Wind turbine maker Suzlon Energy (SEL) is coming out with a 5:21 rights issue open for subscription during October 11-20, 2022. Here the company is raising ₹1,200 crore, of which it plans to utilise ₹900 crore for re/pre-payment of certain liabilities and the rest for general corporate purposes. The issue is priced at ₹5 per share i.e., a discount of around 35 per cent to its CMP of ₹7.65. The amount to be paid on application is ₹2.5 per share while the rest 50 per cent is to be paid on one or more subsequent calls.

Over the last decade SEL has seen reduction in debt owing to restructuring. However, despite that, and the future looking promising for renewable energy in the long run, there have been regulatory headwinds in the wind energy space that make for lack of clarity in the industry’s business prospects.

Till 2017, power generated through wind turbines was sold to distribution companies under Feed-in-tariff (FiT) regime for fixed tariff on the offtakes through PPAs in place which was in accordance with project cost. The tariff under FiT used to be ₹5-6 per unit, which dropped to around ₹2.6-2.9 per unit during 2018-22 when government introduced e-reverse auctions to bring in competition.

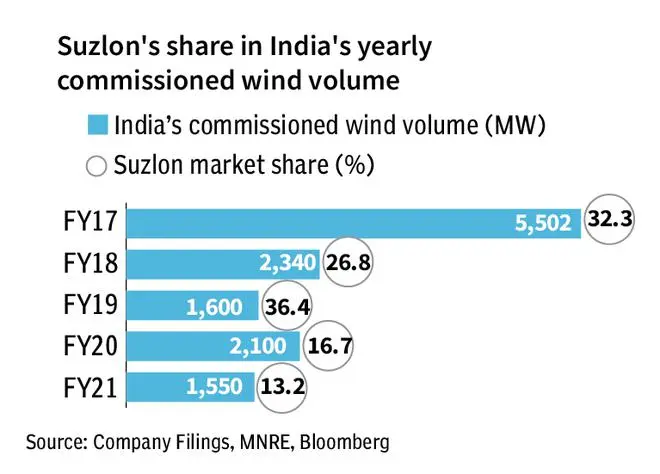

Also, the generation-based incentives and allowed accelerated depreciation of 80 per cent were done away with. These issues, coupled with execution challenges pertaining to land acquisition and regulatory approvals, led to massive reduction in projects commissioning, from about 5.5 GW in FY2017 to around 2.3 GW in FY2018 and so on. Ultimately, the WTG manufacturers got affected due to the regime change as their margins and sales price also depend upon the tariff earned by their customers i.e., developers.

In July 2022, Ministry of New and Renewable Energy secretary stated that the e-reverse auction arrangement will be ended on account of tariffs being artificially lower leading to unhealthy competition and thereby changes shall be introduced. However, nothing has been finalised and hence it remains to be seen what sort of tariff the new regime brings and to what extent it benefits the WTG manufacturers.

Lack of clarity on this factor makes it difficult to reasonably assess the growth prospects for companies in the industry for now. Hence existing investors need not subscribe to the rights issue. However, one can sell their rights entitlement (RE) which is the eligibility to subscribe to the rights issue. RE basically reflects the premium of Suzlon share price over the rights issue price. RE will be credited to the shareholders’ demat account latest by October 10, 2022 while the last date of selling RE through on-market or off-market renunciation is October 14.

Business environment

SEL is engaged majorly in the OEM (Original Equipment Manufacturing) business wherein the company manufactures wind turbine generators (WTGs). Here, along with manufacturing, the company provides end-to-end turnkey solutions to its customers from identifying suitable sites and land acquisition to power evacuation facilities (substations and transmission lines) and operations and maintenance (O&M) services. Majority of the components such as hybrid lattice, tubular towers, controllers and nacelles are developed and manufactured in-house by SEL while other components are sourced from its subsidiary SE Forge Ltd (SEFL), third party Indian and international suppliers. Here, the components’ costs are linked to the costs of underlying commodities such as steel, copper, and glass fabric.

Of India’s current installed capacity of about 42 GW, SEL has installed wind turbines of about 13.45 GW capacity while it also has presence outside India. Further, the company handles O&M for 13 GW in India and 0.96 GW abroad. It sells products and provides O&M services to IPPs, power utilities; PSUs and entities having captive power requirements.

Performance

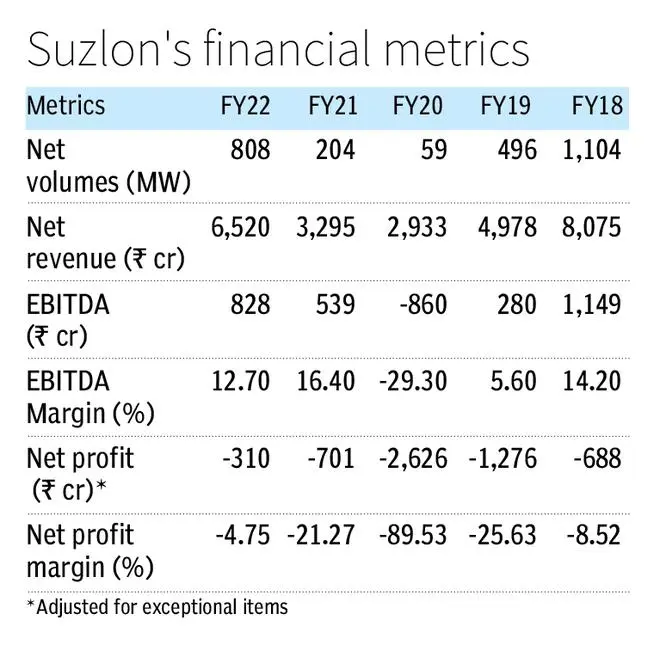

SEL is a negative net worth company with a history of multiple debt restructurings in the past and the latest being in 2022. Though SEL contributes about 33 per cent to India’s overall installed capacity of wind turbines, its market share in new capacity additions is reducing as company couldn’t tap opportunities due to debt overhang. SEL commanded more than 30 per cent share of the total wind volume commissioned in 2017 which dropped to about 13 per cent in 2021. As on June 30, 2022, the company’s debt stands at around ₹3,272 crore majority of which is owed to REC.

In March 2022, an agreement took place between REC and the company wherein REC sanctioned rupee term loan (RTL) of about ₹3,553 crore and thereby refinanced the loans earlier made by banks’ consortium. Under the agreement, the company was supposed to bring down its debt from ₹3,550 crore to ₹2,178 crore through repayment from rights issue proceeds, cash from operations and if further required by selling non-core assets such as corporate office, SEFL and international O&M business. However, management believes that the cash flow from company’s operations and proceeds from rights issue will be sufficient for the repayment and there won’t be need to sell these assets. Consequently, the doors of working capital finance will be open, the access to which is restricted currently for the firm.

SEL’s revenue from operations has increased by around 20 per cent to ₹1,378 crore in Q1 FY23 compared to Q1 FY22 majorly contributed by increase in WTG sales by around 32 per cent on account of economic activity resuming post Covid. Consequently, EBITDA increased by about 38 per cent with a margin of around 16 per cent. Net profit was at around ₹8 crore in Q1 FY23 compared to the net loss of around ₹60 crore in Q1 FY22 adjusted of exceptional gain on account of conversion of financial instruments. During the time of debt overhang and regulatory headwinds, while OEM business has been making losses, the company’s O&M business has been consistently profitable and provided certain stability to the company’s free cash flows, turning them positive due to less capex requirement.

Prospects and valuation

As on June 30, 2022, the company has order book of around 700 MW for its OEM business, almost half of the 1300 MW order book of its listed pure play competitor Inox Wind Ltd. The stock of SEL trades at Price-to-sales (P/S) of about 1.14 times and Enterprise value to sales (EV/S) of around 2.09 times, which is significantly lower than that of Inox Wind’s P/S and EV/S of 5.39 times and 9..2 times respectively (Bloomberg). At the rights issue price of ₹5 per share, the offer is priced at P/S of around 0.74. The discount in valuation of Suzlon might be on account of lower order book and current and past debt overhang. However, contrary to Inox Wind, Suzlon’s Free cash flow has been positive, and the capacity installed by Suzlon is way higher than that of Inox, which also provides Suzlon an edge over Inox in O&M business.

In the recent times, the company has been reliant on its O&M services business for the profitability and cash flow stability. However, its core business i.e., WTG manufacturing will be far more important for the company’s growth in the wind energy space. Hence, despite the massive reduction in the debt over the years and even after fulfilling the REC’s repayment requirement, the company might need further long term and working capital financing for its growth purposes, being in a capital-intensive industry. Though the debt of SEL has significantly reduced, owing to company’s history of using debt as a growth vehicle it remains to be seen how the company grows its business along with managing debt at sustainable levels amid an uncertain regulatory environment.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.