Winemaker Sula Vineyards has been a beneficiary of the evolving tastes of an upwardly mobile population, the perception of low-alcohol beverages being healthier, and a shift towards premium consumption experiences. Established market leadership, security of long-term raw material contracts with farmers (access to over 2,800+ acres of vineyards), and continued focus on own brands as well as success in premiumising portfolio are the investment thesis anchors for Sula.

Since its IPO at ₹357 apiece (47 times P/E) in December 2022, the stock has provided decent gains (up 35 per cent) in sync with the healthy earnings trajectory. We had recommended subscribing to the IPO.

However, Sula’s trailing 12-month P/E valuation is at 47 times. While this appears expensive, the anticipated growth is supportive. Sula is expected to see 16-18 per cent yoy topline growth and 16-17 per cent yoy bottom line growth, backed by 29 per cent EBITDA margins for FY24 and FY25. In fact, Sula’s current valuation is close to alco-bev leader United Spirits (50 times), on which we recently initiated coverage with a ‘hold’ rating.

Sula has witnessed 10 per cent correction from lifetime highs (₹535) in light of the new developments in the 2018 Maharashtra excise blending case. While we await the final outcome on that matter, the correction has factored in most of the risks. Sula is expected to continue delivering good earnings growth. However, at current levels, the risk-reward appears balanced.

Vintage in progress

Emerging from Nashik, India’s ‘Napa Valley’, Sula was the first in the country to introduce varietal wines in India in 2000. Over the years, it has become the market leader (with over 50 per cent share) backed by strong network across key markets, product availability and visibility of its brands — “Sula”, “The Source”, “RASA” and “Dindori”. Sula leads across all four price segments — namely, Elite (more than ₹950 a bottle), Premium (₹700-950), Economy (₹400-700) and Popular (less than ₹400). Its strategy is led by premiumisation, with ‘Elite’ and ‘Premium’ range being at the forefront.

The addressable market for wines in India is big, putting Sula in pole position to benefit. Only 8 per cent of the Indian market currently is with low-alcohol drinks vs over 50 per cent share globally. Alongside, per capita consumption of wine in India, at less than 100 ml a year, is less than one-tenth of global average. Clearly, the ₹1,345-crore wine market has potential for better penetration and growth (from 2 million cases in FY21 to estimated 3.4 million cases by FY25).

Sula’s long-term exclusive contracts secure the supply of raw materials. It has 4 wineries in Maharashtra and 2 in Karnataka, both top wine-producing States, and these States account for over 60 per cent of company’s sales.

Earnings picture

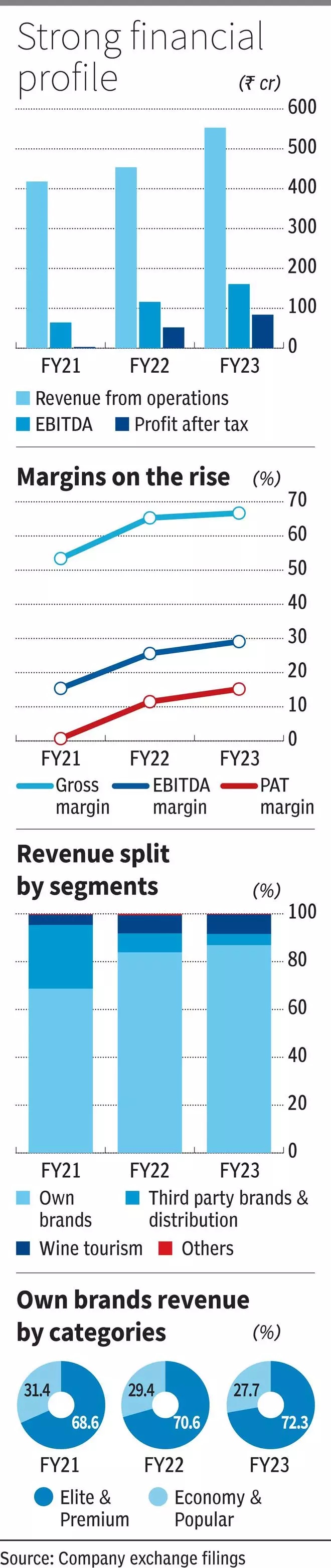

FY23 consolidated revenue from operations grew 22 per cent YoY to ₹553 crore. Sula’s ‘Own Brands’ revenue growth for FY23 was 26 per cent. Elite and premium categories have grown even faster (29 per cent) than the ‘overall own brands’. EBITDA margin stood at 29.1 per cent and EBITDA grew 38.7 per cent YoY to ₹161 crore. Sula clocked profit after tax of ₹84 crore in FY23, up 61 per cent.

As per Q1 sales update (earnings to come out soon), Sula has recorded its highest ever Q1 net revenues overall as well as for Own Brands and the Wine Tourism business. Own Brands witnessed growth of around 24 per cent, with Elite and Premium segment leading the show with around 30 per cent growth.

For FY24 and FY25, Sula’s topline is expected to grow 18 per cent and 16 per cent yoy, according to Bloomberg. Margins will remain at 29 per cent odd. This should typically help Sula clock 15-17 per cent yoy EPS growth for both years.

However, new developments in the 2018 Maharashtra excise blending case (previously disclosed in IPO documents) have cast a slight shadow. A ₹116-crore initial excise duty demand notice by Maharashtra government for the period 01/04/2006 to 31/03/2014, was first received by Sula on 17/02/2018 and subsequently challenged by the company. A stay was granted on 19/09/2019. This interim stay has now been vacated. Sula has challenged the order. According to Sula, the order does not affect the existing business or the activities, which indicates a one-time impact if we assume the final outcome is unfavourable. The 10 per cent stock correction may have baked in the worst-case scenario.

In our IPO note on Sula, we had mentioned that all liquor businesses in India are exposed to high regulatory and policy risks.

Valuations and risks

Many listed wine stocks globally are loss-making, while those who make money, such as Duckhorn Portfolio (US) and Treasury Wine Estates (UK), are in mature wine markets compared to the nascent state of the segment in India. Our long-term positive stance on Sula is a result of the clear runway for growth in India but Sula’s risk-reward is on an even keel. Given the healthy fundamentals, investors may continue to hold the stock.

Risks to our call are the threat to aspirational demand for India-made wines from imported wines from well-known European and Australian brands, reduction/elimination of high import duties on international wines, and unfavourable licensing and excise regime changes. Other risks are adverse climatic conditions impacting quality of wine grapes, and outstanding legal proceedings involving company, subsidiary, promoter and directors.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.