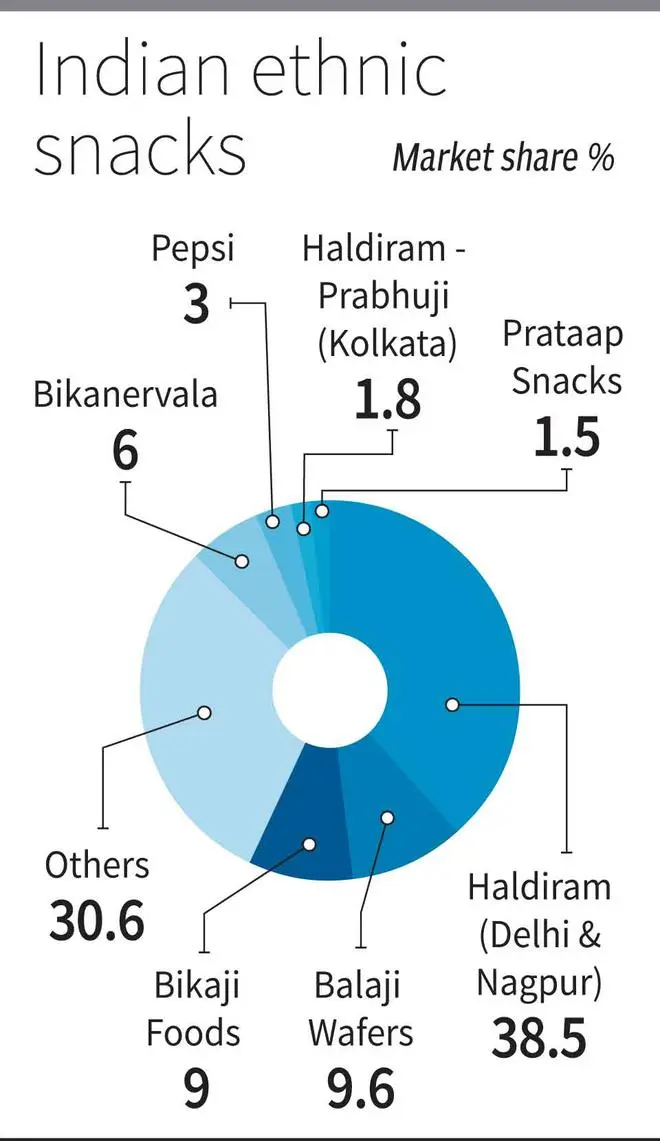

Convenience, assured hygiene and quality and higher shelf life are driving Indian consumers towards branded, packaged foods. In this, the market for savouries such as namkeen, bhujia, chips and other extruded snacks in the organised sector is expected to grow at a CAGR of 15 per cent to ₹73,900 crore from FY22 to FY26. With a market share of 9 per cent, Bikaji Foods is the third largest player in the ethnic snacks segment (ie namkeen, bhujia) , after Haldiram (Delhi and Nagpur brands) as well as Balaji Wafers. While Prataap Snacks (Yellow Diamond) and DFM foods (Crax) are other listed players operating in the same space, their market share is smaller than Bikaji’s.

As against Bikaji’s focus on ethnic snacks, Prataap is a bigger player in the chips and extruded snacks segment, where Pepsi (Lay’s, Kurkure) and ITC (Bingo) are the giants, followed by Balaji. What works for Bikaji vis-a-vis Prataap is the former’s diversified product mix, higher overall market share and margins. However, the valuation sours the taste. At the price band of ₹285–300, Bikaji is valued at a high 87-91 times its trailing 12-month consolidated earnings. Prataap and DFM Foods are loss-making and hence, cannot be compared on a price-to-earnings basis. The company has clearly taken a cue from the premium valuation that bigger FMCG foods players trade at, to price the offer.

Being a pure offer-for-sale for ₹837-881 crore, promoters who are looking for a partial exit and other outgoing investors may want to make the maximum out of the buoyant equity market conditions prevalent now. Investors need not subscribe to the issue. Prataap came at valuation of 220 times in 2017 and is now trading below its IPO price.

What works

As of FY22, Bikaji is the largest producer of Bikaneri bhujia, a GI tagged product since 2010. A little more than a third of revenues come from this segment. However, Bikaji offers a diversified play as well, with namkeen contributing another one-third of the revenues, followed by sweets (rasgulla, soan papdi, gulab jamun, rajbhog), pappad and chips. A wide product portfolio offers good cross-selling opportunities. What also works well for the company is that it derives 60.5 per cent of its sales from ‘family packs’ or SKUs priced over ₹10. This distinguishes it from Prataap, which derives nearly 90 per cent of its revenues from ₹5-packs. Considering that the business is highly raw material intensive (raw material to sales ratio of 70 per cent approximately). higher price points are more conducive to passing on cost increases or reducing grammage to save costs more easily. The rural to urban mix stands at 30:70, vs Prataap’s 50:50. While higher rural mix provides greater opportunities for penetration, urban areas can help sell higher priced products. With a better product and market mix, the company enjoys superior margins to Prataap. Logistics cost, at 4-5 per cent of sales is also lower, helping margins.

The company’s core markets are Rajasthan (45 per cent market share) and Assam (58 per cent) and to a certain extent, Bihar (29 per cent). It is looking to drive premiumisation and up-trading in these home grounds, as well as push newer categories such western snacks (chips, nachos) further. It aims at doubling share of revenues for western snacks (now at 5 per cent).

Most players in the organised snacks and savouries segment have a good presence in the north and east, while they are looking to penetrate the south and west. Bikaji is no different. Launching products such as Mangalore mixture and Southern mixture to cater to regional tastes, the company has experienced good growth in Karnataka and Telangana in recent times and is strengthening its distribution network here for the next leg of growth.

Financials

From FY20 to FY22, revenues have grown steadily at 22.4 per cent CAGR to touch ₹1,611 crore. The profit CAGR for the same period is at 16.5 per cent (₹76 crore in FY22). However, in the latest fiscal, profits have taken a hit, falling from ₹90 crore in FY21. The rise in raw material (palm oil, pulses, crude oil for packing material) as well as employee costs impacted profitability. Operating profit margins came down to 8.6 per cent in FY22 versus 11 per cent in FY21. In the June 2022 quarter, too, the company experienced cost pressures from the rise in commodity prices, with margins further shrinking to 7.4 per cent. According to the management, they have been able to pass on costs pressures through price increases to an extent. Advertising expenses have also been trimmed down steadily, from 3.4 per cent of sales in FY20 to 1.8 per cent in FY22, and further to 0.3 per cent of sales in Q1FY23, to cut costs.

Across facilities, capacity utilisation as of FY22 is the highest for Bhujia at 55 per cent. For the other products, it ranges from 16-42 per cent. About six facilities, including those at Guwahati, Kanpur and Muzzafarpur, have been operationalised only in the last year and this partly explains the lower utilisation levels. Two more are coming up at Bikaner and Patna to cater to growing segments such as frozen snacks, sweets and western snacks. Better operating leverage from higher utilisation may help improve profitability of operations. The company is a PLI beneficiary. The debt-to-equity ratio is comfortable, at 0.17.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.