The spike in the already-high raw material costs due to the geopolitical crisis (between Russia and Ukraine) has put the cement sector in a tough spot. This combined with flat demand in the past few quarters have led to the stocks in the cement sector correcting significantly from their highs, with ACC being no exception. It has corrected nearly 17 per cent from its peak. ACC is currently trading at a discount to its historical multiples. Its one year forward P/E is now at 19.76 times (Bloomberg consensus) versus its five-year average at 22.3 times. On the EV/EBITDA front also, the stock is trading at 10.21 times (Bloomberg consensus) versus its five-year average of 11.3 times.

With a good long-term track record and structural positives from big infra push by the government, recent correction and discount to historical valuations could be a good opportunity in the stock under normal circumstances. However, given uncertainties in earnings trajectory — due to impact of cost spikes and any impact to growth due to Russia-Ukraine crisis, investors can currently hold the stock. Investors can keep the stock on radar and look to enter the stock once these uncertainties play out, depending on the stock valuation at that point in time.

Business and Financials

ACC is the fourth largest cement producer in India based on capacity. ACC has an installed capacity of 34.45 million tonnes and is looking forward for capacity expansion to 40-45 million tonnes. The expansion projects in pipeline are 2.7-million-tonne clinker facility and 1-million-tonne cement grinding plant at Ametha in Madhya Pradesh and split cement grinding units of 3.8 million tonne in Uttar Pradesh. The company is also concentrating on its waste heat recovery system, which will be helpful in optimising energy costs and expects to be producing 85-90 megawatts by 2025 using this waste heat recovery systems. This will be around 25 per cent of total power consumed.

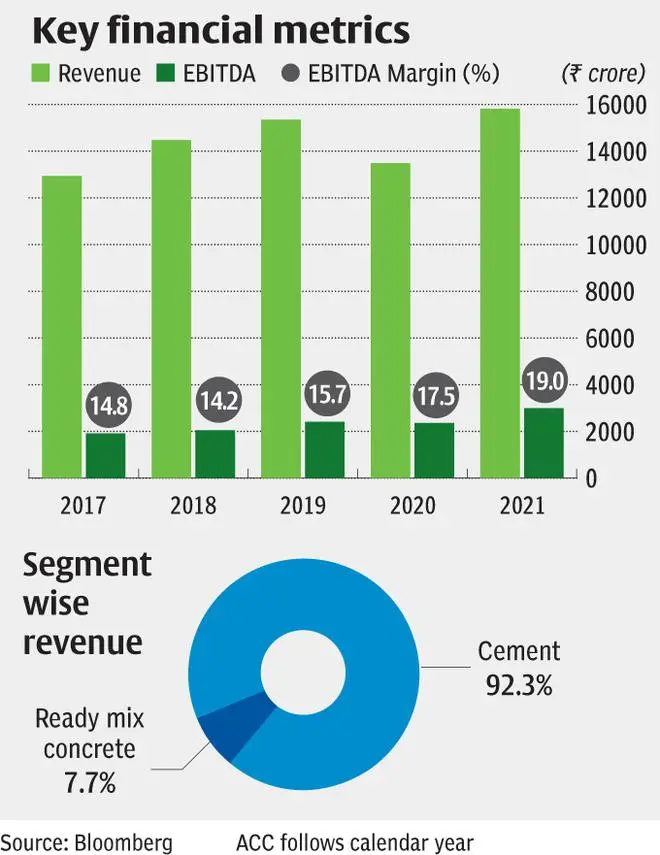

In CY21 (ACC follows calendar year for accounting), the volumes for the company rose 13 per cent to 28.80 million tonnes from 25.53 million tonnes. The revenue also saw an uptick of 17.25 per cent to ₹16,151.35 crore. The operating EBITDA also saw nearly 21 per cent rise than the previous year to register ₹3,000 crore in CY 2021. The net profit saw an uptick of 29 per cent in CY21 over CY20 by lodging ₹1,820 crore against ₹1,415 crore. The EBITDA per tonne of ACC Ltd for CY21 was ₹1,037 which is 12.3 per cent growth from CY20.

The increase in revenue is higher than the growth in volume, which suggests that this growth is driven by price increase of cement across the country.

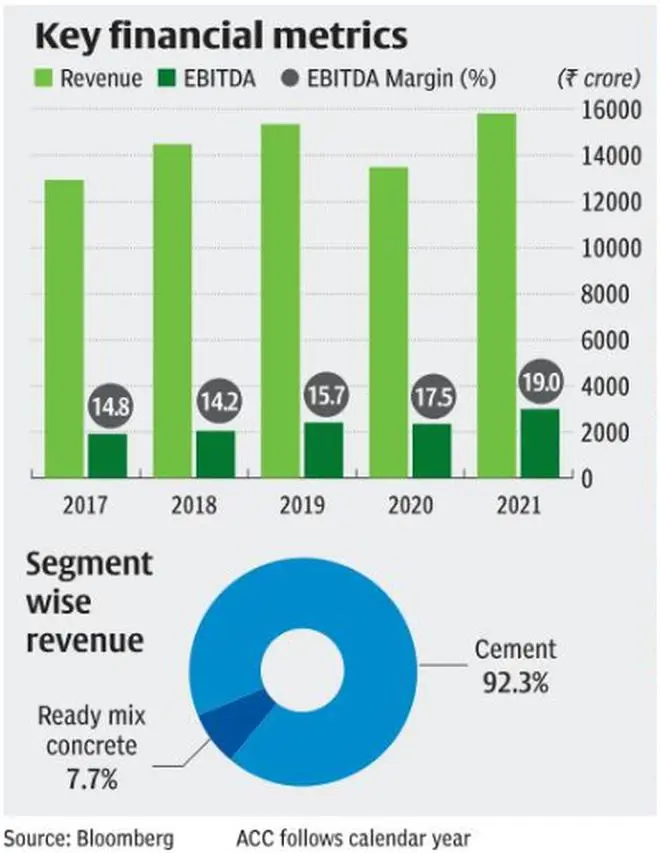

In 2021, ACC derived 92.3 per cent of its revenue from cement and and the rest from ready-mix concrete (RMC). Cement revenue grew 20 per cent from the previous period. The RMC revenue grew 31 per cent from the previous period. Cement accounted for 97.7 per cent of operating income in 2021. The share of RMC in operating income was nearly 7-8 per cent before the pandemic and in 2021, it reduced to 2.3 per cent. However, things are expected to improve with the infra push by the government. With 17 RMC plants and 79 per cent capacity utilisation, ACC seems to be reasonably well-placed to exploit any opportunities that may arise in this space.

With the increase in input costs, the increase in capacity and volume will be important in order to keep per bag price to an optimum level.

Input costs spike

Raw material costs, along with power and fuel costs, form a significant part of total costs in the cement industry. For ACC, it stands around 40 per cent (CY21).

The raw material prices are an actual risk to the industry, as it can exert tremendous pressure on margins. Coal, petcoke, crude, etc, which are inputs in the cement manufacturing process, have all spiked since the start of the Russia-Ukraine crisis.

The ability of companies to pass on the costs to customers without impacting demand will play a crucial role, going forward. Investors need to monitor the upcoming March quarter earnings release, updates from the management on the impact of cost inflation and how the company plans to deal with it.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.