

Recent growth: The company’s asset ownership business model has enabled it to achieve revenue growth in recent years. Total income (proforma including ACIC portfolio) grew 118 per cent in FY23. EBITDA grew 8-fold in FY23 over FY22. This was helped by strong growth in occupancies (46 per cent in FY22 and 73 per cent in FY23) and average room rates (₹3,149 in FY22 and ₹5,037 in FY23). As a result, adjusted EBITDA margins have grown from 8.8 per cent in FY22 to 32.3 per cent in FY23, which is comparable to listed hotel peers. Hence, SAMHI has been a clear beneficiary of a strong post-Covid business recovery.

Going forward, over FY23 to FY25 period, hotels stocks (IHCL, Lemon Tree and Chalet) are expected to post 11-24 per cent CAGR revenue growth and 13-29 per cent CAGR EBITDA growth. In this period, while SAMHI’s top line growth may be at the lower end, this can contribute to a faster EBITDA rise.

Valuation: At the IPO upper band, SAMHI’s stock is valued at about 16 times EV/EBITDA based on FY23 pro forma financials, which is a discount to average valuation of 23-31 times EV/EBITDA for listed peers. One-year forward EV/EBITDA for peers is 20-28 times. Assuming 30 per cent growth in SAMHI’s EBITDA in FY24, its FY24 EV/EBITDA could be around 11 times. Although attractive optically, we believe the discount in SAMHI’s valuation could be warranted due to various factors listed below. We estimate the sector up-cycle could last for another 3 years.

Key concerns

But there are some risks too. The first and foremost issue is the high debt. Net borrowings (pro forma) stood at ₹2,833 crore at the end of FY23. Secured loan facilities have floating rates of interest which vary between 7.90 per cent p.a. and 15.75 per cent p.a. Interest rates on unsecured borrowings range from 10 per cent p.a. to 35.7 per cent p.a.

In FY23, finance costs (₹568 crore), after repayment of certain NCDs via refinance route, were a whopping 59 per cent of total revenue. This is a reason why SAMHI posted ₹365 crore loss (restated). In FY22 too, the company posted a loss due to huge finance expenses. Coming to FY24, if the company pays down ₹1,100+ crore of debt, its borrowing position will be better but still high at about ₹1,700 crore. Lower debt and finance costs may help it post profits, thanks to the G-20 events and upcoming Cricket World Cup sales boost.

Secondly, hotel staff is key to SAMHI’s business model. This sector is highly competitive and goes through cycles. While SAMHI’s average staff to key ratio is low, the massive attrition rates (86-90 per cent) in FY22 and FY23 is worrying. Attrition rate was 18-26 per cent at IHCL which has 8-times more permanent staff than SAMHI.

Thirdly, SAMHI does not have an identifiable promoter. Though promoter-less companies are a new trend in capital markets and is good in some ways, hotels operate in a capital-intensive sector. A strong promoter with reputed credentials can help during times of financial stress and also lend confidence to stakeholders.

SAMHI’s FY23 audit report includes references to certain emphasis of matter paragraphs and qualifications. One of these is in respect of reconciliation of amounts paid by company’s customers through credit cards with receipts recorded in the books of account, not operating effectively.

Lastly, it may be noted that some of the existing shareholders of SAMHI, such as Goldman Sachs Investment Holdings (Asia), are selling shares in the IPO at a lower price than their weighted average cost of acquisition.

In conclusion, risks at this point outweighs the positives. Hence, investors can wait and watch.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.